Analyst Insight: Is UK barley export competitive?

Thursday, 12 September 2019

Market Commentary

- Despite sterling weakening yesterday against the US dollar it is currently the strongest it has been since the end of July against both the euro and US dollar.

- UK feed wheat futures (Nov-19) slipped marginally yesterday to close at £134.75/t, £0.25/t down. This is up £5.00/t from the previous low hit on 2 September.

- Paris rapeseed futures (Nov-19) lost €1.75/t yesterday to close at €381.50/t. However, this morning it has increased again slightly.

- The USDA supply and demand estimates released today (17:00 GMT) will likely drive markets with US corn and soyabean areas of key interest.

Is UK barley export competitive?

The implications of a no deal Brexit on barley trade and associated market access was discussed in a previous article. The UK is facing a large barley surplus which in a “normal” year would be exported to Europe. However, we are all aware that this year is no “normal” year. With little clarification on Brexit, this article continues to focus on a no deal with the UK leaving the EU on 31 October. Even if Brexit is delayed, the UK will still require access to third country export markets.

In order to access non-EU markets, the UK will need to price competitively against the likes of the Black Sea region and France, key competitors to UK trade into non-EU markets. Because of this the relationship between UK and Black Sea prices will strengthen.

Although price isn’t the sole barrier when looking to trade outside of Europe; specifications and phytosanitary limits also play a part, this article focus’ primarily on pricing.

Freight

Knowing FOB (Free On Board) prices for competitors is essential, but freight rates also need to be considered too. UK trade into Europe is often done using 4Kt vessels and therefore our FOB survey quotes prices on a 4Kt basis.

However, the demand from non-EU countries is usually in the form of larger vessels. There are fewer ports in the UK where 60Kt vessels can trade from, which may also limit which traders can access these markets. The rates will also be higher due to the increased distances required to reach alternative markets for the UK.

Exchange rates

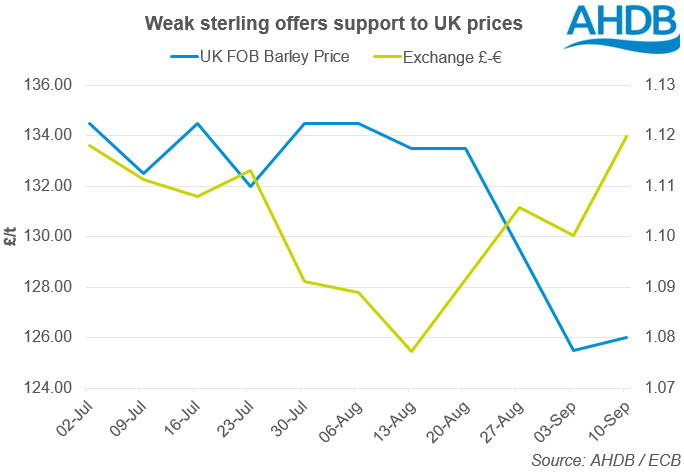

With freight rates similar for vessels from France or the UK, exchange rates will be the next factor to come into play. When sterling is weak it assists UK grain in pricing competitively against other countries while offering support to UK physical prices.

With the Black Sea generally priced in US dollar terms, the dollar-sterling exchange rate will be as important as the euro-sterling exchange rate.

Price Matrix

Pricing needs to be competitive at a CIF (Cost Insurance and Freight) level against the UK’s main competitors; France and the Black Sea. Ex-Farm prices will be derived from a CIF value less associated costs and the pricing will in effect be done in dollar terms in order to be comparable.

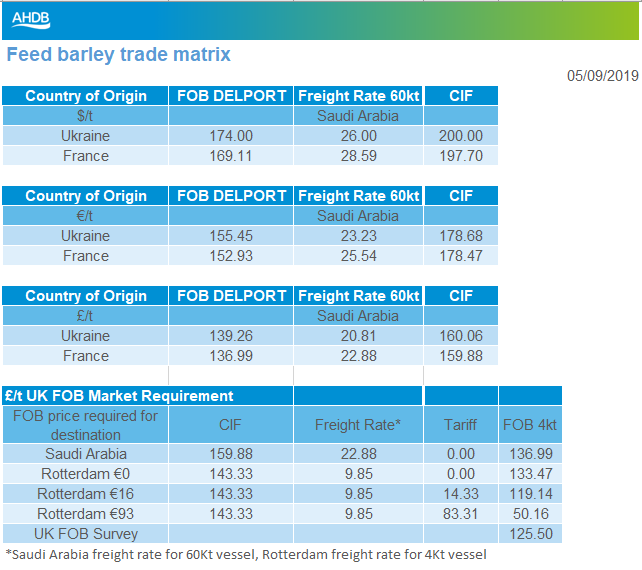

Below is a matrix used to indicate where UK prices need to be in order to compete against France and Ukraine. The first 3 tables show Ukrainian and French FOB prices in dollar, euro and pound terms. It also includes freight costs to Saudi Arabia in order to calculate a final CIF price.

The cheapest CIF price is what the UK will be competing against. This CIF price, minus freight will indicate the UK price required to be competitive into Saudi markets. Also on the matrix is the latest Rotterdam CIF price which would need to be reached by the UK in order to continue trade with Europe post-Brexit if tariffs were applicable.

The table shows that based on the most recent data available, the UK is priced competitively against France and Ukraine for Saudi Arabia. It also shows that the UK is competitive into Europe with no tariff but will struggle at current prices if tariffs are applied, even within the minimal TRQ.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.