Arable Market Report - 02 September 2024

Monday, 2 September 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

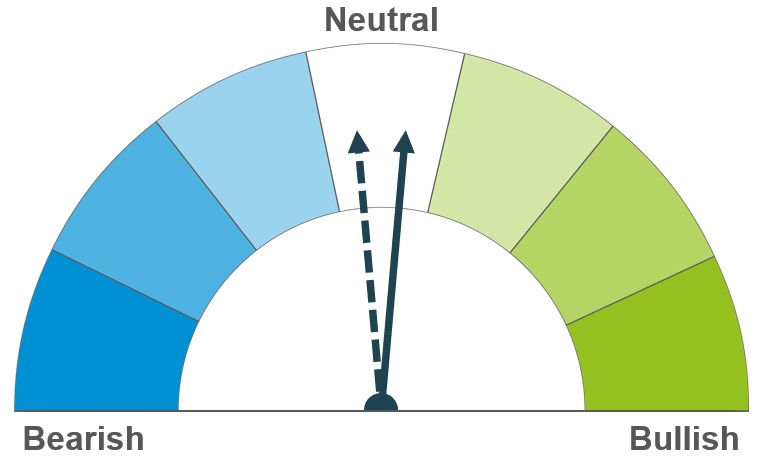

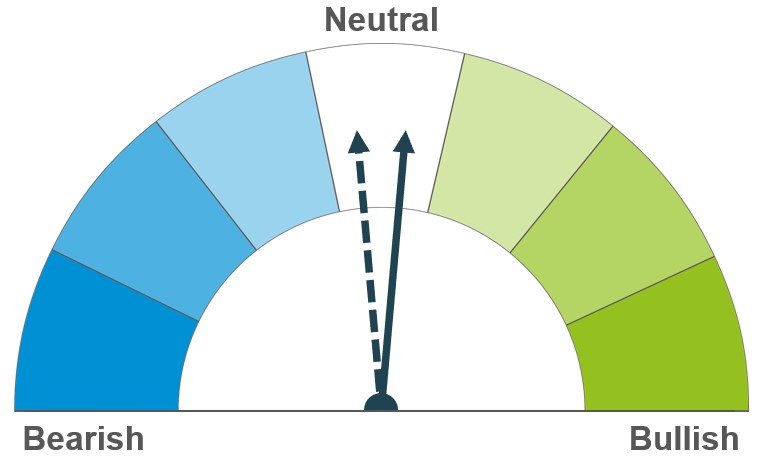

Downward revisions to the EU wheat crop are helping to offset pressure from highly competitive Black Sea exports. The pace of exports and global maize supplies are important for the longer-term outlook.

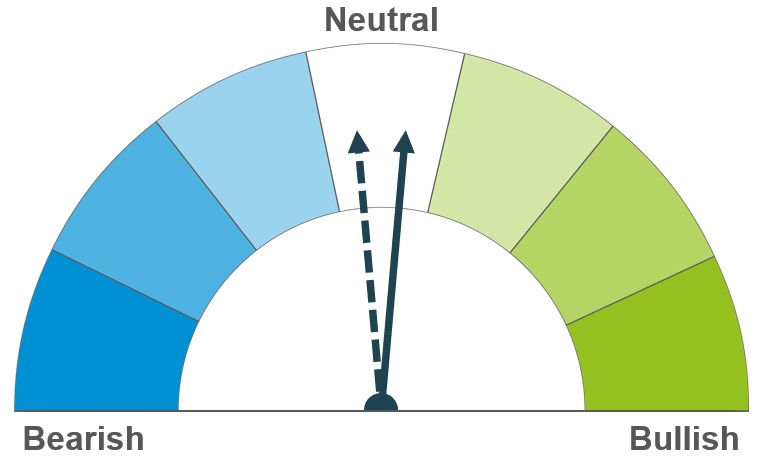

Uncertainty over US and EU maize production is offering some support to markets, although large global crops are still expected in 2024/25. South American areas will be important to monitor going forward.

