Arable Market Report – 3 June 2024

Monday, 3 June 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

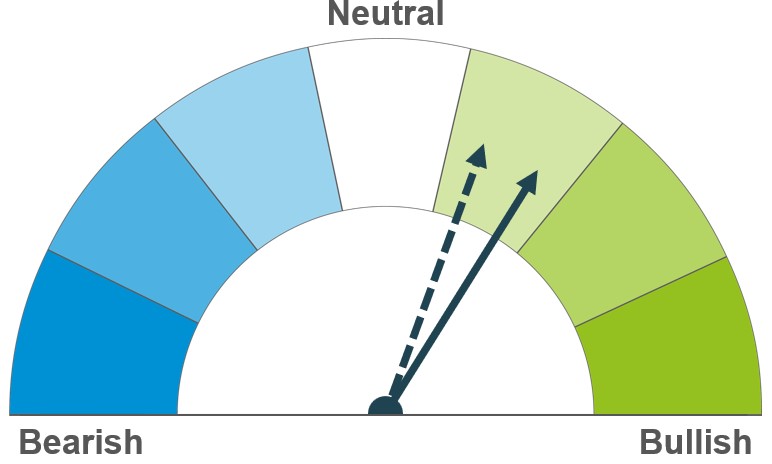

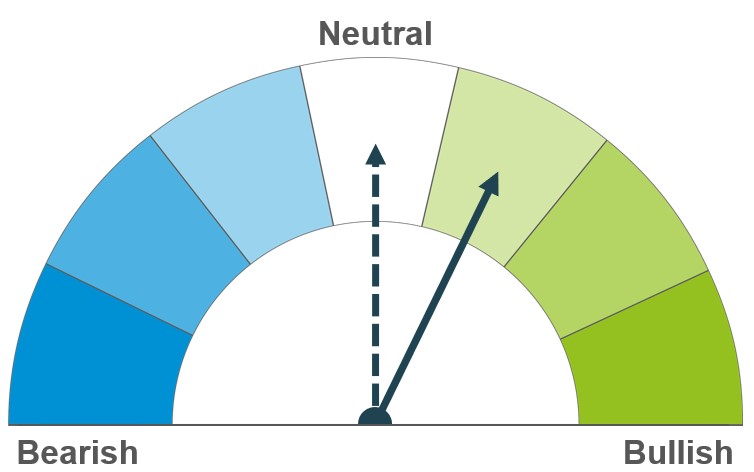

Short-term volatility remains as markets continue to react to the weather outlook in Russia. Something to monitor long-term is a possible softening of global demand if prices continue to climb.

Planting conditions in the US and EU are watchpoints in the short-term. Maize supplies are expected to expand long term, however, concerns over wheat output may push more demand to maize.

Rain forecasts in Australia and crop condition in the Northern Hemisphere are watchpoints. Increased demand in the long term could match heavy barley production forecast for 2024/25.

Global grain markets

Global grain futures

Global wheat futures were generally pressured last week (Friday to Friday). Weather in top producing countries continues to influence global grains markets. Prices were up earlier in the week, extending the previous week’s rally, driven by crop concerns in Russia. However, as the week came to an end, profit taking and forecasts of rain in Russia weighed on prices.

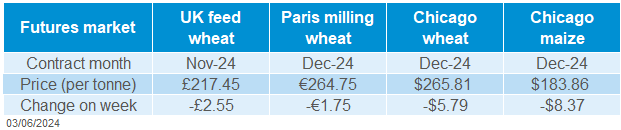

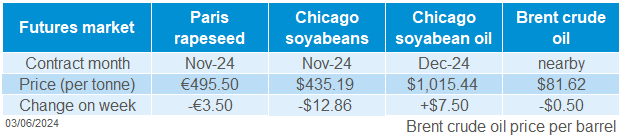

The Chicago wheat (Dec-24) and Paris milling wheat (Dec-24) futures declined by $5.79/t and €1.75/t respectively. The Dec-24 Chicago maize futures also fell $8.37/t over the same period, on pressure from lower wheat prices.

