Analyst Insight: What is the risk of intervention in global grain markets?

Thursday, 2 April 2020

Market Commentary

- UK feed wheat futures continued their retreat from recent highs yesterday. Old crop (May-20) futures lost £2.50/t, to close at £155.25/t. New crop (Nov-20) futures lost more ground, ending the day 1.9% lower (£3.20/t), at £164.50/t. Both contracts have now broken below their respective 20-day rolling averages. With no fundamental support for wheat, following the large global wheat area, currency-accepting declines are likely to continue in the short term.

- Sterling continued to make incremental gains yesterday against the euro, ending the day at £1=€1.129. However, following recent strength against the dollar sterling fell back against the currency yesterday, ending the day at £1=€1.238.

- The latest animal feed and human and industrial usage statistics for February 2020 have now been published online.

What is the risk of intervention in global grain markets?

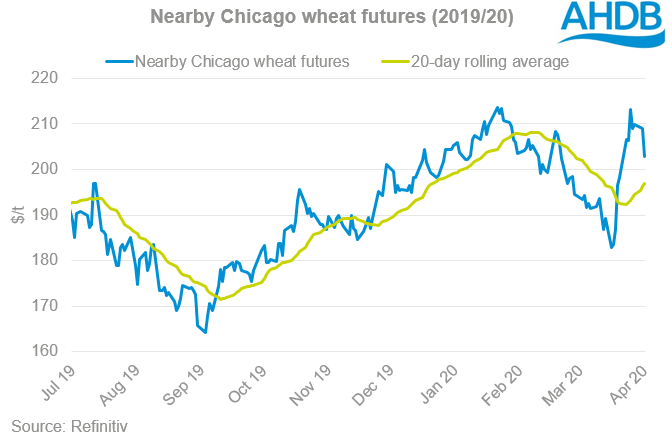

In times of uncertainty, markets can act in a very volatile and erratic manner to news stories. This is especially true when we consider the impact of political intervention in grain markets. Over the past fortnight, we have heard a number of stories, particularly from the Black Sea, surrounding export restrictions for wheat in Ukraine, Russia and Kazakhstan.

While these stories provide short-term volatility, what is the long-term implication of them?

We feel that with large wheat crops expected globally next season it is likely that export bans or talk of them will only add short-term support to an otherwise fundamentally bearish market.

What intervention are we seeing?

Russia - So far, there have been a number of different suggestions around how Black Sea intervention may work. The latest as far as Russia is concerned has come from the countries agriculture ministry suggesting a 7Mt cap on grain exports from April to June 2020. Problems so far have reportedly come for wheat, with challenges obtaining phytosanitry certificates in some regions.

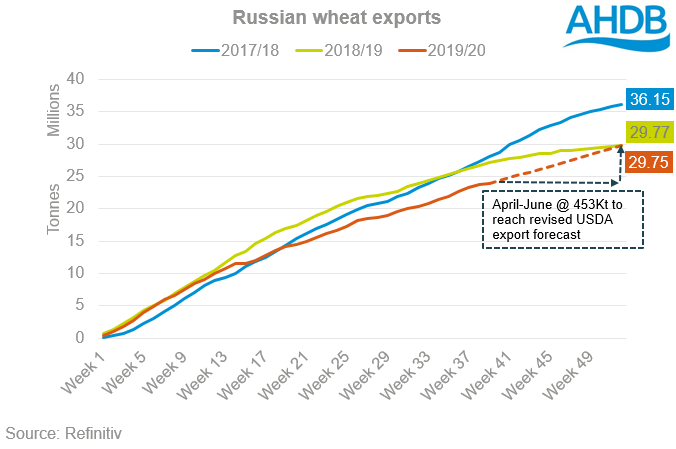

This initially provided significant support to the market but looking at this in more detail suggests that there may be less fundamental support for prices because of the proposed limit. Export data from Reuters suggests that Russia has so far exported 23.9Mt of wheat.