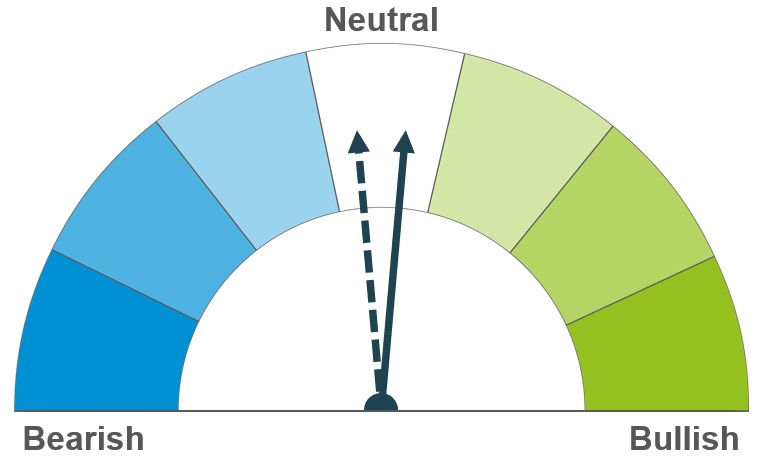

While the EU barley crop this year is expected to be much larger than last year’s poor harvest, it is still smaller than initially expected. This could offer some relative support compared to other crops.

Global grain markets

Global grain futures

Downward revisions to EU yield and crop estimates helped global grain prices to rise last week, despite Black Sea wheat remaining highly competitive into key markets. Stronger than expected US export sales, buying by speculative traders, plus a weaker US dollar also added support. US markets are closed today (2 September) for the Labor Day federal holiday.

Earlier in the week, updated quality results from FranceAgriMer continued to show low specific weights and lower than usual protein levels in France. Germany’s Agriculture Ministry also forecasted German wheat production down 12.7% on the year to 18.8 Mt.

Later in the week and following reduced yield estimates by the EU’s crop monitoring service (MARS), the EU Commission cut its crop estimates for wheat, maize and barley. The large reduction to the soft wheat crop, now 4.7 Mt lower than forecast in July at 166.1 Mt, means EU exports are now projected at just 26 Mt, compared to nearly 32.0 Mt in July. Meanwhile, EU maize production is now lower than in 2023, despite the expanded area. Barley output is also now below the five-year average.

Something to watch longer-term is a prediction that Agrentina’s maize area could fall 17% in 2024/25 by the Buenos Ares Grain Exchange. This is due to concern about ongoing pest and disease pressures. Currently the USDA predicts Argentina’s maize output to rise 1.0 Mt to 51.0 Mt in 2024/25.

UK focus

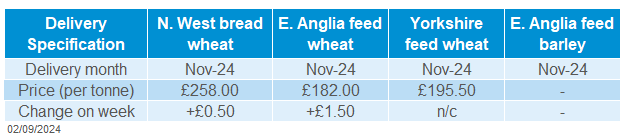

Delivered cereals

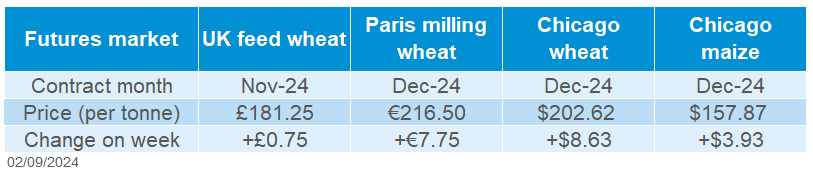

After settling below £180/t on Tuesday, Nov-24 UK feed wheat futures ended the week slightly higher at £181.25/t. The contract gained £0.75/t or 0.42% Friday to Friday. However, this was a smaller percentage gain than many global markets, potentially linked to a lift in the strength of sterling against the euro.

The 2024 English wheat area is provisionally estimated at 1,402 Kha by Defra, an 11% fall from 2023. For barley Defra report a 6% rise (with winters down 17%, but springs up 28%) and oats up 11%.

The UK cereals harvest generally continued to progress well over the past fortnight. However, wetter weather has led to some delays in the west of the UK, and especially in Northern Ireland. By 28 August, 88% of the wheat area had been cleared, along with 32% of spring barley and 61% of oats. While oat yields remain encouraging, more variability has emerged in spring barley yields, with lower nitrogen contents. Read the full report here.

Lower protein contents also remain a concern for wheat. AHDB’s delivered price survey showed that while bread wheat premiums had edged lower in recent weeks, they remain historically high and held stable last week. As of 29 August, full specification bread wheat (Group 1 with min. 13% protein, 250 HFN and 76 kg/hl) was reported at £258.00/t for delivery into the North West in Nov-24. This equated to a £76.00/t premium to Nov-24 futures, unchanged from the previous week.

