2019/20 EU supply raised, will exports reach the new target? Grain Market Daily

Friday, 20 December 2019

Market Commentary

- Following the gains at the beginning of the week in Chicago wheat and maize futures on the back of trade deal hopes between the US and China, prices have backed off. Chicago wheat (May-20) closed at $201.61/t yesterday, down $3.77/t from Tuesday’s 6 month high.

- UK feed wheat futures have received support this week from both gains in Chicago markets and a weakened pound; May-20 closing yesterday at £151.50/t, up £1.50/t from the start of the week. However, Chicago wheat futures have retreated back and the value of the pound has now fallen back to pre-election support levels, potentially reducing further short term support.

2019/20 EU supply raised, will exports reach the new target?

The latest 2019/20 EU supply and demand estimates have further raised wheat and barley production estimates.

The December revised EU balance sheet now places total EU soft wheat production at 147.2Mt, up a further 0.4Mt from the November forecast. EU barley production has also been raised by 0.4Mt, to over 63Mt, the largest crop since 2008, with prices remaining under pressure.

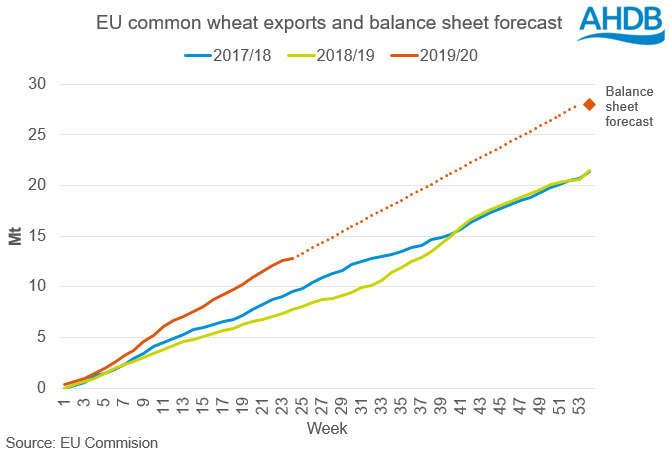

As a result of the greater supply estimate, wheat export forecasts have been raised by 2Mt from 26Mt to 28Mt. Yet how feasible this upwardly revised export forecast is will depend upon global demand and the continued price competitiveness of EU origin wheat.

By week 24 of the 2019/20 season, cumulative EU common wheat exports totalled 12.8Mt, under half of the required export volume to reach the 28Mt forecast and only 3.3Mt ahead of the 2017/18 season.

As such, the export pace throughout the second half of the 2019/20 season will have to remain lively or face a larger crop carry over into next season. This will require continental old crop prices to remain competitive, which could prevent new crop markets from gaining significantly.

With a larger EU surplus of wheat and a need to be export competitive throughout the remainder of the season, European prices could remain under pressure, capping the extent to which domestic UK markets can rise.

Provisional regional results of Early Bird Survey – December 2019

Following the release of the Defra June Survey reporting 2019 harvest estimates, the Early Bird Survey percentage changes by region can now be used in order to provide a regional breakdown. These can be found here.

The results remain intentions of UK farmers, as at mid-November 2019, for harvest 2020. The survey will be re-run at a regional level in the New Year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.