Russia looks to limit grain export from Feb: Analyst's Insight

Thursday, 12 November 2020

Market commentary

- UK feed wheat futures closed lower yesterday, following declines in the US wheat and maize futures markets. May-21 futures lost £0.40/t to close at £190.95/t and the Nov-21 contract lost £0.60/t to close at £159.00/t.

- US futures prices fell slightly because of profit taking by speculative traders. However, the extent of the fall was limited by changes to global supply and demand estimates by the USDA on Tuesday.

- Soyabean futures prices rose again yesterday, due to the latest USDA estimates.

- Paris rapeseed futures (May-21) gained €25/t to close €406.75/t yesterday, the highest closing price yet for the May-21 contract.

Russia looks to limit grain export from Feb

Russia’s agriculture ministry will limit the amount of grain that can be exported from 15 February until 30 June 2021 to 15.0Mt, according to draft legislation. Grain is defined as wheat, barley, maize and rye.

So, could this impact grain markets?

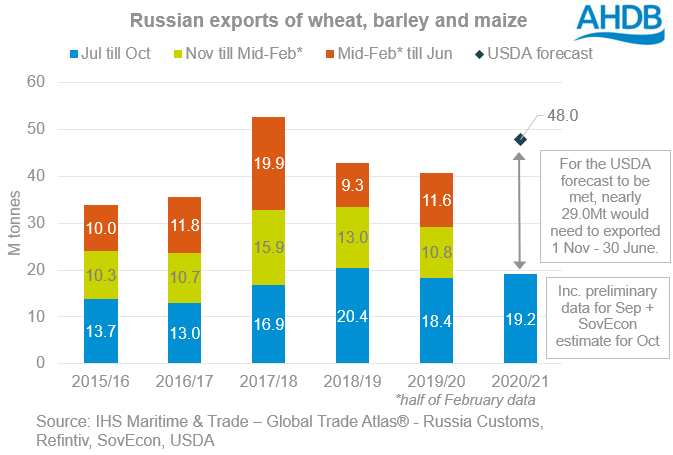

The USDA forecast that Russia will export 48.0Mt of wheat, barley and maize in 2020/21, of which:

- 39.5Mt of wheat

- 5.4Mt of barley

- 3.1Mt of maize

Russia is also expected to export 75Kt of rye.

In July and August Russia exported 8.6Mt of wheat, barley and maize (IHS Maritime & Trade – Global Trade Atlas® - Russia Customs). Preliminary data for September adds a further 5.7Mt (Refintiv) and SovEcon estimate another 4.9Mt was shipped in October. As a result for July to October, Russian exports could total around 19.2Mt.

With exports from mid-February capped at 15.0Mt, this leaves approximately 13.8Mt to be shipped between 1 November and 14 February, if the current forecasts are to be met. This would equate to just under 4.0Mt per month.

13.8Mt is more than was shipped between 1 November and 14 February in the last two seasons, although Russia had a smaller exportable surplus in those years. Subsequently, it is still a feasible export volume and more grain was exported during those months in 2017/18.

The marketing year for wheat and barley is July to June, while the marketing year for maize is October to September. As a result the calculations aren’t exact, but with the amount of maize shipped small compared to wheat, they still give a good guide.

Price will determine volumes

The amount exported over the winter months will be determined by prices, logistics and potentially the weather.

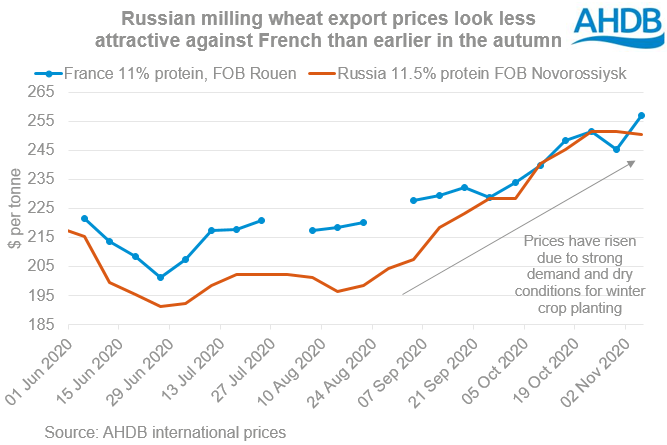

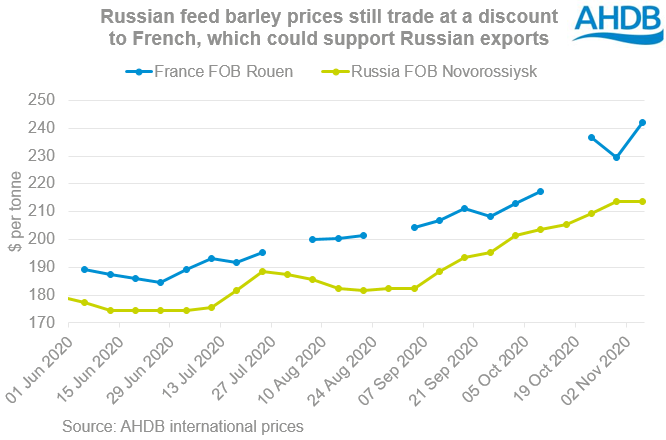

Russian wheat prices have risen in recent weeks, due to strong demand from importing countries and concerns over the planting of the 2021 crop. As a result, Russian prices look less attractive than earlier in the year but were still low enough to win the last GASC tender. Egypt’s state buying agency, GASC, is very price focused and it bought 300Kt of Russian wheat last week.

How prices change compared to other exporters' prices over the coming weeks will influence how much Russian wheat gets exported over the winter. The volume will also depend on how much was sold earlier in the autumn.

Russian logistics and weather can also effect the amount shipped in winter. As the season progresses, grain needs to travel further to the ports and this can be a factor in less grain being exported in January and February. Exports are also sometimes lower in the winter months because cold or stormy weather at port can affect loading. We will monitor for news of either of these impacting on exports in the weeks ahead.

Market impact depends on shipments before 15 Feb

The proposed Russian quota could influence global and UK prices, but it depends on how much gets shipped before 15 February and in November and December in particular.

If large volumes are shipped in these two months; and to a lesser extent Jan and Feb too, a 15.0Mt quota would have limited or no impact on exports. In that case, the impact on global and UK prices would be minimal.

However, if exports slow-down in the next couple of months, the quota will have more impact. If the quota restricts the amount of grain available, especially wheat, from Russia, other nations will need to ship more and this could push up prices. How much prices could rise depends on southern hemisphere wheat production in 2020/21, the prospects for the global 2021/22 harvest and international demand for grain.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.