Arable Market Report - 02 May 2023

Tuesday, 2 May 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

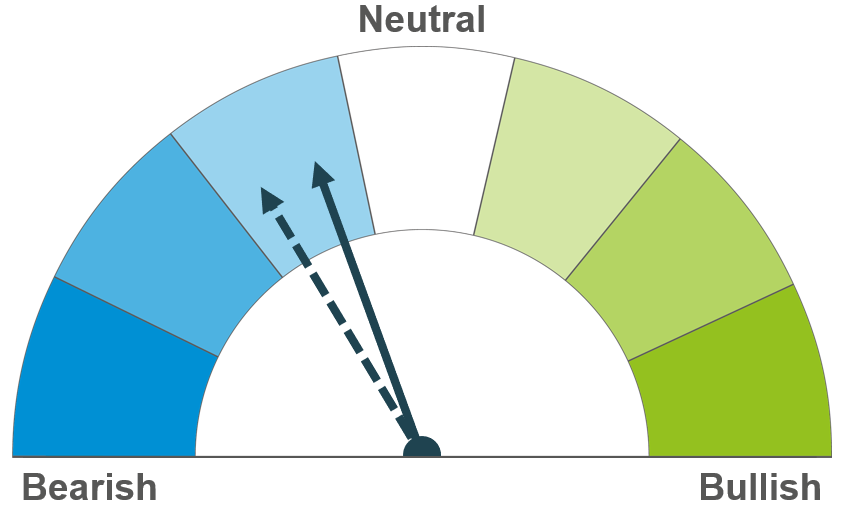

Competitive Black Sea supplies continue to pressure global wheat markets short term. Though, volatility is expected as we near the potential renewal of the Black Sea Initiative. US crop conditions look to be improving, also weighing on prices longer term.

As with wheat, some volatility can be expected short term as we approach the expiration of the Black Sea Initiative. However, sluggish demand for US maize, and cheaper Brazilian supplies expected on the market will likely pressure prices.

Global barley prices continue to follow movements in the wider grain complex. The discount of ex-farm UK feed barley to UK feed wheat stood at £27.00/t as at 20 April.

Global grain markets

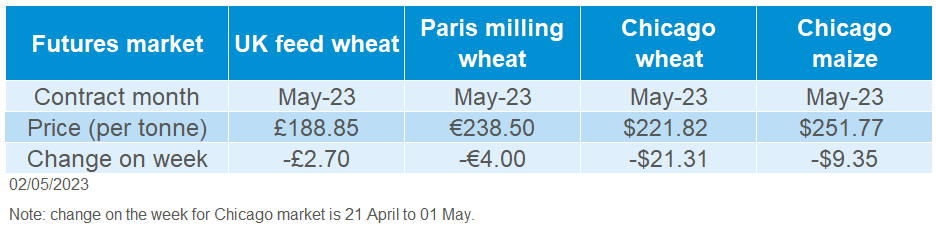

Global grain futures

Global grain markets felt some pressure last week as competitive Black Sea supplies continued to weigh down on the market, US crop conditions improved, and demand for US maize turned sluggish. As global prices fall lower, we have seen global tenders come through for state buyers for Egypt and Jordan.

Yesterday, in its weekly crop progress report, the USDA rated 28% of the US winter wheat crop in good-excellent condition. This was up 2 percentage points from the previous week, after some much needed rain across the US plains. However, according to Refinitiv, this rating remains amongst the lowest on record at this point in the season. Looking over the next 7 days, up to 2 inches of rain is forecast in Kansas and Oklahoma (two key wheat producing states), which could see further improvement to the crop.

On Friday, it was reported that Poland, Hungary, Slovakia and Bulgaria are to lift the ban that they had imposed on Ukrainian grain imports, under a deal reached with Brussels on Friday. The European Commission will impose temporary curbs on a more limited range of Ukrainian products, as a way of protecting the countries’ farmers. Certain grains and oilseeds will only enter into Poland, Hungary, Slovakia, Bulgaria and Romania when in transit to other destinations (Financial Times).

Over the next couple of weeks, global grain markets will remain reactive to any news on the future of the Black Sea Grain Initiative, as the expiration of the deal is fast approaching. The Russian Foreign Ministry maintained their stance on Thursday, saying that Russia does not consider the export corridor deal to be satisfactory. Any further information on the deal will be important for market movement this week, talks are expected between all parties tomorrow (Refinitiv).

Last week, China cancelled US maize cargoes raising doubt over export potential moving forward. Demand for US maize has been weak so far this season, with the USDA predicting US maize exports at 47Mt in its latest supply and demand estimates, down 25% from last year. Cumulative sales up to 20 April were down 33% this season to date from last. It’s likely that the cancelled US shipments will be replaced by cheaper Brazilian supplies coming online in a couple of months, something to watch moving forward.

UK focus

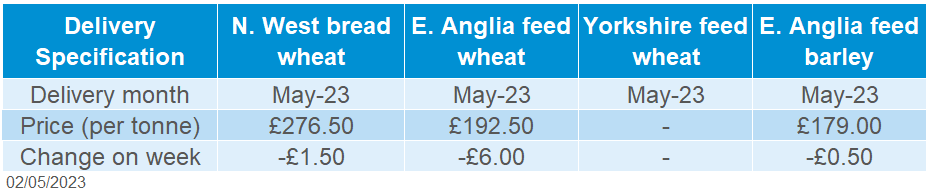

Delivered cereals

Old crop UK feed wheat futures (May-23) ended the week down 1.4% (Friday-Friday). New crop futures (Nov-23) saw greater losses on the week, down 3% over the same period. Domestic futures followed global price movements down last week.

