- Home

- Meat packaging better liked by shoppers than meat-free

Meat packaging better liked by shoppers than meat-free

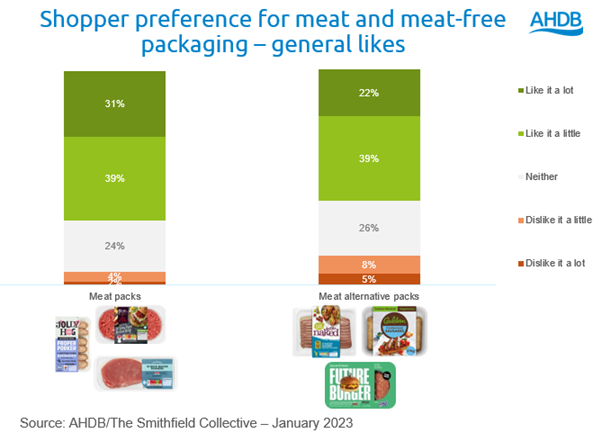

Shoppers are fond of meat packaging with 70% likeability on average across the three meat packs tested.

This was much higher than the meat-free packs which were less liked by shoppers. 75% think there is about the right amount of detail on meat packaging whereas views were more polarised on meat-free packs. Shoppers being able to see the product is hugely important for meat and is a key indicator of quality to the consumer, therefore getting the ratio between label and product window is a key balance. Having cooked product imagery on pack was a key learning for increasing perceptions of the product as tasty and good quality.

Research was undertaken by AHDB with The Smithfield Collective to understand shoppers’ behaviour towards meat-free products. This article forms part of the larger research project, full details of which and methodology can be found on the meat-free products research landing page.

Packaging comparison

A deeper analysis of six packs showed consumer sentiment towards meat packaging compared to meat-free packaging.

The objective of the research here was to see if there were learnings meat products could take from meat-free packaging, as there was a hypothesis that shoppers are more attracted to meat-free packaging.

However, the results show that shoppers actually preferred the meat packaging. The average likeability across the three packs for meat packaging was 70% compared to an average of 61% for meat-free products. There was little variation in the different packs with all meat packs being better liked than the meat-free products. Even the more ‘basic’ bacon pack was liked by 68% of shoppers. There may be something about the simplicity and familiarity of these packs which is appealing to shoppers.

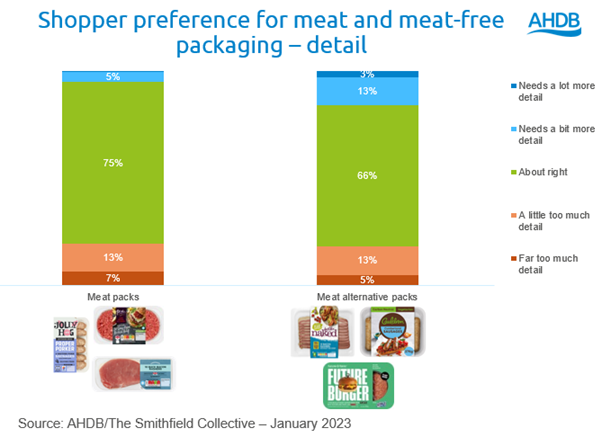

It was not only overall likeability where meat packs outperformed plant-based. The research found 75% of shoppers think the amount of detail on meat labels is about right, in comparison this is only 66% for plant-based packages. Opinion is divided on plant-based packaging with 16% of shoppers wanting more detail while 18% want less. From the shelf shopping test, we saw that the drivers of meat-free products are more diverse and less product-led. Therefore meat-free products have to communicate to different and multiple drivers for different shoppers such as environment, health, brand and taste. The shelf test showed that for meat, shoppers are focused on the product: they like to be able to see the raw product so they can assess taste and quality.

This doesn’t mean there is not a place for meat to communicate their environmental and health credentials. From our engaging shoppers with the meat aisle research, we know that farmer stories and vitamin and mineral messages are very important to showcase the quality of meat. The research highlighted that health messaging was most impactful on pack while farming and environmental messages worked well in bays on fins or barkers.

