Agri Market Outlook Winter 2023: Grain market daily

Friday, 10 February 2023

Market commentary

- May-23 UK feed wheat futures closed yesterday at £238.75/t, down £1.45/t on Wednesday’s close. New crop futures (Nov-23) closed at £232.50/t, down £0.45/t over the same period.

- Our domestic market followed the pressure in both the Paris and Chicago wheat markets.

- Markets were pressured due to rains in the U.S. plains easing some concerns around development. At the start of next week widespread rains are expected across key winter wheat regions in the US. Further to that, wheat export sales (to week ending 02 Feb) were reported at 150.9Kt yesterday, at the low end of market expectations.

- Stratégie Grains has again raised its forecast of EU soft wheat production for harvest 2023. Production is now estimated at 129.7Mt, up from 129.3Mt in January, citing that there has been good growing conditions.

- In the report they have also revised down this marketing year (2022/23) EU soft wheat exports by 1.7Mt, they are not currently estimated at 30.1Mt. Citing that overall EU grains will face competition from Russia and Australia on the export market. Further to that, imported Ukrainian wheat and maize continues to arrive into the EU.

Agri Market Outlook Winter 2023

Released this morning; the AHDB Agri Market Outlook for winter 2023. Over the last 12 months there has been some historically high agricultural commodity prices across the board, rising inline with input costs and also geo-political situations.

Below is just a brief overview of the cereals and oilseed market outlooks. However, further information can be found surrounding livestock and dairy markets, as well as a macro economic outlook can be navigated from the Agri Market Outlook homepage.

Where next for arable crops?

Cereals

Despite global wheat prices coming back down from the highs seen back in May 2022, post the outbreak of the war in Ukraine, prices remain historically elevated. A tight global maize supply and demand too is providing a strong floor for overall grain prices, with concerns surrounding a drought impacted Argentinian crop despite a large Brazilian crop due. Demand now remains a key watchpoint for the direction of global grain prices, considering economic performance and recessionary behaviour concerns across major economies. Price direction will be increasingly influenced by new-crop weather as we head through the second half of the season.

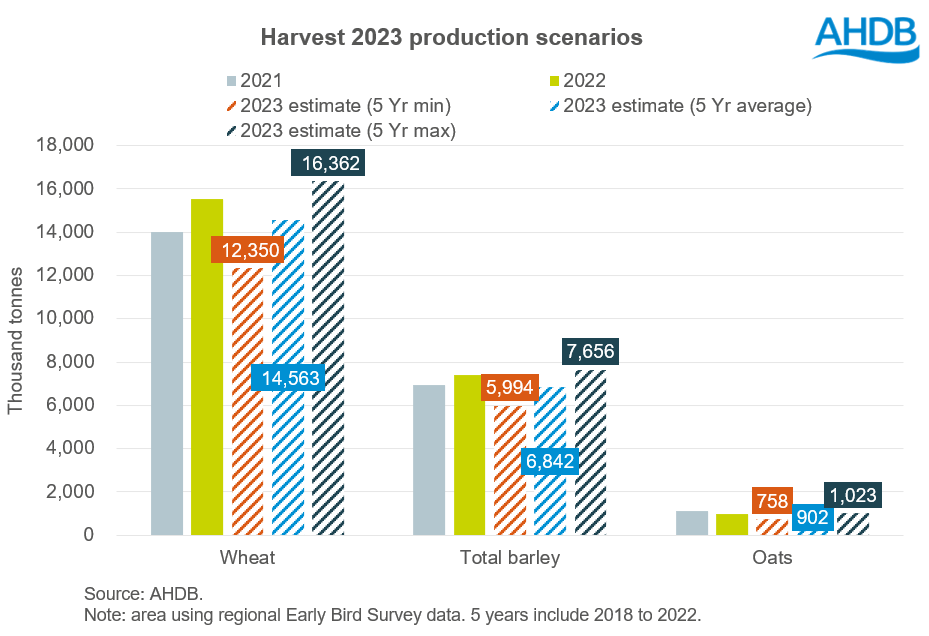

Although UK production of grains will largely be weather dependant over the next few months. Looking ahead, the Early Bird Survey for plantings and planting intentions for harvest 2023 shows a strong continuation of winter cropping given the favourable autumn drilling conditions. On a national level, the wheat area is forecast up 1% from 2022 and winter barley up 4%. However, the spring barley and oat area is anticipated to shrink, forecasted down 6% and 4% respectively. Using these intended areas, production scenario projections for harvest 2023 can be made.