Domestic delivered prices followed futures movements (Thursday to Thursday). Feed wheat delivered into East Anglia (for May delivery) was quoted at £192.50/t on Thursday, down £6.00/t on the week.

Bread wheat delivered into the North West (for May delivery) was quoted at £276.50/t, down £1.50/t Thursday to Thursday, as milling premiums hold firm.

Feed barley into East Anglia for May delivery was quoted at £179.00/t, down £0.50/t over the week.

AHDB published the most recent crop development report earlier today. Using data up to the week ending 25 April, 88% of the GB winter wheat crop was in good/excellent condition, ahead of 84% at the same point last season. 90% of the GB winter barley crop was in good/excellent condition, up from 84% at the same time last year. For the full set of results, click here.

Oilseeds

Rapeseed

Soyabeans

Pressure continues on rapeseed markets as EU conditions are favourable. Longer-term, a large Canadian canola crop will continue to pressure the market.

Short-term pressure will continue as the Brazilian crop is exported to the global market. Long-term conditions look favourable for US soyabean plantings.

Global oilseed markets

Global oilseed futures

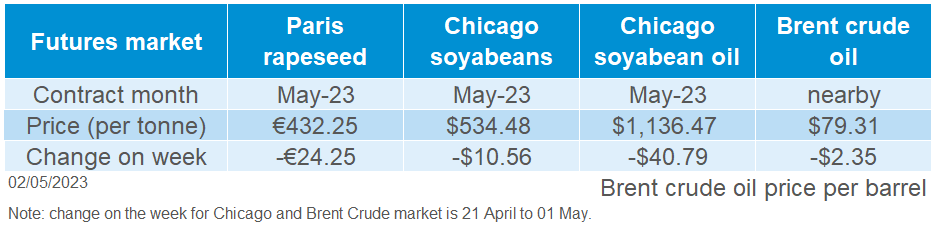

Chicago soyabean futures (May-23) were pressured 2.6% last week (Friday to Friday) from favourable planting conditions in the US Midwest and slower global export demand. The soyabean market did gain towards the end of the week, as liquidation selling slowed, but recovery was marginal. Further to that, the market gained yesterday to close at $534.48/t due to a technical and short covering rebound from the pressure last week.

This pressure on soyabean also filtered into Chicago soya oil, which was pressured across the week and weakness in Brent crude oil weighed on the vegetable oil markets.

Currently Chinese demand for Brazilian soyabeans is lower than expected, despite Brazilian port premiums falling to historical lows. This has been reflected in data from The Brazilian National Association of Grain Exporters (ANEC), as they announced last week that Brazil exported 14.71Mt of soyabeans in April, lower than the estimated 15.15Mt a week earlier.

US soyabean plantings (week ending 30 April) were estimated at 19% complete, up from 9% a week earlier, and ahead of the 5-year average of 11% in the same timeframe. This is ahead of analyst expectations in a Reuters poll, who estimated progression at 17% complete. Towards the end of this week widespread rains are due across the US Midwest.

There was pressure on Malaysian palm oil (Jul-23) last week due to lower demand for exports and weakening in wider vegetable oils. Data released by AmSpec Agri Malaysia, independent inspection firm, estimated that shipments from Malaysia fell 18.4% during 1-25 April, from a month earlier.

Looking a little longer term, the USDA attaché estimated Brazil’s 2023/24 soyabean crop at 159Mt, increasing again on the record crop the market has just had. This is currently an estimate, and this crop will not be online until the start of 2024. Further to that, the estimate is on current market conditions and trends of strong demand, high prices and favourable exchange rates. This is something that could continue to weigh on the oilseed complex as we head towards harvest 24.

Rapeseed focus

UK delivered oilseed prices

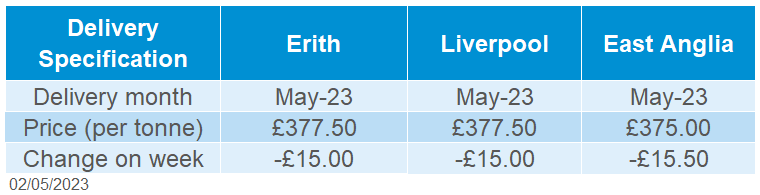

Rapeseed prices were pressured with soyabeans and palm across last week. Paris rapeseed futures (May-23) closed Friday at €432.25/t, down €24.25/t across the week. Domestic delivered prices followed the market trend with delivered prices (into Erith, May-23) being quoted at £377.50/t, down £15.00/t across the week.

Data released from StatCan last week estimated a sizable Canadian canola area of 8.7Mha for harvest 2023, up near 1% from last year, but below the average trade estimate of 8.8Mha.

The Stratégie Grains oilseed report, released yesterday, estimated EU-27 rapeseed production at 20Mt. This is up 500Kt from a month earlier, citing favourable crop conditions in much of Europe for the increase. Most of Europe has had regular rainfall over the last month, with the exception of Spain, which has boosted soil moisture, read more information in Friday’s Grain Market Daily.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.