Arable Market Report - 01 December 2025

Monday, 1 December 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

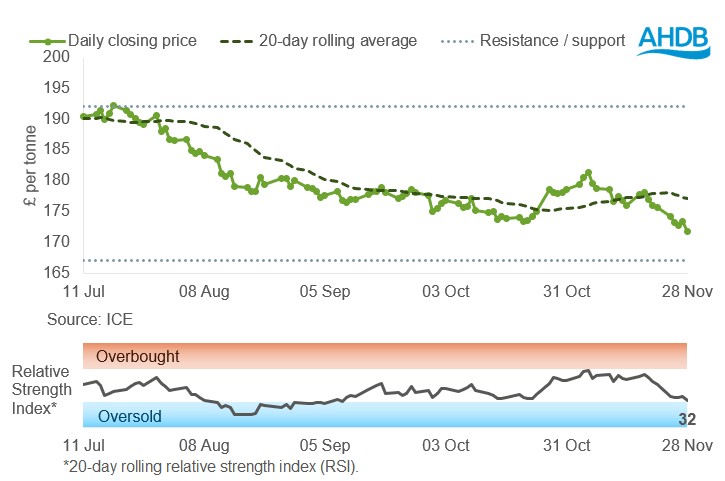

UK feed wheat futures (May-26)

Last week, UK feed wheat futures (May-26) fell below the previous support level of £173/t. The next nearest support level is now £167/t.

The relative strength index (RSI) eased to 32 from 52 the previous week, indicating a significant decrease in price. RSI is now approaching the oversold zone.

Find out more about the graphs in this report and how to use them.

Market drivers

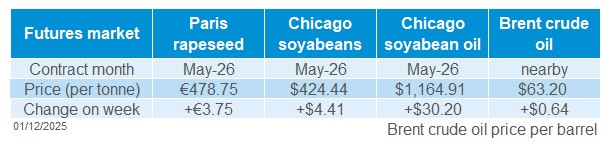

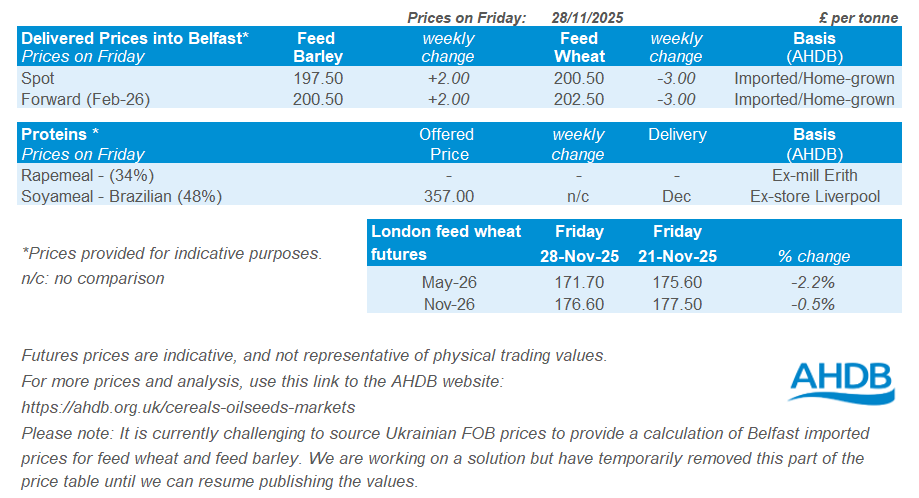

UK feed wheat futures fell last week, with the May-26 contract closing at £171.70/t on Friday, down £3.90/t (2.2%) across the week. New crop futures (Nov-26) contract fell by £0.90/t (0.5%) to £176.60/t. The ample global supply of wheat is putting downward pressure on prices. The strengthening of sterling against the US dollar and euro over the past week has contributed to the downward trend of domestic wheat prices.

Domestic prices broadly followed global market movements. Paris milling wheat and Chicago wheat futures (May-26) decreased by 2.3% and 0.3%, respectively across the week. In an increasingly competitive landscape for the world's wheat exporters, the impact of currencies is growing. Last week, the weaker US Dollar Index put additional pressure on European futures and limited the fall in Chicago.

For old crop, the European Commission increased EU-27 estimate of soft wheat production by 0.8 Mt for 2025/26 to 134.2 Mt last Thursday, given the good growing season. For harvest 26, the MARS European crop monitor showed that the weather is currently generally favourable for 2026 winter crops across Europe.

The USDA's Crop Progress (to Nov 23) reported that 48% of the US winter wheat crop was rated good-to-excellent, up 3% from last week, but behind last year’s rating of 55% The next Crop Progress report will now be published in April 2026, the market will continue to closely monitor US weather as the winter wheat crop enters dormancy.

Argentina's 2025/26 wheat harvest is expected to reach a record 25.5 Mt, up from a previous estimate of 24.0 Mt, this is due to higher-than-expected yields, according to data released by the Buenos Aires Grains Exchange last Thursday. This Argentinian crop will continue to cap any significant global price gain, given Argentina’s exportable surplus.

Last week, Chicago maize futures May-26 showed an increase of 2.5% due to competitive prices and export demand for US-origin. Maize prices were also supported by the delayed harvest of maize in Ukraine and reduced production prospects for the first Brazilian maize crop.

In the geopolitical arena, the results of negotiations between Ukraine and Russia regarding a peace agreement could also be in the spotlight for market participants, at the moment agreements have not been met.

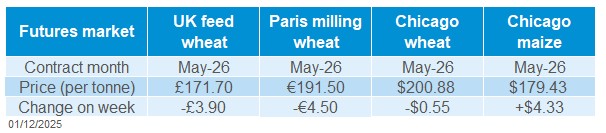

UK delivered cereal prices

Domestic delivered wheat prices were mixed across the week, as UK feed wheat futures Thursday to Thursday ended down.

