- Home

- North America: How much do they consume?

North America: How much do they consume?

The USA and Canada are mature markets for red meat and dairy products, with high levels of domestic production and consumption. While consumption of red meat and dairy is lower per capita in Mexico, demand is projected to rise as the economy strengthens and the middle class grows.

Beef and pork consumption remains high in North America, though growth is slowing. Lamb consumption is rising modestly, although starting from a lower base. Premium red meat provides an opportunity for UK exports to the region, with its high welfare and sustainability credentials.

Cheese is the top UK dairy export to North America, with butter growing steadily. Mexico consumes high levels of skimmed milk powder, but only imports small amounts from the UK.

Beef

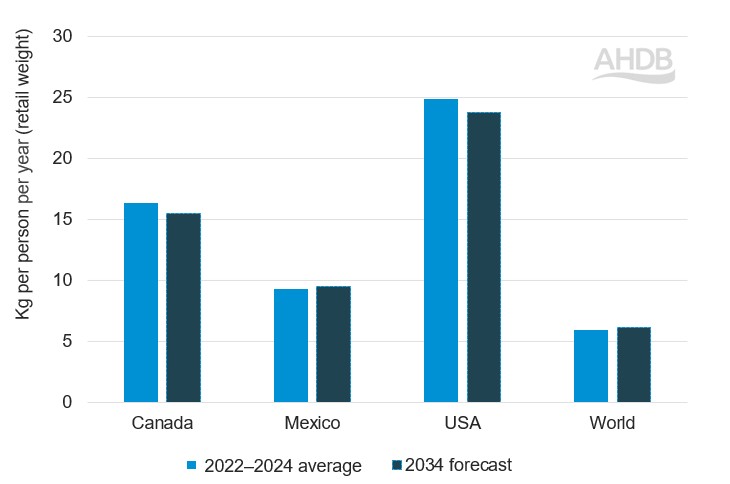

Beef consumption per capita remains high in the USA and Canada; this is attributed to strong domestic production supplemented by imports to meet demand.

Across North America, average annual beef consumption between 2022 and 2024 accounted for 21% of global intake, estimated at 15.7 million tonnes (OECD). Over the next decade (2025–2034), this figure is projected to rise marginally to 16.0 million tonnes, reflecting an annual growth rate of 0.2% (31 thousand tonnes), well below the projected global average of 1.3% (954 thousand tonnes).

Figure 1. Beef and veal consumption in North America per capita per year

Source: OECD-FAO Agricultural Outlook 2025–2034

The USA remains a leading producer and exporter of beef. An estimated record US maize harvest in 2025 will bolster livestock feed supplies, enhancing the competitiveness of the US beef sector. The USDA has forecast US beef production to decline by 4.8% year-on-year in 2026 due to tighter cattle numbers.

Beef production across North America is projected to expand over the longer term. Imports are forecast to decline in both the USA and Mexico, with only modest growth expected in Canada. Brazil, a major global producer, is increasingly targeting the Mexican market, while the USA continues to seek alternative outlets for beef that it cannot export to China due to ongoing political tensions.

Australia and New Zealand have increased their beef exports to the USA, partly by redirecting product away from China. This has been encouraged by historically high US beef prices, driven by tighter domestic supplies.

Canada has shown interest in new suppliers, particularly in the context of some consumer resistance to US products. UK beef export volumes to North America have been growing in recent years and mostly serve foodservice or smaller retail outlets rather than major supermarket chains.

UK beef exports to the USA primarily consist of offal (e.g. tails, tongues), skirt for ethnic markets, and trimmings used in burger patties. The UK’s lean beef is often valued for mixing with USA domestically produced product to complement the difference in fat content. In 2024, the UK exported 1,800 tonnes of beef offal to the USA, valued at £8.8m, accounting for most of the £11.8m total beef exports.

