Analyst Insight: Australian barley offers extra pressure for the UK market

Thursday, 28 May 2020

Market Commentary

- UK feed wheat futures (Nov-20) moved significantly higher yesterday gaining £2.05/t, to close at £171.50/t. The move higher was predominantly sterling driven, with the pound moving to its weakest position against the euro since 26 March.

- Volatility in sterling is likely to be a key driver of domestic values over the next month, with a number of key Brexit deadlines looming.

- Global wheat markets generally tracked lower yesterday, with no fresh news to sustain last week’s weather rally.

- Maize futures have shown some signs of support this week, but continue to trade in a thin channel with fundamental demand still very much lacking.

Australian barley offers extra pressure for the UK market

During our barley week, we highlighted the increase in trade tensions between China and Australia, with the former potentially imposing a $74/t tariff on imports of Australian barley. This offers a high degree of price risk for domestic barley, particularly given the significant export volumes expected from the UK next year.

Conclusions

The proposed tariffs on Australian barley exports are likely to pose a price risk for UK barley prices, particularly in the second half of next season.

While China may be excluding Australian imports, this does not necessarily open a hole which others, in particular the UK, can capitalise on. China looks set to ramp up imports of cheap maize and sorghum to displace some of the feed demand.

With Australian barley coming back into the market global competition is raised, particularly into other parts of Asia and North Africa. With the UK market potentially facing headaches in supplying the EU post-December, competition from Australia in 2020 could well keep UK barley prices under fire.

Over the past five seasons, Australia has supplied around 68% of China’s barley demand. At the same time, Chinese demand represents more than 70% of Australia’s overall barley exports. This goes some way to explaining why a large tariff poses serious challenges for the global market.

According to a recent USDA report, China’s demand is split approximately 50/50 between animal feed and human and industrial consumption. China’s five-year average consumption of barley stands at 7.9Mt.

The tariff set by China came into force on Tuesday and has been set officially on grounds of anti-dumping. However, media suggestions highlight the role that Australia has played in suggesting China is investigated further over the current coronavirus pandemic.

The tariff level has been set at almost 80%, over a period of 5 years. The imposed duty is made up of a 73.6% anti-dumping duty and a 6.9% anti-subsidy duty.

Is there now a gap for others to fill?

With the duties now entering into full force, it is conceivable that there will be a significant gap in Chinese demand for others to fill. This is likely true from a human and industrial perspective, but as far as animal feed is concerned it would appear that a proportion of the Australian demand will be displaced with other feed products.

A USDA foreign agricultural service report from the end of April highlighted expectations of a sharp rise in year-on-year Chinese maize imports. Furthermore, imports of sorghum are also expected to jump. This has been factored into the latest USDA world supply and demand estimates, which highlight a 500Kt fall in year-on-year barley consumption and imports.

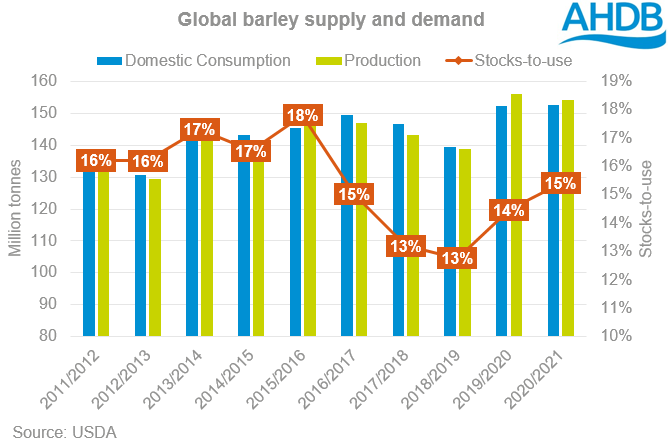

Therefore, although Australia is factored out of the demand situation, the gap for others to capitalise on is reduced on previous years. With barley stocks globally expected to rise, we are stepping into an increasingly bearish market.

Looking at historic Chinese barley imports, it is likely that any excess demand created by the loss of Australian trade will be made up European (French) and Ukrainian boats.

Where could excess Australian supplies go?

We have already seen a potential market for Australian supplies develop, with India opening the door for 500Kt. Outside of the new opportunities into India, Australian supplies could well offer competition to UK supplies into Asian and North African markets, particularly in the second half of 2020/21.

As such, the increase in global barley supplies available in the export market could offer continued pressure for UK barley prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.