A tight malting barley balance this season: Grain market daily

Thursday, 2 November 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £185.50/t yesterday, up £2.30/t from Tuesday’s close. The Nov-24 contract was up £0.50/t over the same period, ending the session at £206.00/t.

- Domestic wheat futures followed global prices up yesterday. Traders continue to monitor tensions in the Black Sea region. Ukraine said yesterday that Russian warplanes had dropped explosive objects into the region yesterday, though as it stands the shipping corridor is still operating (Refinitiv).

- Paris rapeseed futures (May-24) fell €1.25/t yesterday, closing at €439.00/t. The Nov-24 contract ended the session at €447.00/t, down €0.25/t.

- EU rapeseed futures tracked movements in the wider vegetable oil complex yesterday, tracking a weaker tone in Malaysian palm oil futures due to concerns over rising stockpiles.

A tight malting barley balance this season

As discussed in a previous analysis, malting barley premiums remain historically high at the moment. As at 12 October, the gap between the UK average spot ex-farm price for premium malting barley and feed barley was £71.20/t. In the same week last year, this premium was £28.60/t. So, can we expect this widened gap in prices to continue as we progress through the season?

Lacking supply?

In our Early Balance Sheet estimates released in mid-October, total availability of barley was estimated at 8.336 Mt, down 101 Kt on the year due to a smaller crop outweighing a rise in opening stocks. Availability is also slightly down on the previous five-year average of 8.595 Mt.

On top of an overall decline in availability, the proportion of the crop that is meeting the higher quality malting requirements is expected to be lower. The Cereal Quality Survey results published last Friday showed lower specific weights, poorer screening levels and high average moisture content year-on-year. Though nitrogen content for both winter and spring barley was comparable to last year and marginally higher than the three-year average.

It can also be expected that global availability of malting barley will be tighter this season. Total global production of barley in 2023/24 is forecast to be the lowest since 2018/19, and global ending stocks are expected to be the lowest since the early 1980s. Much like the domestic picture, quality is a concern elsewhere as well, with the wet weather in Europe at the beginning of harvest impacting the crop due to delayed cutting.

Strong domestic demand?

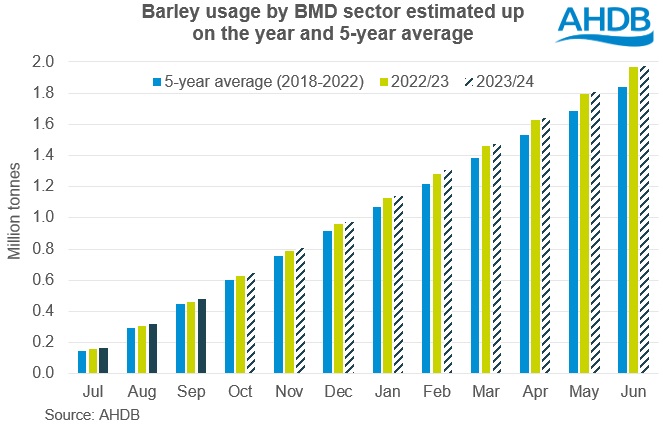

Despite concerns over the cost-of-living crisis, in the Early Balance Sheet estimates, barley usage by brewers, maltsters and distillers (BMD) was estimated to be up on the year, with demand for distilling expected to remain robust from increased capacity coming online last season.

So far this season (Jul–Sep), total barley usage by the BMD sector totalled 477.6 Kt, up 3.6% on the year. Over the previous five seasons, on average, the BMD sector has made up for 99% of total human and industrial barley consumption. Using this proportion, based on the first estimates, barley use for BMD can be expected to reach c. 1.971 Mt this season, up 7.1% on the five-year average and just marginally higher than last season.

What does this mean for premiums?

A tighter outlook for barley both domestically and globally, combined with further concerns over quality means supply of premium malting barley looks limited this season. With a strong start to the season for the BMD sector and expectations that demand will remain firm, it’s likely that premiums will stay elevated in at least the short-term, if not for the remainder of the season. However, domestic demand for beers and spirits will remain a watchpoint as the cost-of-living crisis is still prevalent.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.