Feed wheat delivered into East Anglia in December was quoted at £173.50/t, unchanged on the week.

However, bread wheat for December delivery into Northamptonshire was quoted at £186.00/t, down £3.50/t on the week. Bread wheat for December delivery into the Northwest was quoted at £196.00/t, with no comparison on the week.

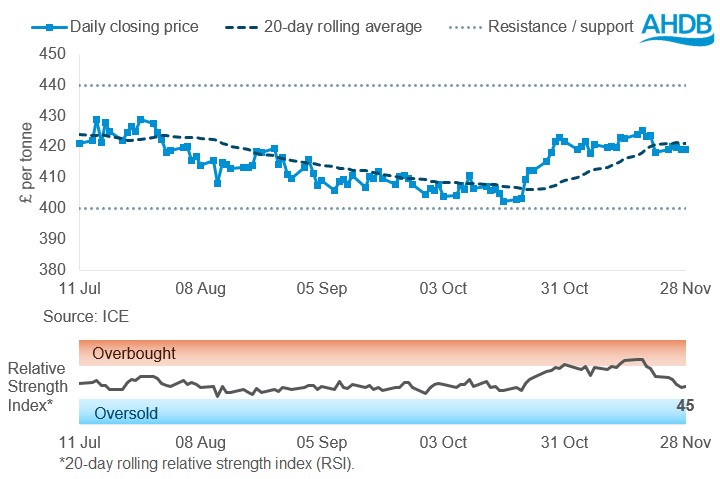

Rapeseed

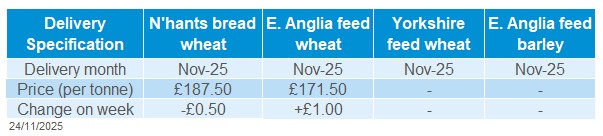

Paris rapeseed futures in £/t (May-26)

In £/t terms, May-26 Paris rapeseed futures increased last week (21 November – 28 November), but closed below the 20-day moving average near £421/t. The RSI fell from 57 to 45, signalling weaker momentum as it moved closer to the oversold zone.

Find out more about the graphs in this report and how to use them.

Market drivers

The oilseeds complex strengthened last week. Paris rapeseed futures (May-26) rose €3.75/t (0.8%) to close at €478.75/t, supported by firmer vegetable oil markets. Chicago soya oil and Winnipeg canola futures (May-26) gained 2.7% and 1.5% respectively. A slight increase in Brent crude oil futures and position adjustments ahead of the US Thanksgiving holiday on Thursday (27 December) also added support. However, ample global supplies continue to cap upside potential.

Chicago soyabean futures (May-26) rose by 1.1% on the week. Demand from China underpinned the market, with reports of around ten cargoes of US soyabeans purchased following a call between Trump and Xi. However, it remains uncertain whether sales will reach the 12Mt by January 2026 referenced by the White House, due to strong competition from Brazil. There were also reports of China rejecting 69 Kt of Brazilian soyabeans after they failed inspection.

Across the EU, fundamentals remain bearish, with higher production forecasts and good crop conditions. Expana forecasts EU rapeseed production at 20.8 Mt in 2026/27, up 1.5% year-on-year. The EU’s crop monitoring service MARS reports that winter crop sowing is progressing well, with cereals and rapeseed showing good early establishment.

In South America, planting progress remains mixed. In Brazil, soyabean planting for 2025/26 is 86.9% complete (to 28 Nov), slightly behind last year and the five-year average. Weather remains mixed, with irregular rainfall and periods of extreme heat raising concerns for crop development, though expectations still point to a record crop (Pátria Agronegócios). In Argentina, soyabean planting reached 36% of the planned 17.6 Mha by 26 November (Buenos Aires Grain Exchange). Progress is behind last year and the five-year average due to excess moisture. Crop ratings have eased, with 62% (to 26 Nov) rated good-to-excellent, down from 70% the week before.

Key data watchpoints over this week include; the release of the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) updated production estimates tomorrow (02 Dec), with the rapeseed forecast anticipated. In Canada, Statistics Canada will release its crop production figures (04 Dec), with traders expecting higher on‑farm canola stocks than previously reported. Lack of Chinese demand continues to limit export opportunities, capping any significant gains.

UK delivered rapeseed prices

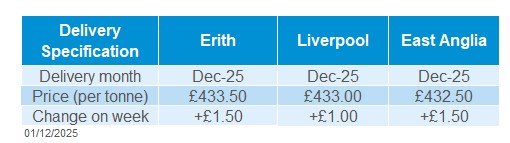

UK delivered rapeseed prices followed Paris rapeseed futures higher on the week.

Delivered rapeseed into Erith for December delivery was quoted at £433.50/t, up £1.50/t from the previous week. While December delivery into Liverpool gained £1.00/t to £433.00 and East Anglia at £432.50/t, gaining £1.50/t week-on-week.

These prices are based on a survey typically carried out mid to late Friday morning, so they may not always reflect trends seen in the Paris futures by close of play.

Extra information

On Thursday, we published the first official UK cereals supply and demand estimates for 2025/26. Given this season’s mixed harvest and uncertainties around demand, we examine what this means for the balance of supply and demand here.

The AHDB’s first crop condition report for harvest 2026, released on Friday, shows strong prospects for winter wheat, barley, oats and oilseed rape. Drilling conditions have been much better than last year, with almost all crops now drilled, only 3% of winter wheat remained as at 24 November.

The Recommended Lists for cereals and oilseeds (RL) 2026/27 will be released today, Monday 01 December 2025.

AHDB UK cereal usage data for November, covering UK human and industrial consumption as well as GB animal feed production, will be released on Thursday, 04 December.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.