There is an opportunity for the UK in the premium beef market. Attributes such as hormone-free and grass-fed cattle are important for health and sustainability-conscious consumers who are willing to pay extra.

Pork

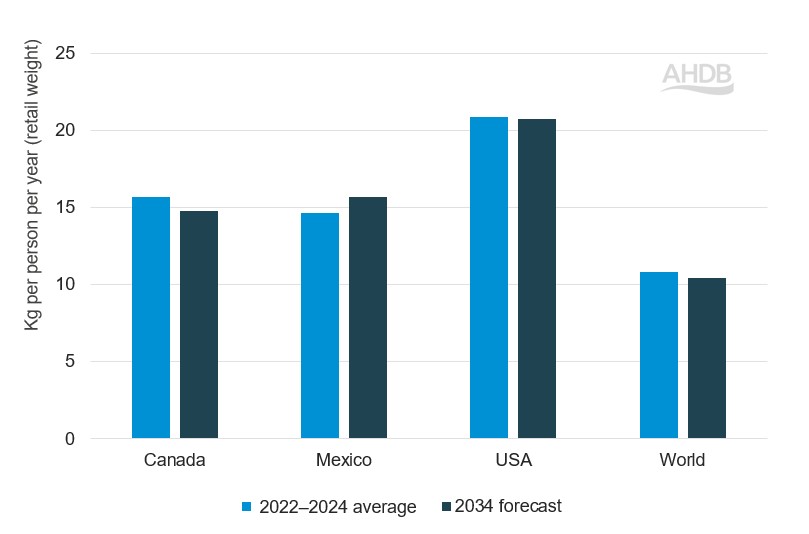

Per capita pork consumption remains relatively high across North America.

Annual pork consumption in the region is projected to increase by around 920,000 tonnes over the next decade to reach 14.4 million tonnes, a growth rate of 0.7% per year (OECD).

Figure 2: Pork consumption in North America per capita per year

Source: OECD-FAO Agricultural Outlook 2025–2034

In Mexico, pork consumption exceeds that of beef, and demand is rising. It offers the strongest potential opportunity for UK pork exporters to the country.

The OECD projects that Mexican pork imports will rise by around 1.1% per year over the next decade, equivalent to an additional 16,000 tonnes annually.

Mexico currently sources most of its pork from the USA, where exports are expected to grow by 18,000 tonnes over the same period. However, the USA faces growing competition from both Canada and Brazil for the Mexican market.

The UK first gained limited market access to Mexico in 2021. This was further expanded in 2024 to cover offal and by-products. Once Mexico ratifies the UK’s accession to the Comprehensive and Progressive Agreement for Trans‑Pacific Partnership (CPTPP), existing 20% tariffs on pork products will be removed, and this will significantly boost the competitiveness of UK exports.

Imports of pork into Canada are expected to grow only marginally (around 850 tonnes annually) over the next decade, while in the USA they are likely to decline (OECD).

The most promising opportunities for UK exporters to both the USA and Canada lie in premium products, particularly outdoor-bred, organic, hormone-free and antibiotic-free lines. Clear provenance is a key differentiator and resonates strongly with consumers.

Lamb

Lamb remains a niche meat in North America, with average consumption at just 0.6 kg per person, well below the global average of 1.3 kg. Despite this, the USA is the world’s third-largest buyer of lamb, following China and the European Union. Between 2022 and 2024, the USA imported approximately 150,000 tonnes annually, primarily from Australia (74%) and New Zealand (25%). These imports were largely premium cuts, such as legs, loins and racks.

Although demand for lamb is expected to rise, growth will be modest. Over the next decade, consumption in North America is projected to increase by only 32,000 tonnes (OECD). This represents less than 1% growth annually, highlighting the limited role of lamb in the region’s diets.

While the OECD does not anticipate major changes in US domestic production, import volumes could rise by 1.7%, suggesting opportunities for high-value UK exports given the country’s limited domestic supply.

