Arable Market Report – 05 August 2024

Monday, 5 August 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

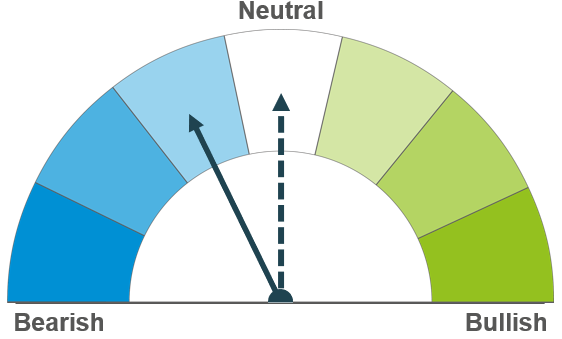

Wheat

While unfavourable weather impacts wheat production in several European countries, favourable conditions in the US Midwest support ample maize production weighing on wider cereals markets. Longer-term, the tighter global wheat balance will offer support.

Maize

Favourable weather conditions for key maize growing states in the US support global maize production. However, a heatwave in Ukraine could impact the country’s crop and impact global supplies going forward.

Barley

Firm domestic demand has supported prices however the outlook of the European spring barley crop as harvest progresses remains a watchpoint. Longer-term, barley will likely continue to broadly track the wider grains complex.

Global grain markets

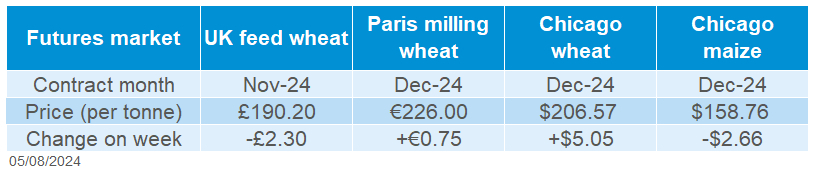

Global grain futures

Global wheat markets rose modestly last week (Friday to Friday) after broadly tracking sideways for most of the period. Chicago wheat futures (Dec-24) gained 2.5% on the week while Paris wheat futures (Dec-24) gained 0.3% for the same period. Concerns over lower European production and speculation that Russian wheat prices had found a floor offered some support. However, US maize production continues to weigh on global wheat markets as Chicago corn futures (Dec-24) were trading below $4/bsh last week, a low not seen since December 2020.

France’s wheat harvest has been in focus following heavy rains, as the soft wheat crop scored 50% in good or excellent condition (as at 29 July), the lowest condition score for this time of year since 2020. Last week, the General Association of Wheat Producers for France (AGPB) forecasted the French wheat harvest at 26 Mt, the lowest production since the 1980’s.

Downward revisions for wheat production were also seen in Ukraine due to the recent hot and dry weather. The Ukrainian grain traders union (UGA) forecasted wheat production at 19.8 Mt for 2024, 2.2 Mt less than last year. It also pegged wheat exports for 2024/25 at 13.0 Mt, down 3.0 Mt from the previous marketing year.

Towards the end of last week, speculation arose that a price floor had been met for Russian wheat as farmer selling slowed down in response to a tightening or negative profit margin (IKAR), offering some relief on further price pressure. Russian wheat exports for July were estimated down 29% on the year at 3.2 Mt but up 7% on the five-year average (Sovecon).

The average EU maize yield saw a large reduction in the EU’s MARS report for July. Though favourable weather conditions over the US Midwest have supported the outlook of the US maize crop. As at 28 July, the US maize crop scored 68% good or excellent condition, greater than the five-year average of 62%. Earlier in July, the USDA forecasted the US maize crop to harvest 383.6 Mt for 2024 (the third largest US maize crop on record), therefore good growing conditions will support the expectation of an already sizable US maize crop.

