Analyst Insight: What can we expect for bioethanol demand in 2025/26?

Wednesday, 10 September 2025

Market commentary

- UK feed wheat futures (Nov-25) closed down £1.15/t (0.7%) at £165.85/t yesterday. The May-26 contract fell £1.40/t yesterday, closing at £176.85/t

- UK feed wheat futures fell yesterday, in line with global wheat futures. Paris milling wheat and Chicago wheat futures (Dec-25) dropped by 1.2% and 0.7% respectively. Ahead of the release of the USDA's World Agricultural Supply and Demand Estimates (WASDE) report on Friday, traders are forecasting higher world wheat ending stocks. This is putting downward pressure on prices

- Paris rapeseed futures (Nov-25) increased by €4.50/t (1.0%) to close at €464.50/t. Meanwhile, Winnipeg canola and Chicago soyabean futures (Nov-25) fell by 1.2% and 0.2% respectively yesterday

- Winnipeg canola futures are under pressure from the ongoing harvesting campaign in Canada. However, Paris rapeseed futures rose yesterday, primarily due to technical factors. EU imports of rapeseed for the 2025/26 season were still below last season's figures on 7 September, at 0.49 Mt compared to 1.03 Mt the previous season

What can we expect for bioethanol demand in 2025/26?

In the latest AHDB Cereals market outlook, we used data from our fourth harvest progress report, Defra’s 2025 June Survey of Agriculture, and results from our Planting and Variety Survey (PVS), to estimate UK wheat harvest for 2025 at around 12.2 Mt.

This current estimate would see an increase of 10% on last year's crop, but would be 12% lower than the 10-year average.

But what about domestic wheat consumption in 2025/26? One of the most unpredictable aspects on the demand side at the moment is from the bioethanol sector.

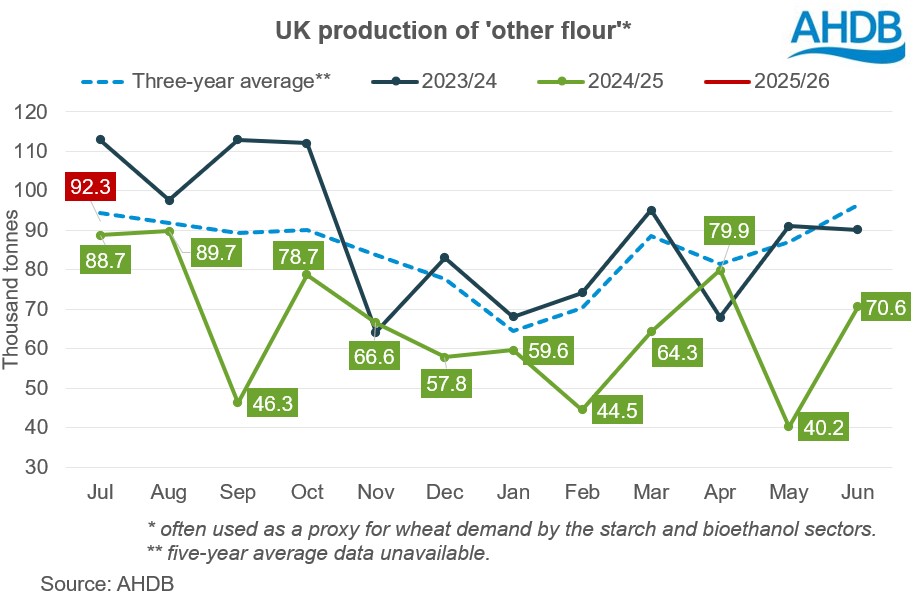

The ‘other flour’ category within our UK flour millers’ usage dataset, is generally used as a proxy for output from the starch and bioethanol sectors.

The start of the 2025/26 season in July showed UK wheat usage for production of 'other flour' to be 4% higher than the same month last season, but slightly below the three-year average.

In the full 2024/25 season, wheat usage for ‘other flour’ production fell 26.4% year-on-year. Neither UK bioethanol plant ran at full capacity last season, largely due to competitively priced ethanol imports.

Another factor driving the decline, was the question mark over the resolution of the status of domestic feed wheat under the renewable energy directive (RED II).

The decision made by the UK government in May to remove tariffs on imported US bioethanol also raised concern over profitability for the UK plants.

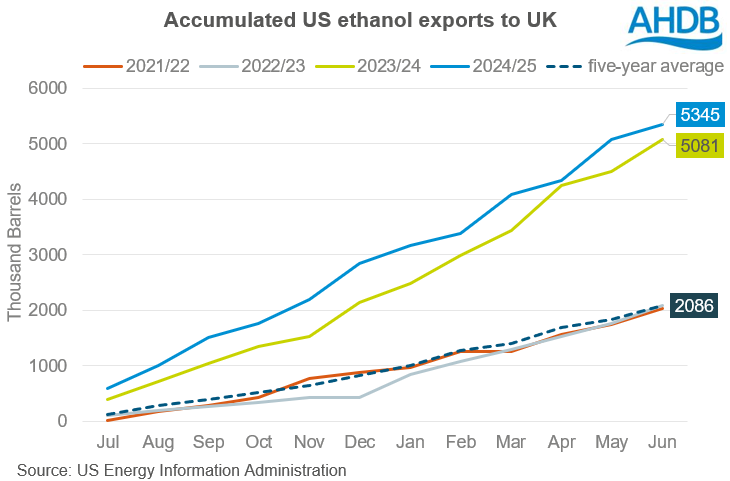

US fuel ethanol exports to the UK reached record levels in the 2023/24 and 2024/25 seasons: 5.1 and 5.3 million barrels, respectively.

The UK's share of total US fuel ethanol exports has increased significantly in recent years, rising from 2.8% in the 2019/20 season to 10.9% in the 2024/25 season (July to June). The highest level was 12.8% in the 2023/24 season.

What next?

In mid-August, Associated British Foods plc (ABF) announced the closure of Vivergo, with all production ceased by the end of the month.

As such, with just the one plant now running we can expect a drop off in wheat demand for the sector. Focus in 2025/26 will now be on Ensus. Providing it prices competitively, maize usage is likely to remain firm, if the plant continues to be operational.

A decrease in the amount of wheat used for bioethanol in the UK will likely affect the balance of UK supply and demand. The drop in demand for the sector could be partially offset, should we see an uptick in demand from the animal feed sector, or an uptick in exports.

However, without these factors, in theory we would see a climb in domestic wheat stocks at the end of this season. A surplus of feed wheat in the North East could affect domestic wheat premiums in that region (where the two bioethanol plants are located).

Moving forward, data on production of 'other flour' in the monthly UK flour millers' cereal usage and production figures, could be limited from September, as has been the case in previous seasons when plants have been out of operation.

Useful links

Find the latest information on UK human and industrial cereal usage

Read our latest information on the UK cereals supply and demand estimates

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.