- Home

- Shoppers against meat and meat-free products being displayed together in store

Shoppers against meat and meat-free products being displayed together in store

The majority of shoppers are not confused by meat and meat-free products being displayed together.

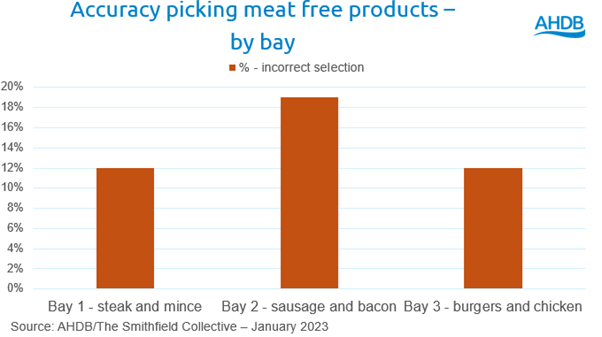

When we look at the accuracy of choosing meat-free products by the different bays, it was the sausage and bacon bay which caused the most confusion. In this bay the meat-free products were more mixed within the meat and there were brands which retail both meat and meat-free products. The shopping missions are very different for meat and meat-free products with a different set of needs and drivers. This is why 60% of shoppers agreed meat-free products should be displayed in a different place to meat products.

Research was undertaken by AHDB with the Smithfield Collective to understand shoppers’ behaviour towards meat-free products. This article forms part of the larger research project, full details of which and methodology can be found on the meat-free products research landing page.

Meat and meat-free shelf test

To determine if shoppers are confused by meat-free products, we designed a shopping test where we asked shoppers to shop as normal and see what they picked up, interacted with and added to their basket. There was some evidence to suggest that displaying these products together could impact shopper behaviour, as 11% of shoppers who hadn’t bought a meat-free product in the last three months added one to their basket in the exercise.

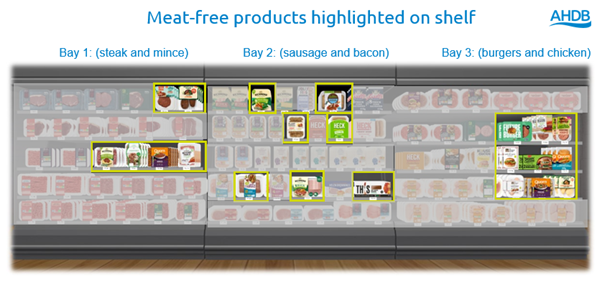

The virtual shelf:

After the shoppers had interacted with the shelf, we gave them 10 seconds to pick out as many meat-free product products as they could. Each bay had between six and nine meat-free product products with differing layouts. While 10 seconds is a short amount of time, previous research from AHDB on the meat shopper journey shows shoppers spend on average between 41 and 84 seconds at a fixture while considering their purchase decision.

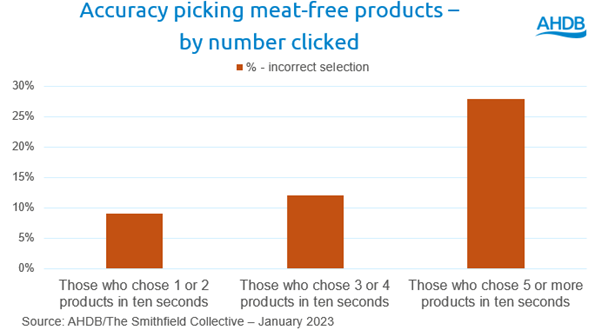

On the whole, shoppers could tell the difference between meat and meat-free products, with 91% of shoppers able to correctly identify at least one meat-free product in 10 seconds. However, the more products selected, the less accurate shoppers became, with those choosing 5 or more products only correctly selecting 72% of the time.

When we look at the accuracy of choosing the meat-free products by the different bays, it was the sausage and bacon bay which caused the most confusion. Only 81% of shoppers could correctly identify a meat-free product in this bay versus 88% in the other bays. This bay was particularly difficult as the products were much more mixed in, and products were from brands which sell both meat and meat-free products. This is the first watch out for shopper confusion.

Only 22% of shoppers correctly identified two or more meat-free product products in bay 2 compared to 45% in bay 1 and 44% in bay 3.

This is also highlighted in the normal shopping behaviour. We tracked which products shoppers picked up but then put back on the shelf rather than add to their basket. Afterwards, we asked why people put these products back. Those products which are primarily a meat brand but are also less clear they are plant-based were put back because shoppers initially thought they were meat.

59% of shoppers agreed meat and meat-free product packaging looks very similar. Once the number of meat-free products on the shelf was highlighted, 57% said they initially didn’t realise how many products on the shelf were meat-free.

Opinion is split on whether it would be easy to mistakenly select a meat-free product, with 43% agreeing but 32% disagreeing. There is a level of confusion with shoppers when the meat-free products are not clearly named or highlighted as meat-free. This is especially true if the meat-free product looks similar to the meat product it is trying to replicate.

Meat and meat-free missions and drivers

The shopping missions and drivers for meat and meat-free products are very different. There were six drivers for meat which motivated over 30% of shoppers, and the top six drivers of purchase, apart from being affordable, are all centred on the product. In comparison, meat-free products saw none of the drivers motivating over 40% of shoppers, showing they have to meet more varied and different needs. The top five drivers are more generic, less about the product and more focused on the halo impacts, like health and environment. The more product-focussed drivers come secondary for meat-free products. The product is a key selling point of meat and the importance of allowing shoppers to see the product is a key learning from our packaging questions.

This doesn’t mean there is not a place for meat to communicate their environmental and health credentials. From our engaging shoppers with the meat aisle research, we know that farmer stories and vitamin and mineral messages are very important to showcase the quality of meat. The research highlighted that health messaging was most impactful on pack, while farming and environmental messages worked well in bays on fins or barkers.

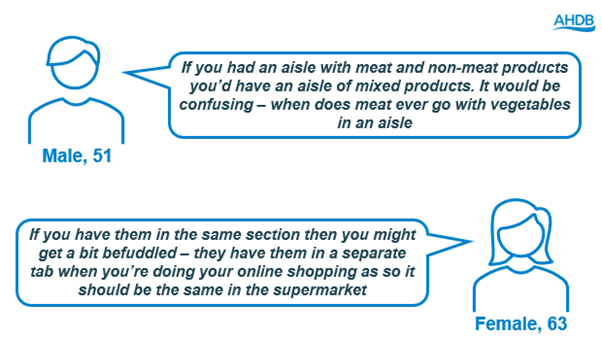

The majority, 60%, of shoppers agreed meat-free products should be displayed in a different place to meat products. Also, 38% of shoppers disagreed that similar products should be displayed together irrespective of what they are made from. The main reason for this is to make the shopping experience easier for consumers, so they don’t have to consider whether a product is meat or an alternative. Having meat and meat-free products mixed together was seen as potentially confusing by 52% of consumers.

Therefore, there may well be a consumer benefit for retailers to keep these two areas separate alongside clear labelling of the two different categories. This is likely to benefit all concerned, resulting in a more logical shopping experience.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.