Analyst insight: Will the UK wheat discount to Paris grow further in 2022/23?

Thursday, 16 June 2022

Market commentary

- UK wheat futures (Nov-22) closed yesterday at £310.05/t, down £0.80/t on Tuesday’s close. May-23 closed at £315.60/t, down £0.60/t over the same period.

- Paris milling wheat futures (Dec-22) were unchanged on the day closing at €386.75/t. Strengthening (+1.26%) sterling against the euro provided a small amount of pressure to the domestic market. Trading closed yesterday at £1 = €1.1659.

- Chicago wheat futures are under pressure as harvest progresses, with dry conditions in the Plains anticipated to speed up harvest. As of 12 June winter wheat harvest in the US was at 10% complete, down slightly from the five year average of 12% at this point. Updated figures will be released 20 June.

Will the UK wheat discount to Paris grow further in 2022/23?

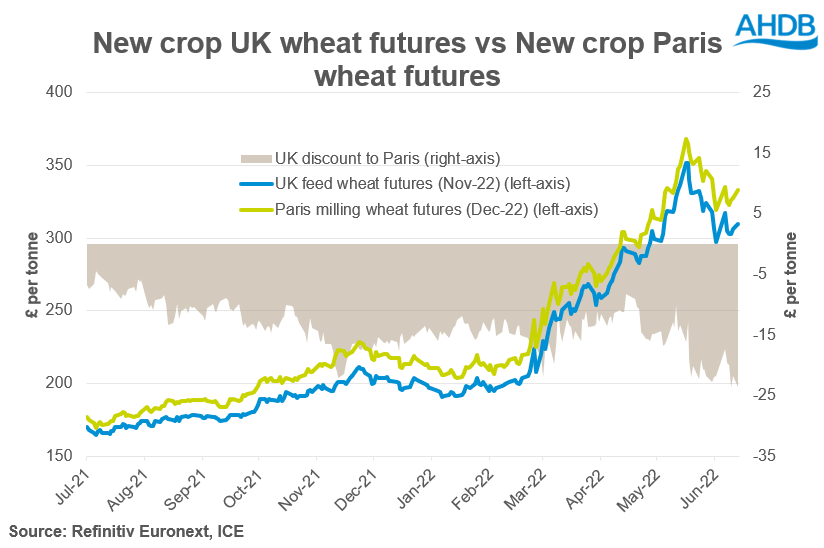

With the strong potential of increased domestic availability for the 2022/23 marketing year, could UK feed wheat futures be at a greater discount to Paris milling wheat futures? Or are there other factors that could change this?

Although UK ex-farm values are ultimately driven by the global market, our domestic supply and demand will dictate how near (or discounted) our prices are to the global market.

Typically, UK feed wheat futures trade at a discount to Paris milling wheat futures. However, the size of our exportable surplus impacts this relationship. In years of tight domestic supply, the UK will often trade near parity or even premium to Paris. However, in years where there is a higher surplus of wheat, the UKs discount becomes larger. The size of the French crop and changes in exchange rate also influence these prices.

Discount to the continent

Yesterday, new crop UK wheat futures (Nov-22) closed at £310.05/t, a £23.82/t discount to new crop (Dec-22) Paris milling wheat futures, which closed at £333.87/t.

In years when the UK has a larger exportable surplus, the UK trades at a bigger discount to Paris to price into the global market. For example, in 2015/16, on average nearby UK feed wheat futures traded at a £14.32/t discount to Paris milling wheat futures. That year we exported 2.848Mt of wheat. Similarly, in 2019/20 on average we traded at a £13.33/t discount, and we exported 1.205Mt of wheat that marketing year.

So far throughout the 2021/22 marketing year, our new crop futures (Nov-22) on average have traded at a £13.84/t discount to Paris futures (Dec-22). This discount is sizable and comparable to historical times when the UK has had a large exportable surplus.

Improved supply outlook

Carry in stocks for 2022/23 are currently estimated at 1.893Mt, 34% higher than 2021/22 levels, according to the latest supply and demand estimates. Furthermore, UK wheat production is expected to be higher on the back of a larger planted area. Last week in Grain Market Daily, I looked at possible production levels for harvest 2022, using the planting intentions from the Early Bird survey and the findings from the latest UK crop development report. Based off this, we could see a c.15Mt wheat crop in 2022/23. Obviously, this is based off planting intentions and a lot can happen between now and harvest weather wise. However, this gives us an indication of the size of the crop, with the information we have to date.

Taking all this information into account, total opening stocks and production for 2022/23 could be in the region of c.16.9Mt, similar to levels recorded in 2019/20 (18.1Mt) and 2016/17 (17.2Mt).

Forward looking points

Despite all of this, markets and trading dynamics can change over time which will influence ex-farm wheat values.

For example, in 2016/17 we started the year front loading a significant amount of wheat exports but ended the marketing year importing wheat.

Currently, our new crop market is at a large discount to the continent but going forward these factors, amongst others, could change that:

- UK domestic production isn’t as high as anticipated – we are expecting a sizable crop this year with better conditions and larger planted area. However, if we experience any adverse weather from now to harvest, or the area is smaller than intentions suggest, this will alter total availability for 2022/23.

- Bioethanol demand – it is expected that both UK bioethanol plants will be fully operational in 2022/23. Strong domestic demand for wheat by the bioethanol sector could close the gap to continental prices.

Concluding thoughts

Although the UK market largely follows global fundamentals our domestic availability going into 2022/23 will influence farmgate prices

We are trading at a large discount to Paris now due to larger supply going into 2022/23. Going forward domestic use is a key watchpoint which could influence our trading relationship with continental markets.

Even with a larger domestic supply next season, if the support and volatility in grain markets due to tight global supply continues, it is unlikely that there will be a dramatic shift in UK prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.