UK lamb exports to the USA are gradually increasing, supported by competitive pricing. UK lamb exports to Canada are also growing, due to demand for higher-value lamb cuts. This is supported by Canada’s diverse migrant population, particularly communities from the Middle East, Asia and parts of Europe where lamb is a dietary staple. There is also growing demand for halal lamb, which the UK is well placed to serve.

The long-term success of UK lamb exports into the region will depend on promoting key differentiators – such as traceability, animal welfare, sustainability and grass-fed production – which help to support the UK’s more premium pricing.

Fresh dairy

Dairy production and consumption is a staple across the USA and Canada, reflected in high fresh dairy product consumption. Between 2022 and 2024, fresh dairy consumption averaged 73 kg/person in the USA and 68 kg/person in Canada compared to a global average of 59 kg/person. It is worth noting that the UK has an exceptionally high consumption of 90 kg/person for fresh dairy products.

Mexico consumes very little fresh product, but has a relatively high intake of milk powders. Consumption stands at 1.7 kg/person for whole milk powder (2022–2024 average) and 2.7 kg/person for skimmed milk powder, well above the global averages of 0.5 kg/person and 0.4 kg/person, respectively.

Meanwhile, cheese and butter are widely consumed across the North America region, cementing the region as a key export destination for British products.

Cheese

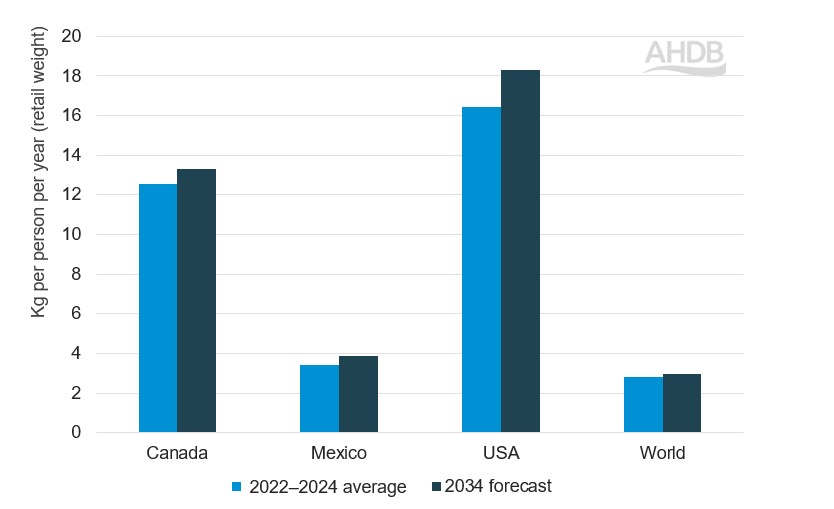

Cheese is a substantial category in North America, with consumption projected to rise by approximately 1.8% annually to 8.4 million tonnes by 2034 (OECD). The USA accounts for around 85% of this volume. The USA remains the UK’s largest export market outside of Europe for dairy products, worth £85 million in 2024.

While this presents clear opportunities for UK exporters, it is important to note that domestic cheese production in the USA is expanding and, as such, the US may reduce its import requirement over time. At least half a dozen new cheese plants were due to come onstream in 2025. At the time of writing, a further three cheese-producing plants are planned to start operating in 2026 and 2027.

US cheese production averaged 6.45 million tonnes between 2022 and 2024. The OECD/FAO forecast US cheese production to reach 7.73 million tonnes by 2034 (20% higher). US cheese imports are forecast to decline by 10%, from an average of 144,000 tonnes (2022-2024 average) to 131,000 tonnes in 2034. The UK must continue to differentiate itself with added value, premium dairy products which have established themselves well in this market.

Figure 3: Cheese consumption in North America per capita per year

Source: OECD-FAO Agricultural Outlook 2025–2034

Cheese represented 83% of UK dairy exports to the USA in 2024, at 9,900 tonnes, recording strong year-on-year growth and reaching a value of £75 million. These exports are split fairly evenly between retail (53%) and foodservice (47%).

