A bit bullish for UK wheat now but what about later this year? Analyst Insight

Thursday, 14 January 2021

Market Commentary

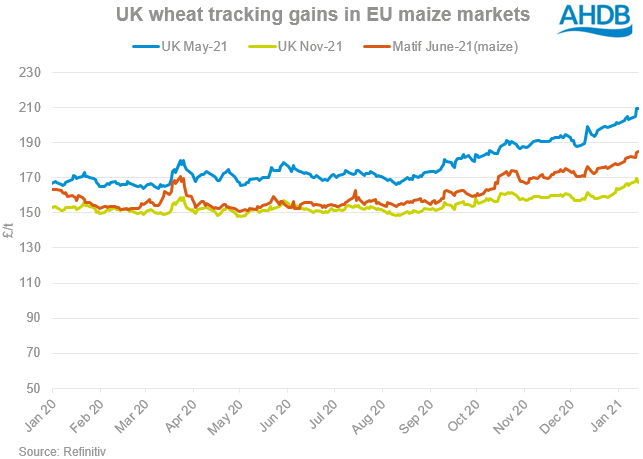

- UK feed wheat futures (May-21) fell slight yesterday after trading above the £210.00/t mark intraday. The contract closed at £209.50/t down £0.25/t from the previous days close. The new crop (Nov-21) contract eased further after trading above the £170.00/t mark, falling £2.00/t on the day, to £167.50/t.

- The Argentine export ban on maize exports has been revoked completely following criticism. After an initial complete ban on exports, plans for a 30Kt daily export cap instead were announced, though this too has been rescinded.

- US relations with China could be tested following a ban on all imports of cotton and tomato products from the Xinjiang region of China over allegations of slavery. The region reportedly accounts for 84% of China’s cotton production. Increasing tensions between the two countries could affect purchases of US commodities by the country.

A bit bullish for UK wheat now but what about later this year?

This week, grain markets have seen a plethora of information that has fed the bullish sentiment for the moment. Whilst news has been mostly maize centred, as my colleague James discussed yesterday, this has still had an effect on UK wheat futures. Both old (May-21) and new crop (Nov-21) UK wheat futures briefly reached new highs yesterday, at £211.00/t and £171.00/t respectively before falling back to close down against the day previous

The January USDA supply and demand estimates (WASDE) released on Tuesday detailed a 500Kt cut to wheat ending stock figures for EU-27+UK. This was due to a rise in export forecasts, accounting for better demand from China this season. Upcoming Russian export restrictions will enable France to meet further Chinese demand, despite reduced availability this season.

The cuts to EU-27 + UK ending stocks leave an estimated figure of 11.10Mt, the lowest since the 1983/84 season. Such a low beginning stocks figure for 2021/22 leaves availability potentially vulnerable should weather threaten crop conditions over the coming weeks.

Why are markets supported now?

On Tuesday, US maize markets jumped to break through the $5.00/bsl handle for the first time since 2014, closing at $5.24/bsl yesterday. This was caused in part by an unexpected 8.2Mt cut to 2020/21 US maize production in the January WASDE report. Further commentary on this can be found here.

Further speculation on the Russian wheat export tax that was discussed last month has supported wheat markets again this week. Rumours regarding an increase to the planned €25.00/t export tax were confirmed yesterday by the Russian Ag ministry. Though only a proposal at this stage, the tax would rise to €45.00/t on March 15, as well as a separate tax on barley and maize exports too. This is an effort to curb food prices in the country amid the coronavirus pandemic.

Russian wheat export prices have increased since the tax news last month, supporting a wider rise in Black Sea wheat prices. In the season to 11 Jan, an estimated 58.3% of EU-27 wheat imports have been from Black Sea origins, meaning Black Sea price direction is a bigger influencer on EU wheat prices this season. This is a large increase on last season, though exact comparisons are difficult, given the removal of Britain from the EU trade bloc as of 1 Jan.

Aggressive Chinese purchasing of feed commodities provided an increased level of demand during the final months of 2020, owing to healthy demand from the country’s recovering pork sector. This has affected US wheat and maize commitments, which to date were both increased from last year, at 10% and 137% respectively. Whether this strong level of purchasing continues, especially after the Chinese New Year celebrations in February, is a watch point for markets.

What’s to bear in mind for later this year?

Some price pressures start to appear if we take a look at fundamentals for later this year. As crops start to enter critical growth stages, crop conditions and weather news will be important, especially if wheat availability looks to be threatened.

The US winter wheat crop, set for harvest beginning in May, is estimated at 12.95Mha, up 5% from 2020. Soil moisture levels for the Midwest and Plains were at their lowest since 2018 in data to 11 Jan. Nevertheless, 46% of Kansas winter wheat was in good-excellent condition as of Jan 3, against 40% a year ago. This crop will be a watch point over the next few months.

In the EU, despite some colder conditions, there are no threats for the wheat crop according to Stratégie Grains. EU-27 wheat production is expected to rebound next season, to 129.72Mt from 119.31Mt. This greater availability next season would pressure prices. Though given a wet autumn, increasing levels of rainfall in central Europe over the next few weeks could create concern.

Russian wheat production was increased 1.3Mt to 85.3Mt in the WASDE report, with export estimates reduced. The wheat export tax is set to be imposed from mid-February until June, meaning the opening months of the 2021/22 season could see a bearish front-loaded export schedule from Russia with the expectedly sizeable carry.

In conclusion

Whilst current sentiment looks to be fairly bullish for wheat markets, it must be noted that global wheat availability looks set to rebound next season. Currently, UK Nov-21 futures are £21.97/t ahead of the five year average for Nov contracts at this point in the season. Once global crop conditions during crucial yield setting stages are known, we could see stronger movement on new-crop values.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.