Winter cropping continues to regain ground for harvest 2022: Grain market daily

Friday, 17 December 2021

Market commentary

- UK feed wheat futures (May-22) slipped again yesterday closing at £220.65/t, down £1.35/t from Wednesdays close. Since Monday the contract has lost £6.60/t, although at the time of writing had rebounded a little. New crop (Nov-22) closed yesterday at £195.65/t, down £0.35/t.

- US wheat (May-22) regained some of the recently lost ground yesterday, closing at $284.73/t up $4.78/t. The Dec-22 (new crop) contract also closed yesterday up from the previous day, closing at $284.55/t.

- The US is said to be experiencing dry and unseasonably warm weather in some key bread wheat growing regions. The crop is suffering as a result and may be more susceptible to harsh winter weather in the coming weeks.

- Stratégie Grains has revised their EU-27 soft wheat and maize exports up, to 31.5Mt (+1.1Mt) and 4.5Mt (+0.7Mt) respectively for the current marketing year (2021/22). Looking ahead to harvest 2022, the firm estimate wheat production down year-on-year at 127.6Mt.

Winter cropping continues to regain ground for harvest 2022

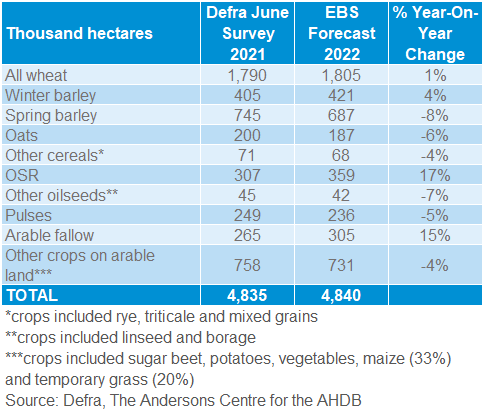

Yesterday, Defra released their final estimates for the 2021 UK arable crops. This allows us to look at our Early Bird Survey of planting intentions results at a regional level for the four main crops; wheat barley, oats and oilseed rape (OSR). The results show that on a regional level there are some changes compared to last year.

Wheat

The total wheat area is forecast up 1% (15Kha) year-on-year at 1,805Kha, but there are some larger differences in the regional changes.

The East remains the largest wheat growing region and is expected to have the largest absolute increase in wheat area of 15Kha. However, in percentage change terms, the North West region is anticipated to see the biggest planted area change at 15%.

The South West, West Midlands and Yorkshire & the Humber regions are all intending to reduce the planted area. The combined drop in area is expected to be 14Kha.

This is particularly surprising in Yorkshire & the Humber, due to the delivered premium that wheat is obtaining from this region over other areas of the UK.

Other headlines

- Total barley area is down 4% year-on-year at 1,107Ka.

- The winter barley area has risen for harvest 2022, but with regional differences.

- Spring barley planting intentions are down 8% (58Kha) year-on-year. Almost all regions of the UK anticipate a drop in spring barley plantings for harvest 2022.

- The UK oat area for harvest 2022 is estimated at 187Kha. This is a 6%, or 13Kha, drawback to last harvest.

- A rebound in domestic rapeseed production is expected. At 359Kha nationally, it is anticipated to be up from last harvest.

For the full regional breakdown of cropping intentions for the four key crops (wheat, barley, oats and oilseed rape) visit the Early Bird Survey webpage.

This is the first insight into regional cropping for harvest 2022 and could have an impact on regional pricing throughout the 2022/23 marketing year.

It is paramount to stay ahead and use this information to plan strategies to market your commodity.

Be sure to sign up to the Arable Market Specialists outputs as we use this information to give further insight into domestic market implications of this survey and much more!

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.