Black Sea weather more important than ever: Grain Market Daily

Wednesday, 18 November 2020

Market Commentary

- May-21 UK wheat futures closed yesterday at £191.35, gaining £0.70/t on Monday’s close. New crop (Nov-21) gained £1.40/t to close at £160.15/t.

- Chicago soyabeans (Jan-21) closed yesterday at $429.77, gaining $5.97/t on Monday’s close. The nearby contract traded at its highest since June 2016 spurred on by Chinese demand and supply concerns from South America as weather remains relatively dry.

- FranceAgrimer projected soft wheat exports outside the EU+UK at 6.85Mt, up from 6.7Mt seen the previous month. Although down from last year, China have been actively purchasing from France.

Black Sea weather more important than ever

As the Northern Hemisphere combinable harvests wrap up, weather will become the key focus point for 2021 harvest; particularly conditions in major producing regions such as the Black Sea region.

Although the latest WASDE report put an extra 1.4Mt onto global wheat opening stocks this season, wheat markets are still feeling support, capitalising on gains seen in maize markets. However, conditions in key areas will still either pressure or support.

Why is the Black Sea so important?

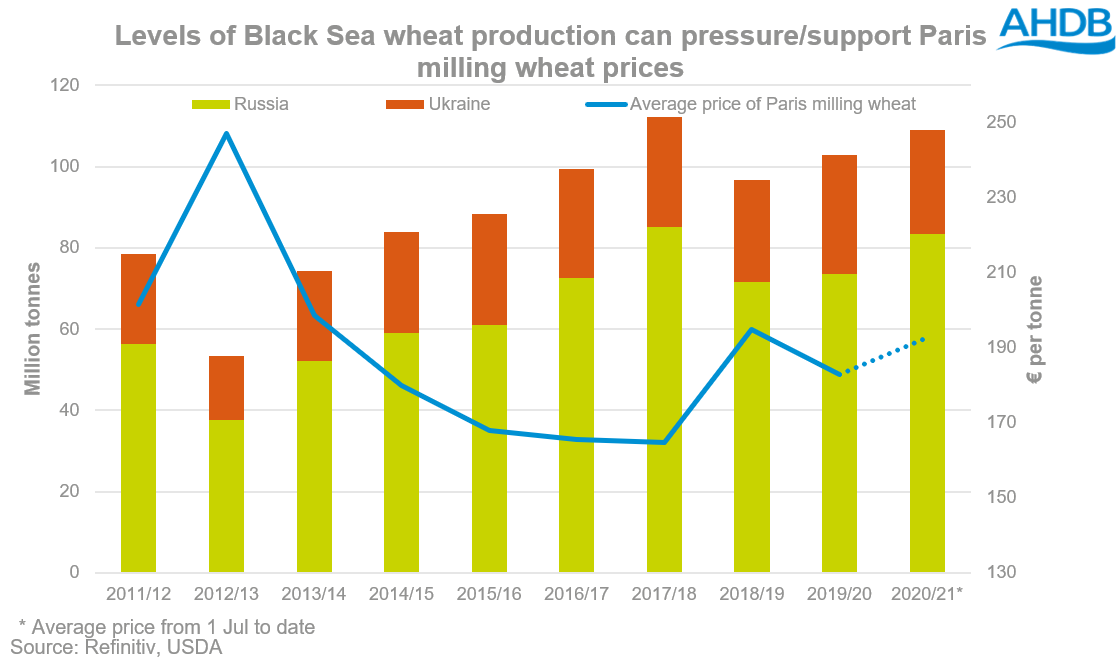

The two largest producers and exports of wheat from the Black Sea region are Russia and Ukraine. They largely grow wheat to export as a cash crop, with their supply onto the global market dictating a sizeable proportion of sentiment for the whole marketing year.

Ukraine mainly sow winter wheat, helping to achieve higher yields and around 70% of Russian wheat is winter sown.

According to UkrAgroConsult, 95% of Ukrainian winter wheat is sown as at 9 November and the planned area for 2021 is 6.1Mha, a 5% increase of last season’s area.

The Russian Agriculture Ministry reports that 99.7% of winter grains, or 19.1Mha, is sown, an increase from this time last year when that figure was 18.1Mha. The larger area planted this season could offset some dry weather yield impact, if realised, on total production changes on the year.

What are the conditions currently like?

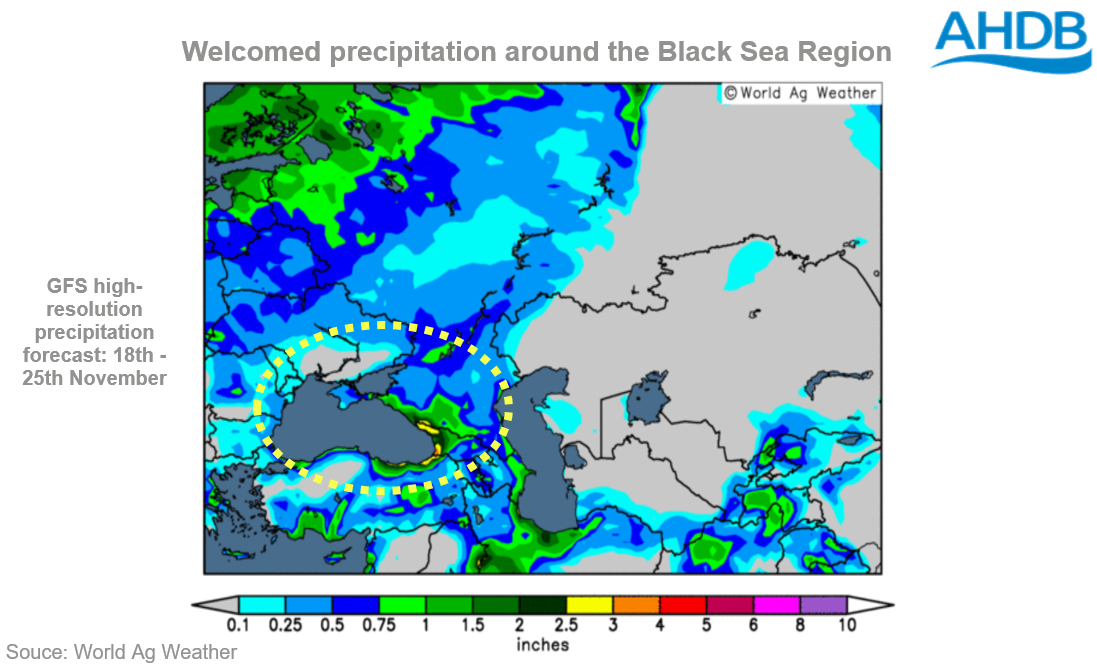

Crops are being sown into relatively dry seed beds and there is a lack of moisture at subsoil levels, which could cause issues for both winter and spring cropping. A warm snowy winter will improve current conditions for both winter and spring crops.

Throughout this week, there are parts of the Black Sea where the temperature is getting close to freezing; especially in Eastern parts of Ukraine and parts of the Southern and Northern Caucasus region of Russia.

Currently, there is a lack of snow cover that would insulate these crops from mass winter kill, but momentarily temperatures around 0 °c will not have a significantly impact.

As this cold weather is coinciding with precipitation, moisture conditions should improve around much of the Black Sea region. However, should this rain fall short of expectations, it could add more concern around crop prospects in the region.

I discussed earlier this month how a moderate La Niña could affect domestic grain prices. With La Niña’s arm extending over the Black Sea region too, how much the ongoing dryness and any moisture relief impacts the 2021 crop, will sway the sentiment around possible production levels, and therefore provide a steer for domestic pricing also.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.