Analyst insight: Decline in animal feed production set to continue in 2022/23

Thursday, 30 June 2022

Market commentary

- While US grain markets closed down yesterday on the back of harvest pressure and improved weather, European markets closed up. The later is partly due to strong demand for EU wheat with Egypt’s GASC putting out a tender to buy 815Kt of wheat, with offers from Europe.

- Nov-22 UK feed wheat futures closed at £282.50/t yesterday, up £5.50/t from Tuesdays close.

- Paris rapeseed futures (Nov-22) settled at €701.75/t on Wednesday, up €16.25/t from Tuesdays close. The rise in rapeseed prices is partly due to higher than expected soyabean crushing’s in the US.

Decline in animal feed production set to continue in 2022/23

Animal feed makes up over 50% of total demand for cereals in the UK. Therefore, it is important to keep an eye on the developments across the different sectors.

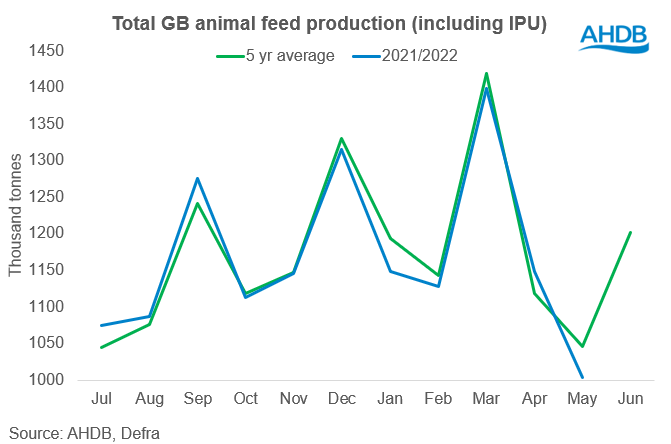

As with all industries in these current times, livestock and poultry producers have been hit with rising input costs, tightening margins. In GB, poultry, pig and cattle feed accounts for nearly 90% of total animal feed production, including integrated poultry units (IPU). With tomorrow being the start of the new marketing year (2022/23), we take a look at the three largest users of animal feed and what demand may look like going forward.

In GB, poultry feed makes up 45% of total animal feed production and is by far the largest sector. As I discussed in an Analyst Insight back in May, the domestic poultry sector has been struggling of late with soaring input costs, avian flu pressures and labour shortages. This was and still is particularly prominent for layers, which has led to cuts in production and some even exiting the industry all together.

According to latest data released today by AHDB, total poultry feed production (including IPU) was down 8% in May on year earlier levels. Poultry feed production has been declining for a number of months but the fall has been getting sharper since March.

With soaring inflation and subsequent rises in cost of living it has been reported that demand for meat has been down across the board, with consumer demand for poultry down too.

Looking further ahead, the full impact of inflation and rising costs has not yet been felt, by both industry and consumers, and is expected to hit later in the year. With this in mind, poultry feed demand may continue to decline in 2022/23.

In 2021/22 pig feed production in GB has been higher than year earlier levels for the whole season. However, the increase in pig feed production hasn’t necessarily been as a result of the pig industry flourishing. Instead, it has been a result of pigs being unable to be slaughtered due to labour shortages, which has led to animals being held on farm for longer. Earlier on in the 2021/22 season it was expected that the back log of pigs would have cleared sooner than in fact they have.

While there are still localised issues, nationally with pig carcass weights now coming down over recent weeks, it indicates that the back log of pigs on farms is now clearing. According to the AHDB Pork Outlook review, pig meat production is expected to come down by 2% this year, driven by a contraction in the breeding herd.

Similar to poultry production, pig producers have more inputs than beef cattle and sheep, due to their production systems. Therefore, with rising input costs, a contraction in the herd and a fall back in consumer demand due to the cost of living crisis, it is likely that pig feed demand will start to come down over the next few months.

Cattle feed demand is split into two separate sectors, feed for dairy cows and feed for beef cattle. In GB, feed for dairy cows makes up over 70% of total cattle and calf feed. Total dairy feed production has been down on year earlier levels for the majority of the 2021/22 season. In latest forecasts released today by AHDB, milk production is expected to be down 1% on year earlier levels this year. While a rise in the milk price has offset some of the increase in input costs, its not expected to incentivise farmers to increase production.

It is likely that the dairy feed demand will remain subdued going forward due to soaring inputs. Some may utilise turn out and forage to try and offset rising feed costs. However, with ever increasing fertiliser prices too, this may affect the quality/ quantity of forage for this coming season.

For beef cattle, feed demand throughout the 2021/22 season has been down on year earlier levels. The fall in feed usage can be partly attributed to a smaller national herd. Beef cattle prices have been relatively strong this year, with a smaller herd size met with lower demand. Going forward, with rising feed costs it is likely that feed demand will remain subdued.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.