Meanwhile, results available from AHDB’s Recommended List trials show some very high disease levels and variable yields. Find out more here.

Oilseeds

Rapeseed

Soyabeans

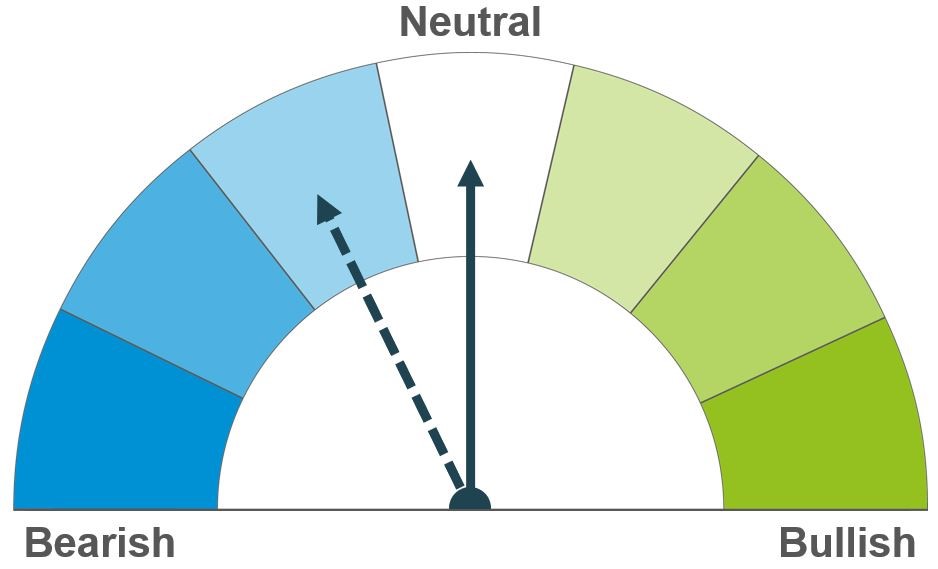

The recent strengthening in the vegetable oils complex offers support, as well as lower European rapeseed production. However, ample global soyabean stocks and strong rapeseed production estimates in Canada keeps a lid on price movements.

Dryness in key soyabean growing regions in the US and Brazil, in addition to improved US soyabean demand, has offered some support. However, as it stands, Brazil is still forecasted to produce a record soyabean crop.

Global oilseed markets

Global oilseed futures

Global oilseed markets strengthened last week (Friday – Friday), as Chicago soyabean futures (Nov-24) gained 2.8% to close at $367.40/t. Support came from weather concerns in the US Midwest and Brazil, strong US soyabean sales for the 2024/25 marketing year and a strengthening in vegetable oils.

As mentioned in last week's market report, there were continued concerns about dry weather over the US Midwest leading to soyabean pod development abortion, hindering yields. As at 25 August, 89% of the US soyabean crop was in the pod setting stage. However, later in the week, beneficial rains and milder temperatures were forecast over the US Midwest following the hot spell. As at Tuesday last week, 12% of the US soyabean crop was in drought conditions, up 4 percentage points from the week before.

As the 2024/25 marketing year for US soyabeans started yesterday (01 September), sales last week were above market expectations totalling 2.6 Mt, the fourth consecutive weekly increase. While sales to China were slightly lower on the week by 56Kt, sales to other destinations supported the weekly rise overall. However, it is important to note that total outstanding sales for the next marketing year remain behind this time last year by 21.5% and the five-year average of 34.1%.

Chicago soyabean oil futures (Dec-24) gained 4.0% over the week (Friday – Friday), buoyed by the strength in Chicago soyabean futures as well as an appreciation in rival vegetable oils. Malaysia palm oil futures (Nov-24) gained 2.8% over the same period following news that Indonesia may alter its current palm export tax to improve competitiveness, while tighter Indonesian palm oil production as well as firm exports also offered support.

In Brazil, the largest global soyabean producer, planting is usually underway at the start of September. However, the Brazilian National Weather Service had forecasted above average temperatures and dry conditions from August to October for key soyabean regions, which could hinder planting progress. If there are considerable delays to soyabean planting, this can shorten the time the crop has to develop and lead to yield concerns.

