Analyst Insight: Basic Payment Scheme data confirms tight UK supply of wheat for 2020

Thursday, 4 March 2021

Market commentary

- Old crop UK wheat futures (May-21) closed yesterday at £205.75/t, down £1.70/t on Tuesday’s close. New crop futures (Nov-21) were pressured too and closed yesterday at £170.50/t, down £1.45/t on Tuesday’s close.

- Pressure on global wheat markets was mainly from Chicago wheat futures. US prices fell due to expectations of lacklustre export demand, on the back of the dollar strengthening.

- Paris rapeseed futures (May-21) closed yesterday at €503.75/t, up €1.25/t on Tuesday’s close. This contract is up €12.25/t since Friday. Oil World (oilworld.biz) suggests that this will boost EU imports for the first six months of 2021. Such support usually filters into our domestic rapeseed prices.

Basic Payment Scheme data confirms tight UK supply of wheat for 2020

This morning the Rural Payments Agency (RPA) released the total area of land claimed for under the Basic Payment Scheme (BPS) in the 2020 cropping year for England.

The cropping area that was claimed reduced from 3.93Mha in 2019 to 3.78Mha in 2020.

Payments under the BPS are set to start reducing this year. However, currently this data can confirm credibility to Defra’s June Survey that was released December 2020.

In theory, the BPS data provides clarity as it is based on the area to be paid a subsidy. Yet, there are still concerns over the accuracy due to its purpose; the data shows the land eligible for subsidy, rather than the cropped area. There are also structural issues with the data gathering and management.

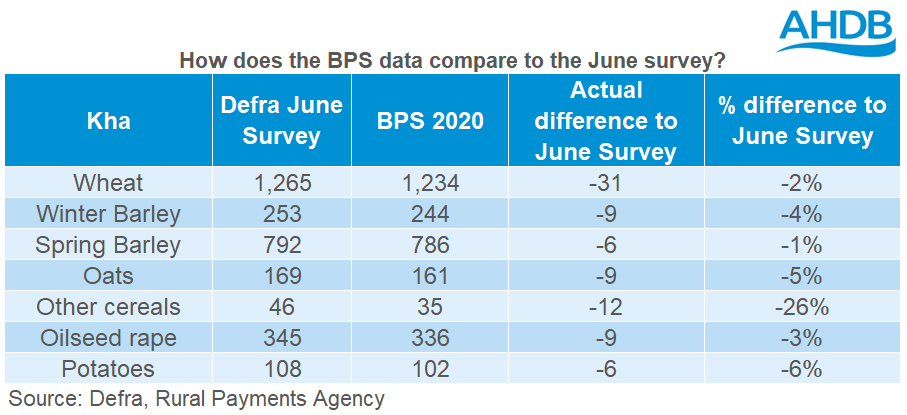

How does the BPS data compare to Defra’s June Survey?

Data plays a vital role in the structure and sentiment of a market. Impartial information is key to giving an accurate representation of domestic production. This is used by for the trade, processors, government, and growers in business, planting and policy decisions. It is also used in the AHDB balance sheets.

The BPS area data is below the Defra June Survey on all major crops. However, what is worth noting that the different for wheat this year is the lowest since the survey began in 2015, with a difference of 31Kha from June to BPS.