Again, when looking at the product to labelling ratio, meat-free packaging is dividing shoppers more. For the meat packs, 73% of shoppers think they can see the right amount of product compared to information on the packaging. This is only 64% for meat-free products, with 16% wanting to see more product but 20% wanting to have a bigger label.

Meat packaging heat maps

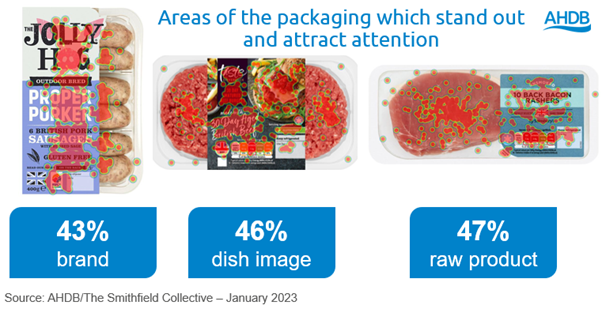

In the heat map part of the research, shoppers clicked on the aspects/areas of the packaging that stand out and attract your attention.

The key areas which saw high amount of clicks were the raw product, brand and product name.

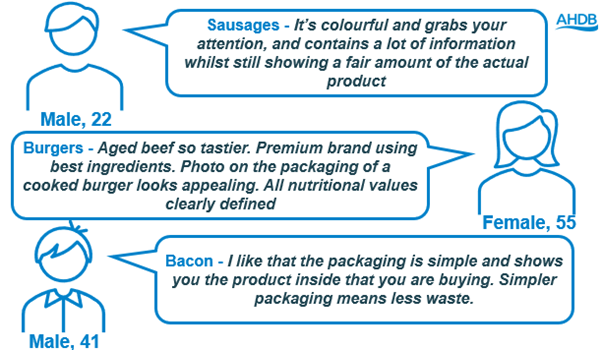

The most clicked areas were different across the three meat packs we tested, with the brand being most eye catching on the jolly hog pack. For bacon, the product itself was the most eye catching and for burgers it was the imagery of the cooked dish.

This shows there is a need for balance between showing the product and having information on the label, which as we saw above, shoppers think meat has got about right at the moment.

Shoppers being able to see the product is hugely important for meat and is a key indicator of quality to the consumer. Therefore, making sure the product looks high quality is as important as having a good label. This is a key area where meat has an advantage over plant-based products as they try and often fail to replicate the look, texture and feel of meat. Those meat-free products which have been better able to replicate the look of meat are more confusing for shoppers. While meat-free products are trying to replicate meat packaging to indicate to shoppers that they are a possible substitute, they are not currently as appealing with consumers. Currently, meat-free products show less of the raw product to consumers. This is an opportunity for meat to continue to showcase quality, rather than covering the product.

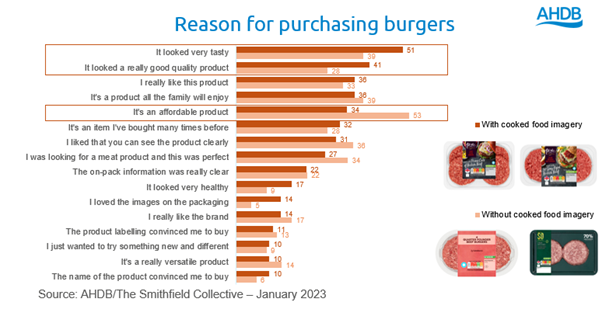

Having cooked imagery on packaging was a learning from AHDB engaging shoppers with the meat aisle research. Burgers which had cooked imagery had increased shoppers’ opinions of being tasty and good quality. This shows that having the correct packaging can change shopper perceptions of the product, so ensuring you have the right quality cues on pack is essential.

We recommend for meat brands to continue to showcase their high quality products and use cooked imagery on pack. Meat should learn from best-in-class meat packaging as it is more directly linked to consumer desires and purchase motivation, rather than meat-free packaging which has different motives. Shoppers also claim to like meat packaging more than meat-free packs.

Looking forward to the next year AHDB wish to build on these learnings, and our research for 2023 will look to optimise meat packaging. This follows on from our previous reinventing research which looks at how reputational message can be used to improve perceptions and consumer attitudes towards the meat industry.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.