.png)

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-24) gained €15.50 over the week (Friday – Friday) to close at €470.25/t. Paris rapeseed futures found support following the gains in Chicago soyabeans futures as well as the strengthening in the vegetable oils complex despite StatCan’s forecast of a large Canadian rapeseed crop.

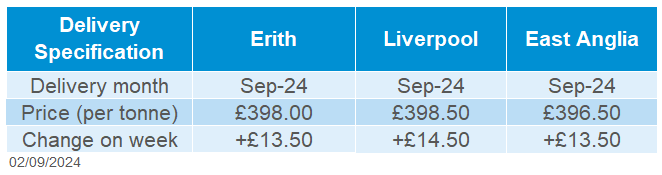

Delivered rapeseed prices followed the trend of global prices. Rapeseed delivered into Erith for September was quoted at £398.00/t on Friday, gaining £13.50/t on the week. Meanwhile, delivery for May was quoted at £408.50/t rising £12.00/t over the same period.

Statistics Canada released their first model-based estimate of the year for the country’s field crops. The 2024 rapeseed production is estimated to be 19.5 Mt, up 1.6% from last year due to higher yields offsetting a smaller area. The rapeseed harvest in Saskatchewan, where 55% of Canada’s rapeseed crop is produced, is reported at 8% complete as at 26 August.

The European Commission released their monthly supply and demand estimates regarding cereals and oilseeds for the EU. Rapeseed production for harvest 2024 is estimated at 18.0 Mt, 8.7% less than last year, but 1.8% greater than the five-year average. This differs to the forecast from Stratégie Grains released on Friday which estimates EU rapeseed production at 16.9 Mt.

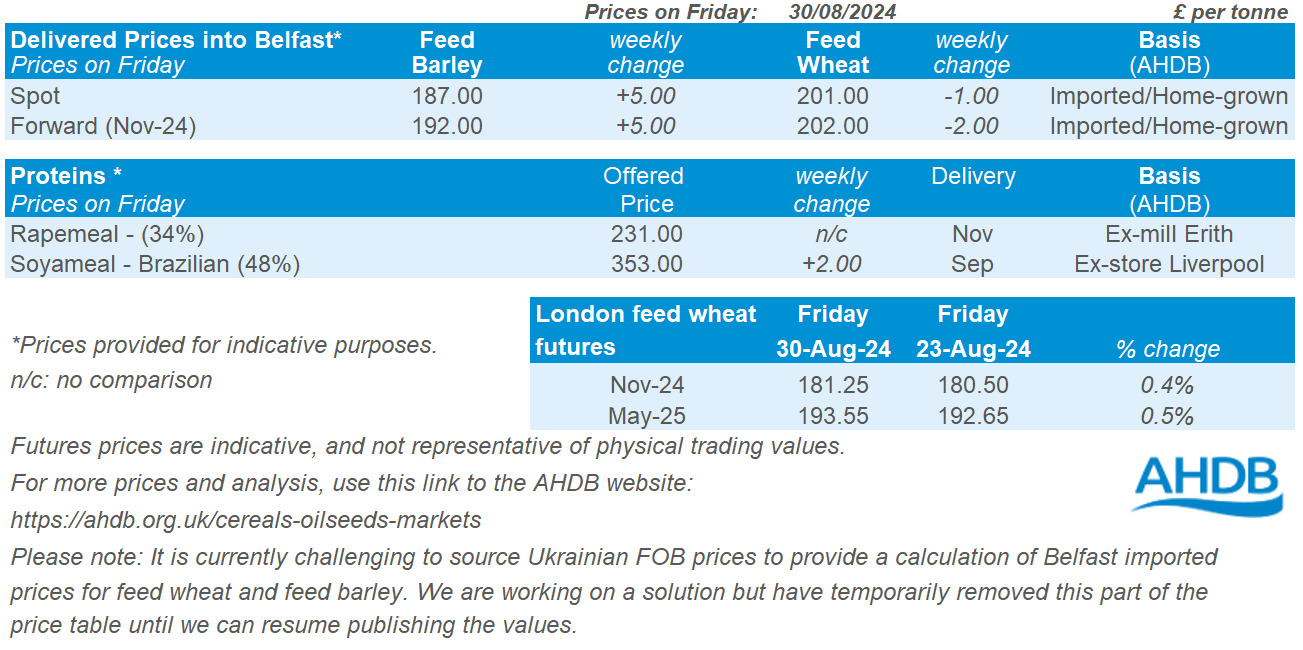

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.