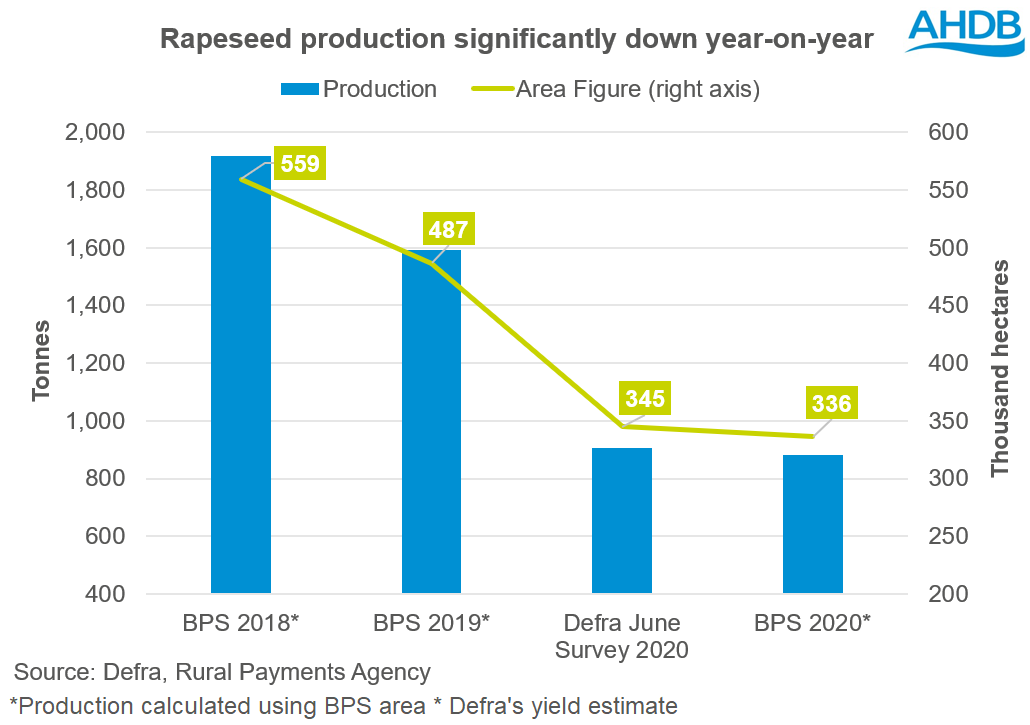

What does this mean for oilseed rape production?

The BPS area figure for 2020 is almost half (57%) of the oilseed rape (OSR) area when the first data was released in 2015, at 336Kha. Using the Defra yield estimate for 2020, this would suggest a production of 882Kt, 23Kt lower than the official figure for 2020 from Defra.

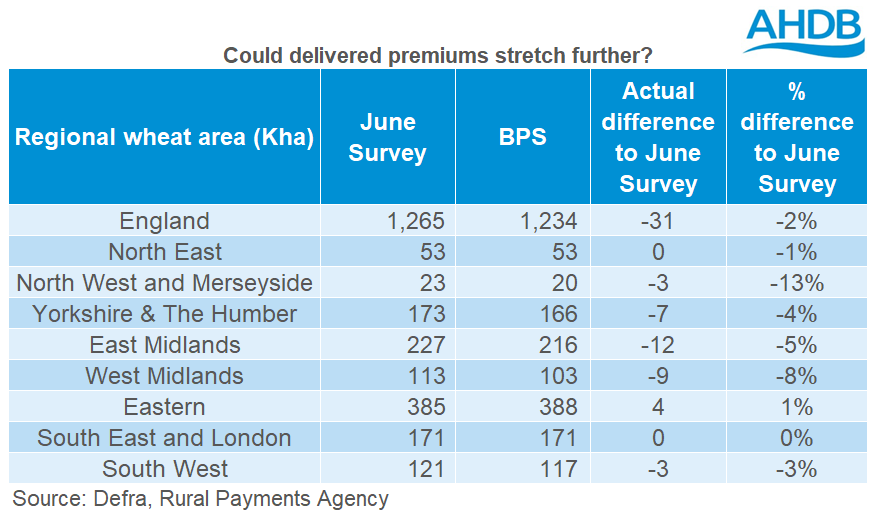

A region breakdown of wheat

As we look into the regional data from the BPS and June Survey, the largest reductions are in Yorkshire & The Humber (-7Kha), East Midlands (-12Kha) and West Midlands (-9Kha).

This could mean that delivered premiums in the North could stretch towards the end of the marketing year if supplies are tighter than expected. This could especially be the case as the East Midlands is not providing that as much of a supplement as the June Survey showed. However, if demand is lower than expected e.g. in animal feed, this could limit the rise in premiums.