Interest in artisan cheese remains strong in the USA, where cheese is increasingly viewed as a nutritious food.

To maintain momentum in the US market, UK cheese must remain either competitively priced or clearly differentiated. Uncertainty around tariffs remains a key barrier to further progress. Branding matters, with imagery of cows outside grazing grass, small farms, rolling hills and hedgerows resonating with American consumers.

Mexican cheese consumption is expected to continue its upward trajectory as consumers look for alternative protein sources to meat, driven by high prices and health concerns.

Euromonitor International estimates retail cheese sales to increase by 61% in 2030 from 136 billion Mexican pesos in 2024 (Euromonitor, Cheese in Mexico, country report, October 2025). According to Euromonitor data, the retail/foodservice split in the Mexican cheese market is 75:25 based on the 2020-2025 average in volume terms (Euromonitor, Dairy Products and Alternatives statistics).

Mexican cheese production is expected to grow by 3% to 490,000 tonnes in 2025 compared with 2024. Investment in cheese manufacturing facilities is also expected to increase the quality of domestic Mexican cheese.

Nevertheless, consumers’ interest in a variety of cheeses is providing opportunities for imports, including Cheddar. Pizza is a popular food item in Mexico, and demand for shredded cheese has increased accordingly. The USA is a key supplier of cheese for the Mexican market, and so it is a competitor for UK exports in the country.

On 1 January 2024, the UK lost access to Canada’s World Trade Organisation (WTO) cheese tariff-rate quota (TRQ) reserved for EU members (14,272 tonnes) and now has to rely on the non-EU reserved quota of this TRQ. This quota is smaller in size (6,140 tonnes) and open to all non‑EU countries, leading to greater competition among those eligible.

UK cheese exports to Canada in 2024 were 28% lower year-on-year in volume terms and 26% lower year-on-year in value terms. Exports in 2025, however, have improved: between January and September 2025, UK cheese exports to Canada were 41% higher year-on-year in volume terms and 45% higher in value terms; both figures are above the previous five-year average.

Butter

Butter consumption across North America is projected to reach 1.7 million tonnes by 2034 (OECD). The USA will be the main driver for this growth, increasing by nearly 3% annually.

Butter consumption in the USA is on the rise, with per capita intake forecast by the OECD/FAO to reach 3.43 kg by 2034, up 22% on the 2022–2024 average. Retail sales grew 10% year-on-year to $5.8bn in 2024 and are expected to hit just under $8bn by 2029 (Euromonitor). This upward trend presents a clear opportunity for British butter, particularly where provenance and quality are key. US butter imports rose to 102,100 tonnes in 2024, with a value of £594 million. Ireland and New Zealand are the key individual suppliers, although the EU accounted for 62% of the total.

British butter currently has limited visibility in mainstream US retail. It is found mainly in speciality aisles, online gourmet shops and high-end kitchens, but no brand has dominated the market like Irish Kerrygold. There could be a golden opportunity for a well-positioned British contender where taste, story and sourcing matter more than price.

While this sounds like good news for exporters, domestic butter production across North America is expected to increase over the next decade and will likely cover the bulk of regional demand. We expect a gradual decline in US import volumes over the long term.

Milk powders

Mexico stands out for its high consumption of milk powders, driven by limited domestic dairy production. While Mexican intake of both skimmed milk powder (SMP) and whole milk powder (WMP) remains above the global average, growth is expected to slow over the next decade compared to the more rapid increase observed between 2022 and 2024. US producers supplied 97% of Mexico’s milk powder imports in 2024: 205,000 tonnes.

UK exports of milk powders to the North America region are negligible or non-existent due to sufficient supply and trade within the region, alongside high transport costs.

Continue reading about the North America market

Market access and barriers to trade