Analyst Insight: Price risk management tools for rapeseed in the UK

Thursday, 14 November 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £174.05/t yesterday, falling £3.35/t from Tuesday’s close. The May-25 contract fell £3.25/t over the same period, to close at £186.60/t.

- Domestic wheat futures, Chicago wheat futures, Paris milling wheat and Paris maize futures prices fell on Wednesday’s close. US Dollar Index futures (Dec-24) closed higher for the fourth consecutive day yesterday, pressuring US commodity markets, which in turn has weighed on global grain and oilseed markets. The USDA weekly export sales report will be updated tomorrow. Favourable rains are forecast in the US, which could improve winter wheat crop conditions further.

- Paris rapeseed futures (May-25) closed at €529.25/t yesterday, falling €3.50/t from Tuesday’s close. The Aug-25 contract also fell €4.25/t over the same period, to close at €492.50/t.

- European rapeseed futures prices followed Winnipeg canola and Chicago soyabean futures down yesterday. Technically, Jan-25 Chicago soyabean futures could find some support as prices are about to reach the psychological $10 per bushel level. Argentina's Rosario grains exchange forecasted soybean production slightly up, compared to previous estimates.

Price risk management tools for rapeseed in the UK

Rapeseed prices have been volatile recently due to lower production in the current marketing year and prices changing in the vegetable oils complex. With the volatility in rapeseed markets, this analysis explores how to better mitigate risk, as well as which price risk management tools are effective.

The 2024 UK oilseed rape (OSR) crop is expected to be the lowest since at least the early 1980s. AHDB have 2024 OSR production pegged at 837 Kt, down 31% on the year, on the back of a significantly lower planted area and lower yields. Furthermore, according to our last harvest report, winter oilseed rape yields were down 7.7% across the UK, at an average of 2.97t/ha. Lower rapeseed output and high risk of price movement is a very tough combination for farmers.

With smaller UK OSR crops over recent years, the share of imported rapeseed in the UK balance sheet has increased and the influence of Paris futures on the domestic market is higher. This could present us with additional risks and opportunities.

For Nov-24 Paris rapeseed futures, the 31 October was the last trading day. We can do some analysis of the price risk from the beginning of the current marketing year (July 2024) until the expiration of Paris Nov-24 futures, compared with delivered rapeseed prices to Erith for November delivery.

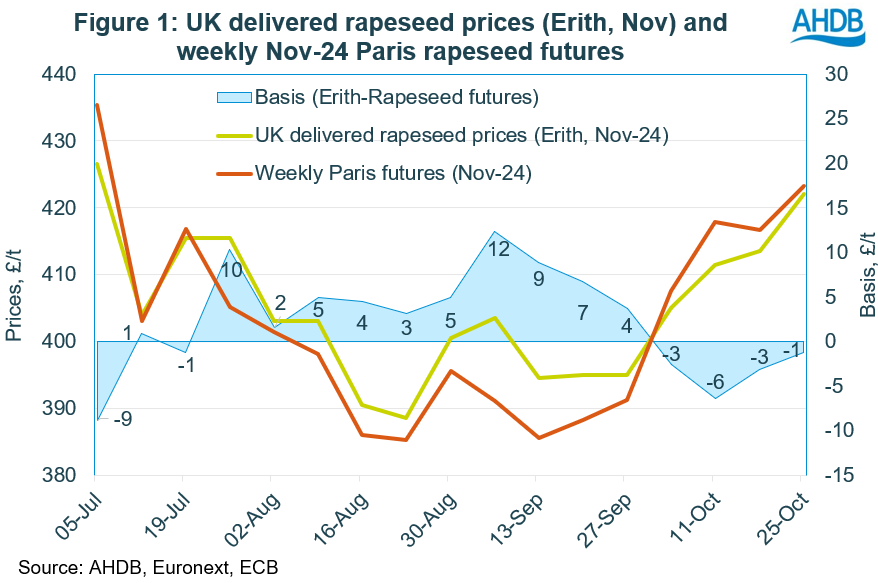

The price difference (basis) between the weekly delivered rapeseed prices into Erith for November delivery and the Nov-24 Paris rapeseed futures shows the potential risk of using price risk management tools, such as the forward basis contract, Paris futures or options. Selling rapeseed using a forward basis contract (fix difference with link to Paris futures) at the beginning of the marketing year (basis fixing at -9 to Paris Futures) would have resulted in a potential loss in September 2024, as physical prices were higher than the futures prices (Figure 1). Conversely, fixing the basis at +12 in September and taking a physical delivery in October, would have resulted in additional income.

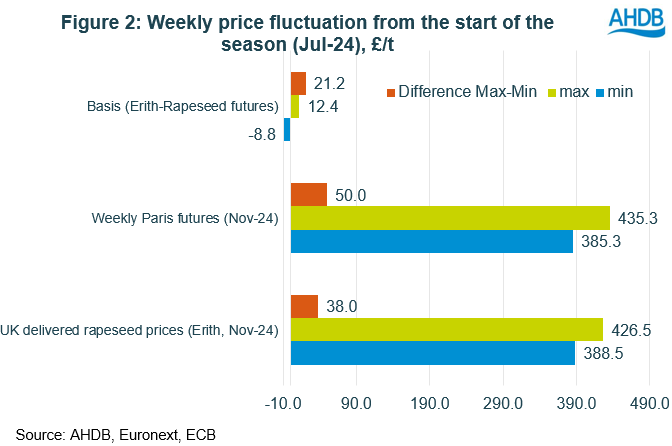

Before using price risk management tools, it is necessary to assess the basis risks and compare them with price risks. If the fluctuation of basis is higher than the fluctuation of futures prices, any instruments for price risk management will not be effective. As can be seen in Figure 2, the basis fluctuates in a smaller range than futures and physical prices. As such, using price risk management tools such as forward contract with fixed basis, Paris futures and options could be effective.

Looking ahead

The high degree of interdependence between UK delivered rapeseed prices and Paris futures prices allows the use of price risk management tools such as forward contract with fixing basis, Paris futures or options. However, the range of fluctuations in the basis need to be considered. When concluding a forward contract for rapeseed with a fixed basis and a link to futures, it is imperative to check historical data when the basis is stronger or weaker. This analysis uses UK delivered rapeseed prices for delivery to Erith in November 2024 and weekly Nov-24 Paris rapeseed futures prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.