UK focus

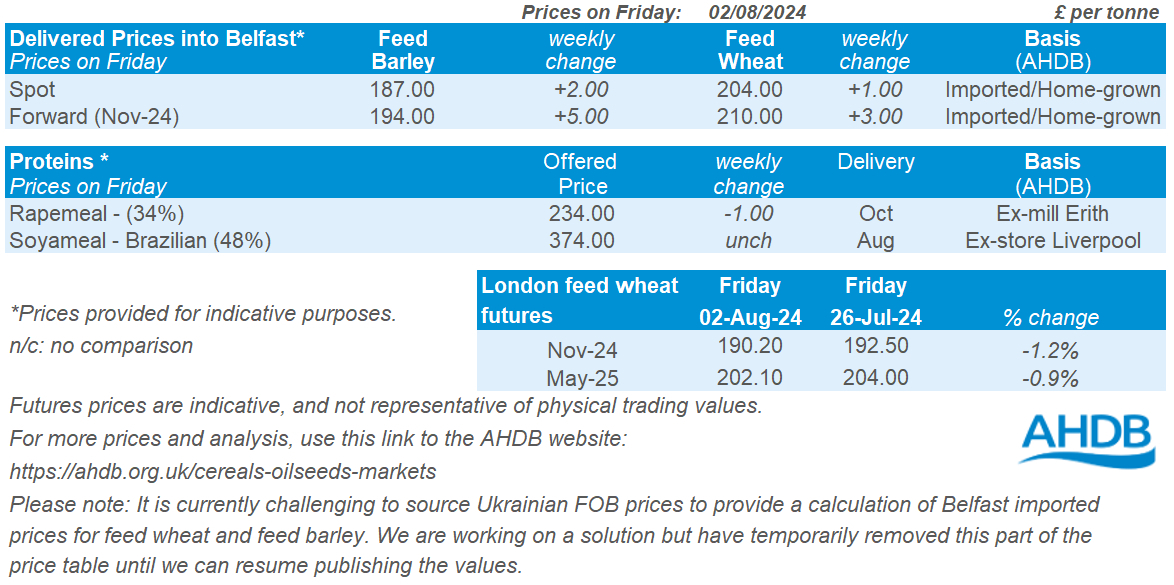

Delivered cereals

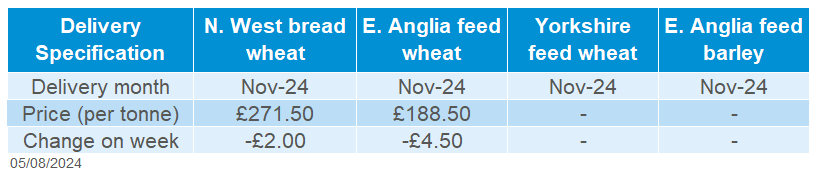

Domestic wheat futures did not follow the modest gains seen with Chicago and Paris wheat futures (Dec-24) last week (Friday to Friday). Nov-24 UK feed wheat futures closed on Friday at £190.20/t, down £2.30/t on the week. The May-25 contract fell £1.90/t over the same period, ending Friday’s session at £202.10/t.

Domestic delivered feed wheat prices followed futures down Thursday - Thursday. Feed wheat delivered into East Anglia for November delivery was quoted at £188.50/t on Thursday, down £4.50/t on the week. Delivered bread wheat into the North West for November delivery was quoted at £271.50/t, down £2.00/t on the week.

On Friday, AHDB published the first harvest progress report of 2024, covering the beginning of harvest up to 31 July. In total, 85% of the GB winter barley harvest is complete. This is well ahead of the same time last year, when harvest was 48% complete, and the five-year average of 51% complete at this point in the season. Early yield indications vary significantly by region, ranging from 5.3-8.5 t/ha, and averaging 6.2 t/ha across GB.

On Thursday, the Bank of England (BoE) cut interest rates from 5.25% to 5.0%, the first cut to interest rates since March 2020, as the twelve-month consumer price index inflation was at the 2% target set for both May and June. Andrew Bailey, the governor of the BoE, explained that the BoE were not committing to further interest rates cuts of quick succession. Against a number of other major currencies, sterling weakened by 1% on Thursday.

Oilseeds

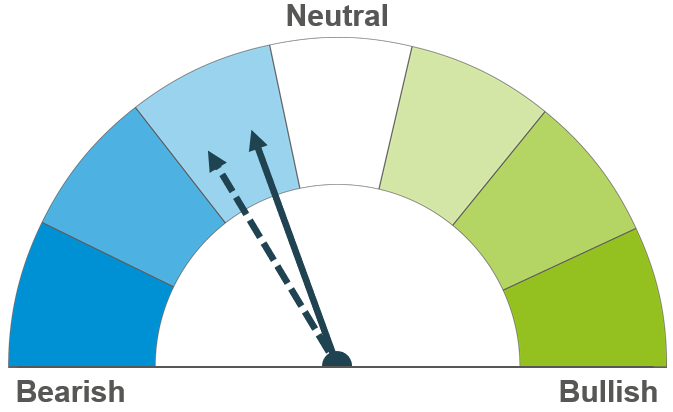

Rapeseed

For the short term, rapeseed markets are weighed on by weakness in the wider oil markets. However, lower production expected in Europe and Australia could keep prices supported in the long term.