In the past two seasons Reuters export data has shown Russian exports reach circa 85% of the USDA full season forecast. Using this figure for 2019/20 suggests Russia has 29.8Mt to export this season. This leaves 5.9Mt to be exported in the April to June window. Applying a similar approach to barley exports suggests around 690Kt left to be exported.

That said, the weakness in the rouble is worth noting as it has supported export demand and we could see firmer exports as a result.

At present it would appear that the Russian administration is taking alternative measures to export caps to support domestic demand, selling 50% of its wheat stocks.

Ukraine – Ukraine’s grain trade agreed on Monday to impose a restriction curbing wheat exports at 20.2Mt for the 2019/20 season. As with Russia, this has been done in order to protect national interests and relieve some of the pressure on wheat prices.

The Ukrainian hryvnia has also seen significant weakness through March, prompting increased export competitiveness.

Ukraine has had a very heavily frontloaded wheat export schedule this season, and has already shipped 17.2Mt through to March 23, with a further 428Kt booked. The USDA forecast Ukraine to export 20.5Mt this season; as such, the proposed export cap is likely to have a limited effect on old crop fundamentals.

What happens next for prices?

As I have mentioned below in my explanation of the 2010 Russian export ban. A ban at this time would seem strategic rather than fundamental, and it is hard to see an export ban, if implemented, sustained beyond the end of this season.

The latest IGC report (26 March) estimated 2020/21 Russian wheat production at 80Mt, assuming Russian domestic demand of 40Mt (USDA five-year average), there is a large exportable surplus for next season. If those stocks are carried forward because of a sustained export ban then Russian cash prices will be pressured, achieving the goal of reduced food inflation in the short term, but is this sustainable in the long term?

Furthermore, the loss in value of maize because of increased US area and a reduction in US ethanol demand has pulled the rug from under the feet of wheat prices. With large wheat crops expected globally next season it is likely that export bans or talk of them will only add short-term support to an otherwise fundamentally bearish market.

This is not the first time this season that Russia has proposed an export ban. In January, last year Russia proposed a 20Mt non-tariff barrier for wheat for the second half of the season. Markets initially reacted in a bullish manner to the sentiment of the story. However, with Russia’s exportable surplus at the time, reputedly less than the 20Mt target proposed, and not actually coming to fruition, prices fell back.

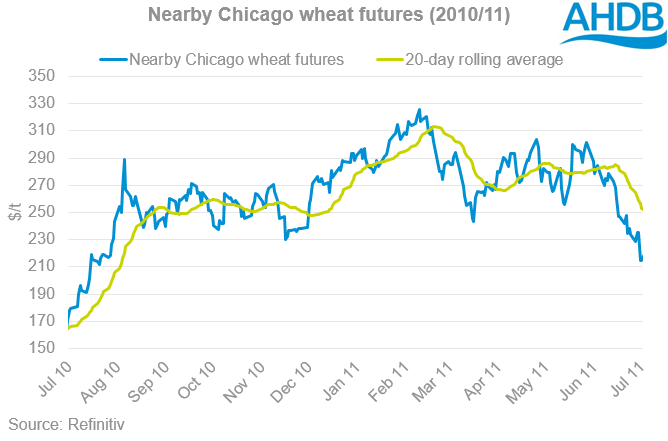

Should we see a more significant ban on Russian wheat exports in response to virus, it is prudent to consider the effects of the Russian export ban on exports in 2010.

Before going into the detail, it is important to consider that the circumstances between 2010 and now are very different, as is the level and stability of wheat production in the Black Sea. With wheat prices supported and large crop expectations, it is expected that unlike in 2010, Russia will remain dependent on wheat exports next season for capital income, especially given the current value of crude oil.

In 2010, Russia was faced with a significant cut to wheat production following significant drought. As a result Russian wheat production fell by 20.3Mt, year-on-year, to 41.5Mt drastically reducing the nations exportable surplus, leading to the export ban.

The reduction in both Russian and global production (down 27.5Mt, to 660.6Mt) in 2010/11, resulted in a significant rise in global wheat prices, which was sustained, given there was a fundamental rather than strategic shift in supply.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.