Analyst insight: Will milling premiums move higher?

Thursday, 3 October 2019

Market Commentary

- UK feed wheat futures (Nov-19) continued their decline yesterday, falling £1.45/t to close at £137.30/t.

- Yesterday’s value decline of UK wheat futures follows moves lower for global grain futures.

- This movement in UK wheat futures see prices drop back below the 50-day moving average for the contract, having broken above earlier this week.

- Sterling has continued to weaken against the euro this week, further undermining the value of UK wheat.

Will milling premiums move higher?

On Tuesday we published the second provisional results of the Cereal Quality Survey. The results are now beginning to reflect some of the challenges facing the industry with this year’s wheat crop. As we’ve moved through the 2019 harvest, rainfall has been a significant challenge, particularly for wheat in the North and Scotland.

However, despite the challenges, which are now largely known by the industry, we have not seen milling wheat premiums rise to the extent that we might have thought they ought to. Why is that?

A note on quality

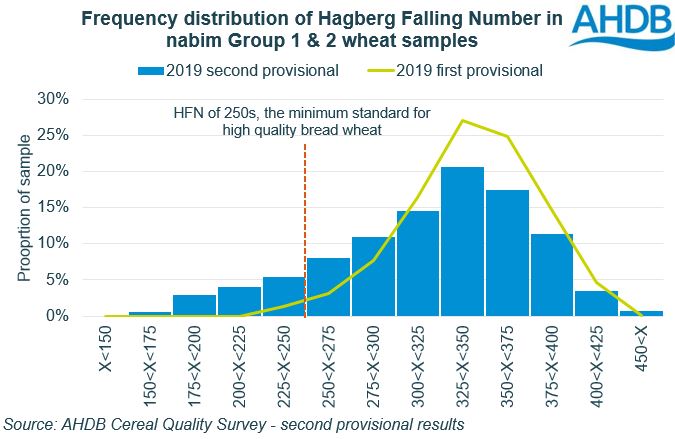

I’m not going to go over every detail of the Cereal Quality Survey, the results of which are available here. However, one challenge worth highlighting is the changing pattern of Hagberg Falling Numbers (HFN) as we’ve progressed through harvest.

Looking at a frequency distribution of HFN shows that, from the first release to the second release, we have seen an increased proportion of samples with a HFN of less than 250s, the minimum standard for high quality bread wheat.

This has affected the proportion of wheat meeting a high quality specification, dropping 10 percentage points from 55% to 45%. But, the pass rate remains 2 percentage points above last season.

There are some important differences between this season’s quality challenge and last years. It is worth noting that last season was primarily a low protein led challenge, whereas this year is a HFN led issue. While you can mitigate low protein through blending, lower HFN is more difficult to manage.

How have premiums reacted?

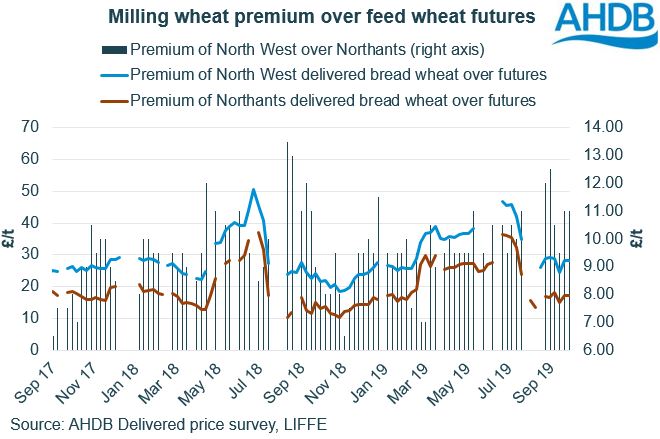

Given the reducing quality, particularly in more northern parts of the country, we would expect to have seen the milling wheat premium extend. However, the premiums of North-West and Northamptonshire delivered bread wheat over UK feed wheat futures are only sitting marginally above last year’s levels.

The lack of rise in domestic bread wheat premiums likely reflects the overwhelming size of the UK wheat crop.

How big is the premium milling crop?

The area planted to nabim Group 1 increased for harvest 2019. Added to that, average UK wheat yields are up 14.8% year-on-year according to ADAS. Theoretically the UK nabim Group 1 wheat crop stands at 4.19Mt, a rise of 807Kt on last season.

With a 45% pass rate, the volume of wheat meeting a premium milling specification for GB as a whole is provisionally 1.89Mt, up from 1.46Mt last year (43% pass rate).

What about the North?

From the ADAS harvest reports, we know that wheat in the north of England and in Scotland has been significantly affected by rainfall and anecdotally HFNs fallen accordingly.

Although there is insufficient data to give explicit results for Northern England and Scotland at this time, anecdotal reports suggest that HFN is significantly lower than the UK average in those regions. In the North HFN has reportedly averaged 250-260s while in Scotland HFN has averaged 220-230s.

We have seen some increase in the premium of North West delivered milling wheat over Northants milling wheat however.

However, whether Northern premiums needs to move higher to attract grain remains to be seen. With ample availability of wheat in the South and East, we will likely see those origins hold at a significant discount to the North in order to attract movement rather than seeing North-West delivered milling premiums move higher.

Furthermore, the ability of prices in the North to rise will be limited by the value of imported wheat. With Europe largely unaffected by the rainfall which hampered UK harvests, the availability of good quality milling wheat is strong. This will limit the upward potential for domestic milling wheat.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.