Soyabeans

Favourable weather conditions in the US Midwest, coupled with slower crushing demand continues to weigh on prices at the moment. Long-term, the expected ample global supply could keep prices subdued.

Global oilseed markets

Global oilseed futures

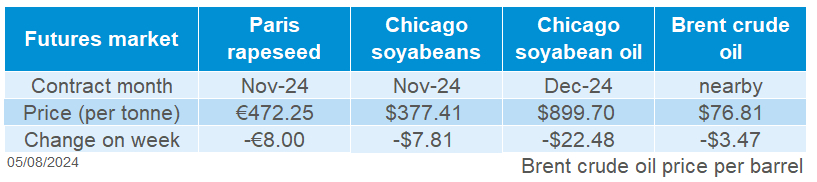

Last week (Friday-Friday), Chicago soyabeans futures were generally pressured, with prices falling to a four-year low. The expected ample global supplies coupled with historically slow crushing demand in the US have continued to pressure soyabean prices. Although higher Brent crude prices, following crises in the middle east, and concerns over weakening of the US economy slightly supported prices during the week. Chicago soyabean futures (Nov-24) dropped 2.0% on the week to close at $377.41/t on Friday.

According to the latest USDA data, US soyabean net sales reached 376.4 Kt for the week ending July 25, up from the previous week and prior four-week average. Also, soyabean exports rose to 565.6 Kt, up 54% compared to the prior four-week average. The key export destinations include; Germany, Mexico, the Netherlands, Egypt and Indonesia.

Soyabean processors in the US have faced pressure as biofuel producers are using less soyabean oil, opting for cheaper alternatives like imported used cooking oil. Global grain merchant, ADM reported lower crushing margins in its 2024 second-quarter financial report.

The US soyabean crop has continued to develop, at a faster pace than the five-year average. Though crop condition was slightly lower last week. According to the USDA report, the proportion of the crop in good to excellent condition was rated 67% last week, up from 52% last year. Recent rain forecasts and cooler weather in the US Midwest have eased concerns about the crop prospect. The USDA’s crop report due out later today will be a key watch for global price direction.

Malaysian palm oil prices continued to fall last week, from Friday to Friday. The September-24 contract fell 0.1% over the course of the week. Though prices closed higher on Friday following strong import demand from India (biggest buyer) after price correction in anticipation of a potential import duty hike. The Malaysian palm oil exports rose by 22.8% and 30.9% in July, according to cargo surveyor Amspec Agri and Intertek Testing Services respectively.

Rapeseed focus

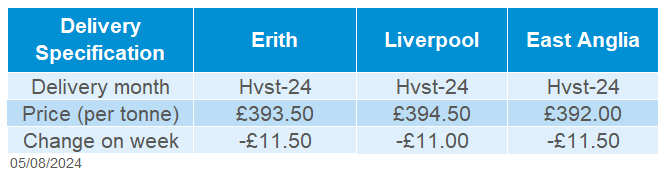

UK delivered oilseed prices

Rapeseed futures tracked soyabeans prices last week (Friday-Friday). Paris rapeseed futures (Nov-24) fell €8.00/t to close at €472.25/t. The May-25 contract also declined 2.0% to close at €473.25/t.

Delivered rapeseed prices followed the trend of global prices. Rapeseed delivered into Erith for August delivery was quoted at £393.50/t on Friday, falling £11.50/t on the week. Also, delivery into East Anglia for November was quoted at £401.50/t, down £12.50/t on the week.

In July, Stratégie grains revised its EU rapeseed harvest outlook to 17.27 Mt, down 3% from June. This downward adjustment mainly affects Germany, the Czech Republic, Poland, Hungary and Romania on lower acreage and low yield.

LSEG kept its forecast for the 2024/25 Australia rapeseed production unchanged at 5.35 Mt, slightly below USDA’s outlook of 5.5 Mt. This follows the latest weather forecast showing that temperatures across Australia will stay near normal in the next 7 days, with warmer weather expected through mid-August.

AHDB’s first harvest progress report of 2024 which covers the beginning of harvest up to 31 July was released on Friday. Our analysis shows that 73% of the winter oilseed rape harvest is complete. At the same point last harvest, just 21% had been harvested. This year’s pace is also well ahead of the five-year average of 29% complete. Read more on the analysis here.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.