Analyst Insight: Why isn’t UK wheat more expensive?

Thursday, 5 December 2019

Market Commentary

- The value of the pound has continued to gain, closing yesterday at £1=€1.1826. This is the highest close price since 15 May 2017 and over 10% stronger against the euro from the lows recorded in August this year (9 Aug 2019, £1= €1.0767).

- Gains in the value of the pound have added pressure to both May-20, old crop UK feed wheat futures and new crop (Nov-20) contracts, closing down £0.75/t, at £149.50/t, and down £0.45/t, at £155.80/t, respectively.

- UK usage data highlights changes in other flour production, read about the link to biofuel demand and the sector outlook here.

Why isn’t UK wheat more expensive?

As we gain greater clarity that next year’s wheat area will record a decline, backed up by the Early Bird planting intentions survey, why have new crop feed wheat futures (Nov-20) been in decline?

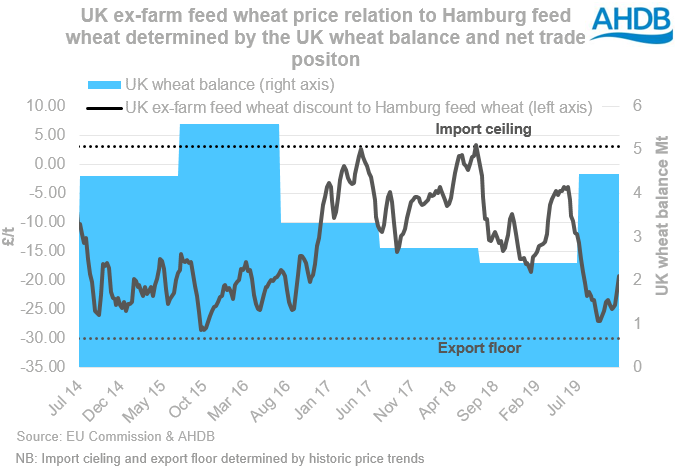

The single most important factor for where the UK prices relative to other trading partners is our supply and demand outlook. The way in which the UK swings from surplus to deficit determines the pricing relationship with continental Europe.

In surplus years, domestic wheat needs to price competitively into Europe and is at a discount, by the cost of freight rate, to export to the continent. Whereas in years of deficit, domestic wheat prices rise to reach a premium to European wheat to allow imports from the continent into the UK.

Using the UK wheat balance to represent supply and demand, the binary pricing relationship can clearly be seen. The exception to this is the 2018/19 season, domestic prices were unable to gain as high due to cheaper maize imports.

Where are new crop futures pricing?

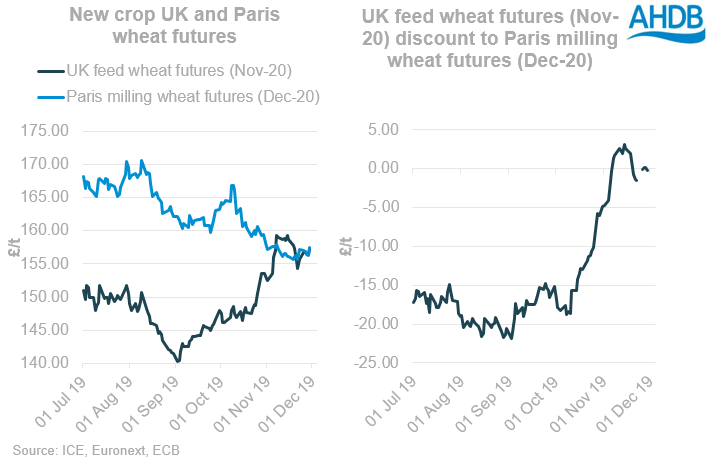

Looking to new crop, in order to assess where domestic wheat is pricing, we can compare UK feed wheat futures and Paris milling wheat futures.

Due to the difficult drilling conditions and production concerns for harvest 2020, the price of new crop UK feed wheat futures gained consistently from September until mid-November. Yet, further gains in UK feed wheat futures have since been difficult to achieve.

Once new crop UK feed wheat futures reach the same price as Paris milling wheat futures the import price ceiling, which has been recorded in previous deficit years, appears to have been reached.

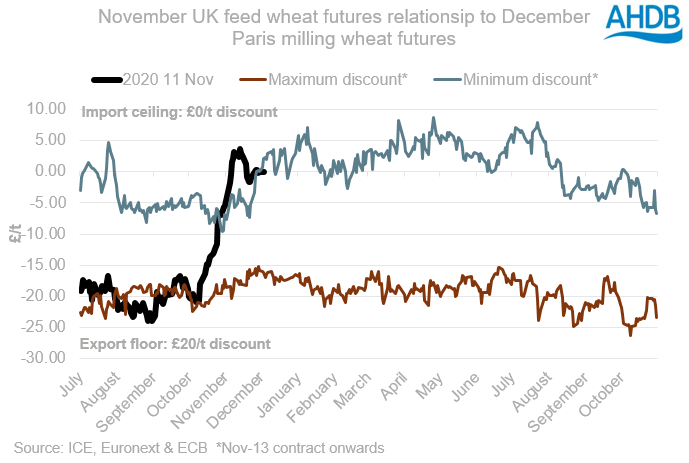

Looking back, the relationship between UK feed wheat futures and Paris milling wheat futures again shows the binary surplus or deficit pricing relationship. UK feed wheat prices are unable to climb much above a small premium to Paris milling wheat futures contracts in years of deficit, and fall to an export floor in years of surplus.

With new crop UK feed wheat futures (Nov-20) now having reached the import ceiling, further gains relative to continental wheat will be difficult to come by.

As such the somewhat bearish global price trends and strengthening currency are now the predominant driving force behind UK futures markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.