Two Russian crop forecasters, SovEcon and IKAR, trimmed their 2024/25 wheat production forecasts for the world’s largest exporter to 82.1 Mt and 81.5 Mt respectively last week. This was a further downgrade from their earlier estimates of more than 90 Mt a month ago.

Also, during the week LSEG reported that India, the second-largest wheat consumer, could remove wheat import duties to boost domestic reserves. According to the report, India could import between 3.0 Mt and 5.0 Mt of wheat in 2024/25, a significant increase from 120 Kt in 2023/24.

The EU Commission in its latest supply and demand projections for 2024/25, continues to expect increased EU production of barley and maize on the year, but below average wheat production. Weather conditions over the next few weeks remain in focus as crops develop.

UK focus

Delivered cereals

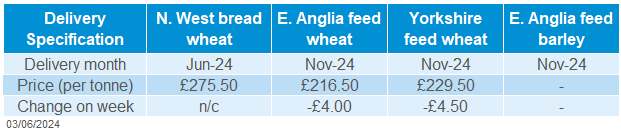

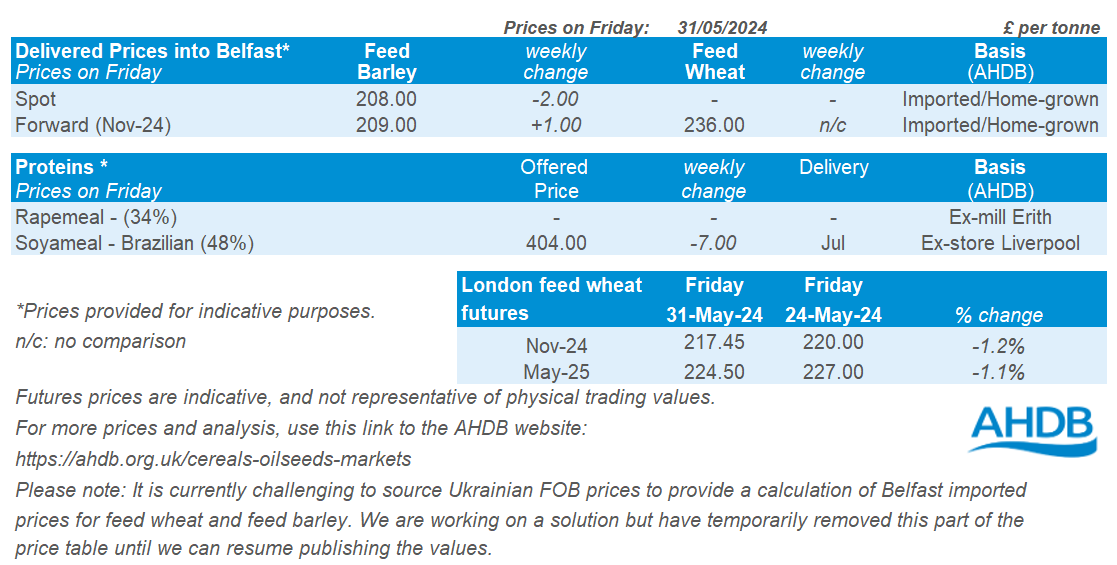

The Nov-24 UK feed wheat futures tracked global price movement last week, down 1.2% (Friday to Friday).

Delivered prices also followed futures movement down last week. Feed wheat into East Anglia for Nov-24 delivery was quoted on Thursday at £216.50/t, down £4.00/t on the week. Similarly, for the same delivery period (Nov-24), feed wheat delivered into Yorkshire fell £4.50/t on the week, quoted at £229.50/t on Thursday.

Last week, AHDB published the latest UK cereal supply and demand estimates for 2023/24 with total cereals domestic consumption relatively unchanged from March’s estimate, but some changes made to trade estimates. Estimates of wheat and barley imports were increased by 175 Kt and 20 Kt respectively, click here to read more.

