A recent surge in home cooking can support rapeseed: Grain Market Daily

Tuesday, 21 April 2020

Market Commentary

- UK wheat futures (May-20) closed yesterday at £153.95/t, up £4.95/t on Friday’s close. Furthermore, the November contract gained £3.70/t to close at £167.50/t. The spread between these two contracts closed yesterday at £13.55/t, which provides a large incentive to domestically carry grain.

- Recently imposed restrictions from the Black Sea Region could possibly be depleted before the end of the marketing year, which could see the Western Europe pick up export trade to North Africa.

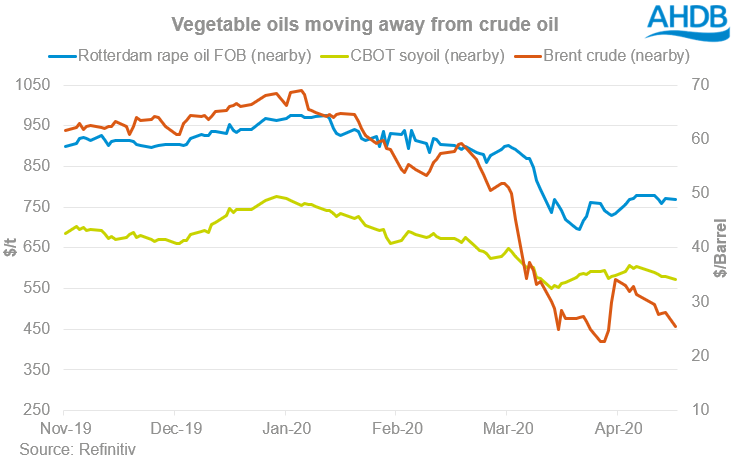

- Nearby Brent crude oil closed yesterday at $25.57/barrel, this contract has plummeted by $40.43/barrel since the start of 2020.

A recent surge in home cooking can support rapeseed

For the first time in history yesterday we saw the price of US oil turn negative. Meaning that oil producers were paying buyers to take the commodity away, as there were fears over storage capacity could run out.

It’s inconceivable that this will filter down to fuel station pump prices. However, one can only dream of a day when we are paid for filling our vehicles with fuel.

The OPEC+ agreement of cutting 10 million barrels per day will start in May and continue into June, with a tapering reduction for the rest of 2020, this is all in an attempt to stabilise oil prices.

However, it’s advocated that the plunging demand for oil as the coronavirus slows the global economy is unsavable in the short term, and it’s possibly too little, too late.

We have witnessed the demand for bio-fuels and ethanol subdue significantly as road traffic slows abruptly, which has pressured many agricultural commodities that are utilised by the energy sector such as maize.

What is key to consider though, is as an international community we haven’t stopped consuming, it’s just our consumption that has changed as we all now isolate away from civilisation.

In recent successive weeks the retail sector has had a large uptick in demand for products as populations adapt to full-time home life. One of these products that has seen an increase is cooking oil.

Sales of cooking oil in the last 12 week period are the highest in at least the last two years. Retail sales to 22 March were 14% higher than the last 12-week period (ending 23 February) which included Christmas sales (Kantar).

With this demand we have seen rape oil have a less secure correlation with crude oil as fundamentals around edible demand have caused support for rape oil, it’s worth noting that the euro weakening against the dollar has provided support too.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.