How much grain could we carry into next season? Grain market daily

Thursday, 30 May 2024

Market commentary

- Nov-24 UK feed wheat futures declined slightly by £1.55/t yesterday to close at £222.00/t.

- Domestic wheat futures were pressured as they tracked global wheat markets which retreated yesterday, mainly on profit taking, after the recent rally caused by Russian crop concerns. Expectations of rainfall in Russia and Ukraine this week could further weigh on the markets.

- Paris rapeseed futures (Nov-24) climbed €4.25/t yesterday, ending the session at €500.75/t.

- Support in European rapeseed markets yesterday followed Chicago soyabean oil and Canadian canola futures. This was despite pressure on Chicago soyabean futures as the USDA weekly crop report released on Tuesday showed above average soyabean planting progress in the US.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

How much grain could we carry into next season?

Earlier today, AHDB published the latest UK supply and demand estimates for wheat, barley, maize and oats for the 2023/24 season. Overall, few changes were made to UK usage estimates, with total cereals domestic consumption revised up just 6 Kt from March’s estimate. However, adjustments to import and export figures for wheat, barley and oats all contributed to some change in what we can expect to carry into the 2024/25 season.

Wheat

Wheat imports are expected to remain firm for the remainder of the season. This is due to the limited availability of domestic milling wheat, and the relative price of imported wheat. As such, wheat imports are estimated to reach 2.175 Mt this season, up 60% on 2022/23 levels. This is also the highest since the 2020/21 season, following the poor harvest. This season- to-date (Jul-Mar), imports have totalled 1.637 Mt, up 63% on the year.

On the other hand, wheat exports are forecast at 225 Kt, down 86% on the year. This is the lowest since the 2020/21 season, and is well below the five-year average of 774 Kt. So far this season (Jul-Mar), wheat exports have totalled 195 Kt, down 83% on the same period last season.

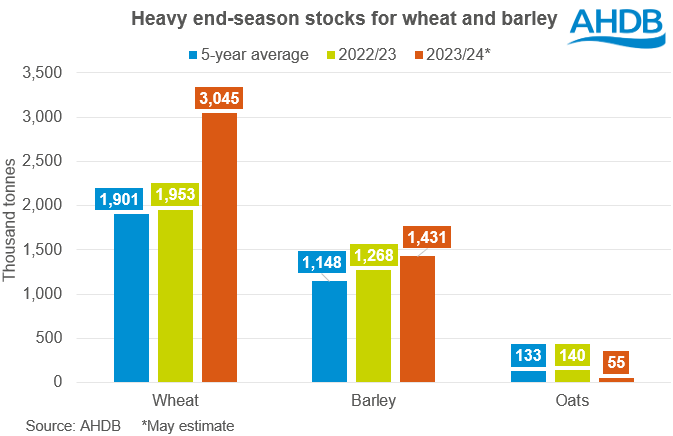

With a high level of wheat expected to still be on farm, plus the level of imports expected to be carried over for milling, and minimal exports, commercial end-season stocks therefore sit at 3.045 Mt. This is up 1.093 Mt from 2022/23 levels, and if realised would be the highest level of ending stocks this century. Though this is perhaps unsurprising given the concerns over the 2024 wheat crop, and what will be required to fulfil next season’s demand.

Barley

Barley imports are estimated at 145 Kt, up 64% on the year, and above the five-year average of 81 Kt. The majority of these imports are expected to be of feed quality, largely going into Northern Ireland. So far this season (Jul-Mar), barley imports have totalled 131 Kt, up 137% on the same period last year, suggesting some drop off in pace for the rest of the season.

Much like wheat, barley exports are minimal, estimated at 730 Kt, down 35% on the year and below the five-year average of 1.166 Mt. From July to March, exports totalled 625 Kt, down 29% on the year.

Slightly lower forecast domestic consumption, combined with minimal exports leaves commercial end-season stocks at 1.431 Mt. If realised this would be up 13% on the year and the highest stocks level since 2014/15.

Oats

Despite a much smaller-than-average crop this season, imports of oats are expected to fall 26% on the year at 13 Kt in 2023/24, with lacklustre domestic usage leading to a minimal import requirement.

On the other hand, oat exports are forecast to reach 130 Kt. While this would be down on the year, it would be the second highest level of oat exports since 2002/03, behind only last season.

Despite sluggish domestic consumption, limited availability and historically high exports leave commercial end-season stocks forecast at 55 Kt. If realised this would be the smallest figure since 2005/06.

Look out for more analysis on domestic supply and demand for this season and next in the coming weeks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.