Oilseeds

Rapeseed

Soyabeans

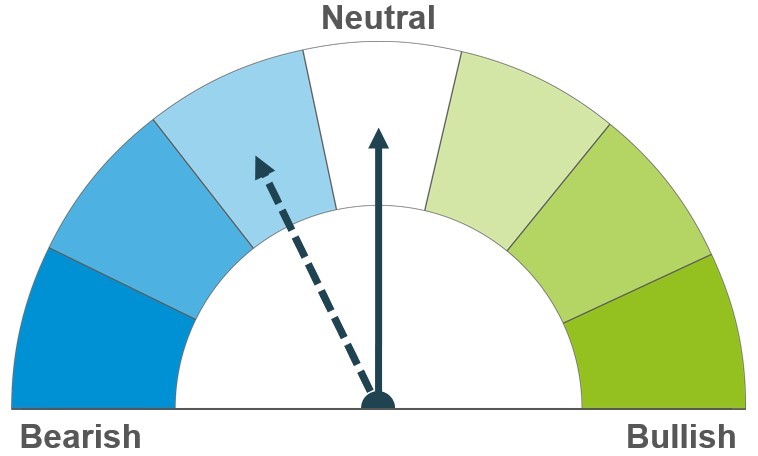

Crop conditions in Canada and Europe remain in focus, with rapeseed continuing to extend its premium over soyabeans. Forecasts of declining rapeseed stocks offers support longer-term.

Sluggish crush demand weighs, though supported vegetable oil prices will likely limit losses. Longer-term, the outlook continues to show heavy global supplies.

Global oilseed markets

Global oilseed futures

The US soyabean market was pressured last week (Friday to Friday), filtering through to the wider oilseeds complex. However, vegetable oils were generally supported on the week. Chicago soyabean futures (Nov-24) fell 2.9% Friday to Friday. Chicago soya oil futures (Dec-24) were up 0.7% over the same period. Pressure in soyabeans came from technical trading, South American supplies, sluggish crush demand and US planting progress.

The National Oilseed Processors Association (NOPA) reported that US soyabean crush dipped in April, due to rising soyabean prices and slowing biofuel demand. NOPA reported a monthly decrease of 15.5% in April and 1.6% on the long-term average. This fall is the first of the 2023/24 season, and the first month to not achieve record highs.

Planting of soyabeans in the US is progressing. US farmers have been sowing soyabeans in between showers, with the rain expected to help early growth of the crop. As at 26 May, 68% of US soyabeans had been planted, up from 52% the week before, and the five-year average of 63% complete at this point in the season. Progression and development of the crop will remain a watchpoint over the next few weeks.

Malaysian palm oil futures were supported last week. This was due to expectations of a 20% increase in exports of Malaysian palm oil products in May. Increased demand comes from the recent uplift in rival vegetable oil prices, and as such, buyers turning to palm oil as a cheaper alternative.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-24) fell €3.50/t last week, closing at €495.50/t on Friday. Despite downward revisions to EU rapeseed production last week, pressure came from the wider oilseeds complex, as well as beneficial rains in Canada.

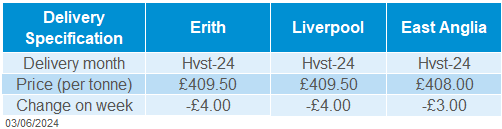

Rapeseed delivered into Erith for June delivery was quoted at £403.50/t on Friday, down £3.00/t on the week. For November delivery, rapeseed was quoted at £420.00/t, down £5.00/t Friday-Friday.

The EU commission on Thursday revised down its estimate of EU rapeseed usable production for the 2024/25 season to 19.1 Mt. This is down 0.3 Mt from the previous estimate. This morning, Stratégie Grains also revised down its estimate of the EU rapeseed crop for 2024/25 to 17.9 Mt. This is down from the previous estimate of 18.12 Mt and if realised, would be a 9.9% decline on the year (LSEG).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.