Market direction for UK wheat

Over the next couple of months, the war in Ukraine will continue to add volatility to markets, especially as we near the expiry of the already extended export corridor deal on 21 March. Looking further ahead and US crop conditions will come to the forefront, as any crop damage caused by the extreme cold/dry conditions is assessed.

While the developments in Ukraine, strong EU exports and potential US crop damage could all add support to markets over coming months, it is unlikely prices will rise back up to levels we saw last May (unless another major global incident occurs), as a surplus of Russian supply will continue to limit gains somewhat.

Oilseeds

Rapeseed prices have been on a downwards drift since the start of this marketing year (2022/23). However, prior to this, in the second half of the last marketing year prices reached highs that have never been seen before.

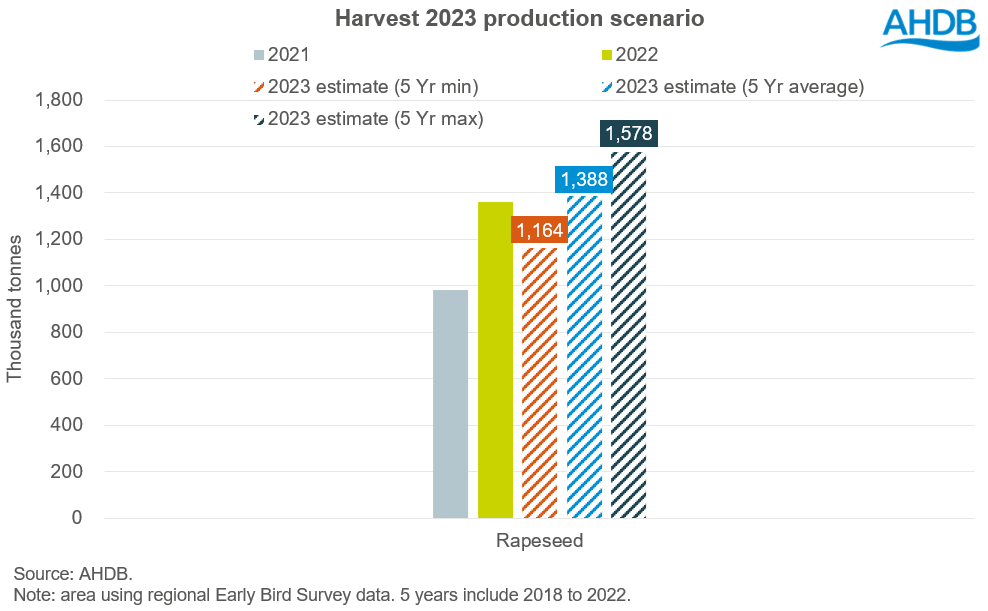

The UK oilseed rape (OSR) area has been increasing off the back of these high prices, as intentions would have been made when the market was peaking. In the results of the Early Bird Survey for planting intentions, the planted area for 2023 is estimated at 416Kha, the highest area since 2019. With an increase in every single region year-on-year apart from Wales and Northern Ireland.

Market direction for Rapeseed

Forward looking though, as we head towards harvest, the balance in Europe will become heavier in the 2023/24 marketing year, as larger production is expected for harvest 2023. If a larger crop comes to market, we could see prices coming down as we head into the 2023/24 marketing year.

This bearishness could be reinforced by a potential rapeseed oil surplus in the EU and indeed the world (with production growing faster than consumption). Demand from China over the next few months could change sentiment. Currently, Chinese rapeseed oil stocks are at a historical low compared to other vegetable oils. If demand remains lacklustre this could add to the further bearish outlook.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.