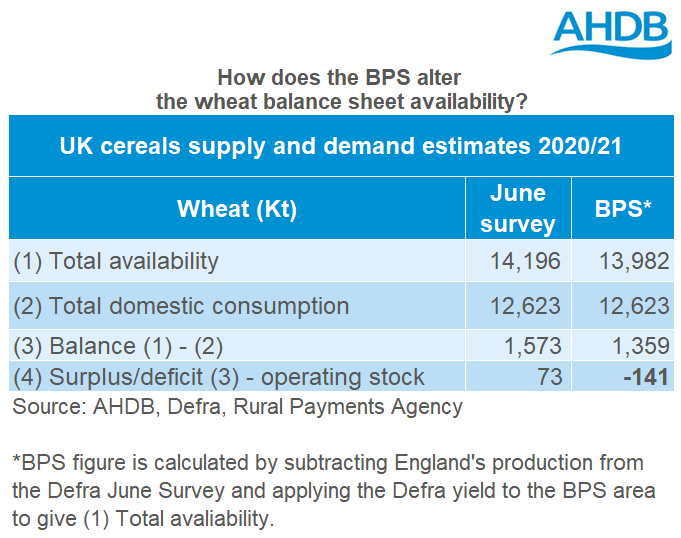

How does the BPS data alter UK supply and demand?

The AHDB supply and demand balance sheet uses the official UK production figures from Defra to formulate the supply of grain. These official production figures are produced using the area from the June Survey.

But, the BPS areas are lower than those from the June Survey. So, what could the lower area mean for UK supply and demand? To understand this, we subtracted the English Defra production from the balance sheet. Then, we applied an alternative English production to the balance sheet, calculated using the BPS data (BPS area x Defra yield).

Wheat

The UK’s wheat balance reduces from 1,573Kt to 1,359Kt when the English production figure calculated from the BPS area is applied. When the minimum operating stocks are included, the UK balance sheet changes from a small surplus to a deficit of 141Kt.

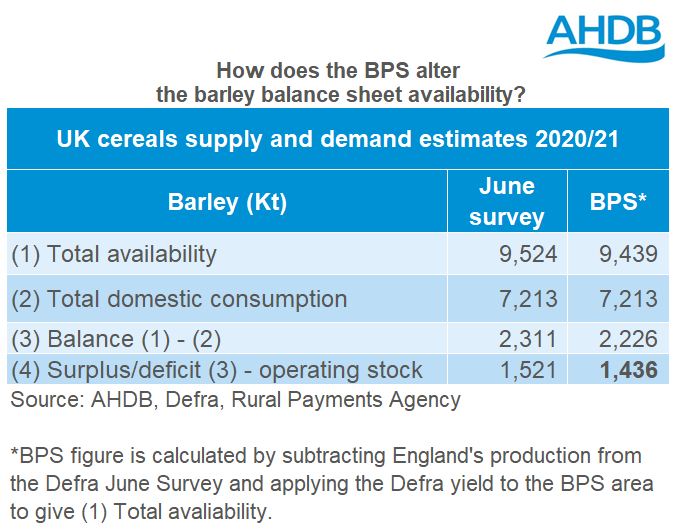

Barley

If we take the BPS areas and apply the Defra winter and spring yields accordingly, it reduces the availability. As a result, we can see the balance reduce from 2,311Ka to 2,226Kha. Once minimum operating stocks are included, the surplus available for export or to be extra stock decreases to 1,436Kt.

What could this mean for markets?

The BPS figures give further clarification to what happening in our domestic market. They confirm that our domestic supplies are tighter than previously thought this marketing year.

For wheat, this means we could possibly require significant imports of wheat throughout June and July to maintain supplies until our domestic harvest.

The tighter supply of barley means the domestic barley market will have to price away from export parity to keep barley in the country. But, prices cannot rise not too high as the crop needs to remain competitive in feed rations.

For rapeseed, the tight domestic rapeseed supply means we will continue to rely on imports this season. Rapeseed prices are being supported off the back of soyabean markets and the greater demand for oilseeds globally. The supply outlook is tight in both the UK and EU, meaning that large imports will be required for the rest of this marketing year and into next season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.