What is the outlook for domestic bioethanol wheat usage?

Thursday, 5 December 2019

Flour and bioethanol

In October the year on year decline in total wheat usage by UK flour millers (including starch and bioethanol) slowed somewhat to 488.6Kt, 3% lower than in October 2018. The easing decline in total usage can be partly attributed to Vivergo Fuels being offline for a full calendar year, following a cease in production at the end-September 2018. This means the annual comparison of data is now more representative.

That said, season to date (Jul-Oct) total wheat usage by UK flour millers is 1.9Mt, 13% down on the same period in 2018/19. This is the lowest level for this point in the season since 2006/07, which was before either of the UK bioethanol plants started production.

With it being assumed that Vivergo Fuels will remain offline for the rest of the 2019/20, what are the prospects for wheat consumption by UK flour millers (including bioethanol and starch)? According to the latest UK supply and demand estimates published last week, demand is expected to remain relatively stable this season compared with last.

While the proportion of wheat used by the bioethanol sector is anticipated to be higher this season, due to its relative price and availability compared with imported maize, it is expected that total usage will be lower.

'Other flour' usage

Due to the sensitive nature of the information, usage of wheat by the bioethanol industry is not published as a separate entity to flour millers. That said, a good indication of the general level of wheat used in the UK for bioethanol and starch is captured under the ‘Other flour’ production category.

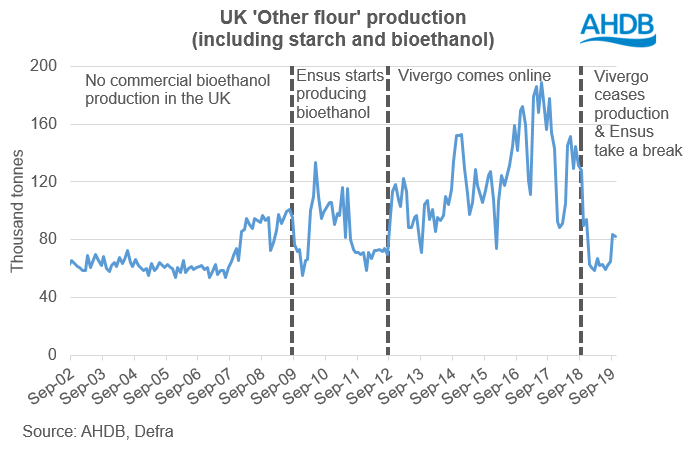

The above graph shows the growth in ‘Other flour’ production at different points in time. Prior to large scale bioethanol production in the UK, the ‘Other flour’ category showed minimal fluctuation. Once both Ensus and Vivergo Fuels came into play, you can see the jumps in production, peaking at 189Kt in June 2017.

You can also note the drop off in production when Vivergo Fuels went offline at the end-September 2018 and Ensus paused production at the end-November for a few months. It is worth bearing in mind that it’s not just wheat used in the production of bioethanol in the UK, maize is also included, with its relative price to domestic grains last season being more favourable.

While caution should be taken when viewing these figures, as flour production is not a complete representation of grain usage, it can give an overall trend. Therefore, if this reduced demand from the bioethanol industry continues for the long term we could see lower wheat usage by UK flour millers (including bioethanol and starch) become the new norm, although it should be noted that this is also dependent on a number of factors.

2019/20 season

Going back to overall wheat supply and demand for the 2019/20 season. Higher availability from a bumper harvest, combined with below average human and industrial demand and relatively stable animal feed usage, gives a surplus available for either export or free stock at just short of 3Mt. This would be to be the largest since 2015/16.

With July to September exports totalling 414Kt, there is 2.565Mt of wheat to be either exported from October to June or carried over into next season. You can view the latest supply and demand estimates here.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.