Global commodities bounce on hopes of a US-China trade deal: Grain Market Daily

Tuesday, 17 December 2019

Market Commentary

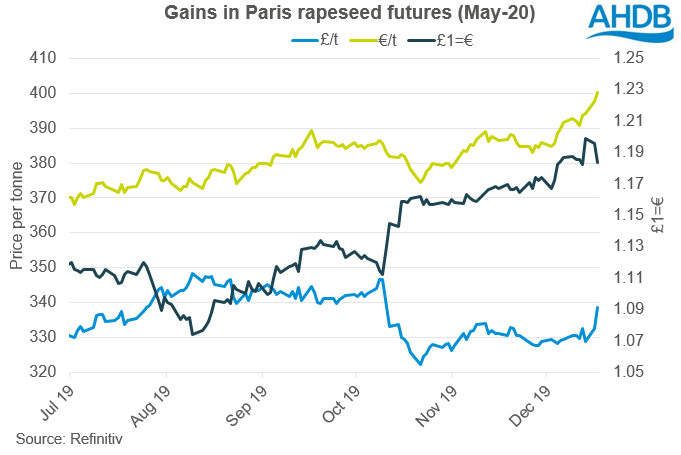

- A combination of a softening in China - US trade relations (read more below) and a slight weakening of the pound has lent support to domestic markets.

- Following the result of the general election, the pound recorded strong gains, reaching a high of £1=€1.2079 on Thursday 12, but has subsequently fallen back to pre-result levels, recording £1=€1.1830 at 10:50 this morning.

- Old crop UK feed wheat futures (May-20) closed at £150.00/t yesterday, gaining £2.45/t to recoup some of the losses recorded over the last couple of weeks.

Global commodities bounce on hopes of a US-China trade deal

After a long and protracted dispute between China and the US, with tariff barriers put in place on a range of agricultural products, a ‘phase one’ trade deal has been said to be completed.

The result of the previously imposed trade barriers between the two economies led to disrupted global trade flows and a build-up of stocks in the US, which has continually weighed on global commodity prices.

The prospect of a trade deal between China and the US could potentially allow more traditional trade routes to resume and allow a drawdown on swelled US stocks.

Oilseeds

Prior to the trade disputes, China were the main purchaser of US soyabeans with annual US exports of around 58Mt in 2016/17 and 2017/18. However, the last two seasons have recorded US exports falling by 10Mt and ending stocks swelling to record levels. Should the ‘phase one’ trade deal allow US soyabeans to be imported into China without prohibitive tariffs, then 2019/20 export volumes could well rise above the current 48.3Mt USDA forecast.

The optimism regarding a potential trade deal has led Chicago soyabean futures to record gains; May-20 closing yesterday at the highest price in over a month.

Increases in the benchmark oilseed complex futures market has allowed Paris rapeseed futures to gain; May-20 closing at €397.75/t yesterday, a new contract record. As UK domestic oilseed rape markets have a close relationship to Paris rapeseed futures, gains will likely be recorded in domestic markets too, unless outweighed by a strengthening of the pound.

Grains

Trade optimism has also spread into wheat and maize markets in the US. Although the trade disruption for wheat and maize has been to a lesser extent, the sentiment behind a relaxing of trade tensions has lend support across agricultural commodities. Chicago wheat futures (May-20 HRW) closed at $202.53/t yesterday, up $9.28/t on the previous Mondays close, lending support to Paris and UK wheat futures.

However, with less of a fundamental reason to reach elevated levels, support could well prove to be temporary.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.