Will US maize dictate UK wheat prices through July? Grain Market Daily

Tuesday, 23 June 2020

Market commentary

- UK wheat Nov-20 futures declined by £1.85/t yesterday to £164.00/t under pressure from increased Russian crop forecasts and the advancing US wheat harvest.

- 29% of US winter wheat had been harvested by 21 June, vs 26% on average for the time of year (USDA).

- US maize crop conditions continue to look good as they reach a critical growth stage (silking) – see below. The USDA report 2% of crops were silking as at 21 June with 72% of crops were rated as in a good or excellent condition, up from 71% last week and 68% on average.

- EU maize import tariff reduced from €10.40/t to €4.65/t reflecting the small pick-up in US maize prices and freight rates since early May. The tariff is partially insulating the European market from the full effects of the impact of low US maize prices. The EU’s variable tariff also applies to maize imports to the UK until the end of the calendar year, when the transition period for the UK leaving the EU ends. After this, the UK is proposing to liberalise maize import tariffs to 0%.

Will US maize dictate UK wheat prices through July?

UK wheat could receive either a boost or come under additional pressure in the next few weeks from what happens to US maize crops as they’re now at a critical growth stage.

The US maize crop is currently forecast to reach an all-time high of 406.3Mt in 2020 and crops are in a good condition. However, the weather in the next few weeks is important to whether or not this forecast is achieved as crops have begun silking.

This is their reproductive growth stage when they are particularly sensitive to heat or moisture stress. As a result, there’s a strong relationships between final yields and US maize condition scores when the crop’s silking.

The long range weather outlook looks reasonably favourable, with a slightly increased chance of above average temperatures and above average rainfall. If realised, this would increase the chance of the record crop being confirmed, which could mean downward pressure on global maize prices.

If the weather turns adversely dry and hot prices may see some support, especially as investment funds hold a large net-short position in Chicago maize futures and may react quickly to cover their positions.

The impact on UK prices?

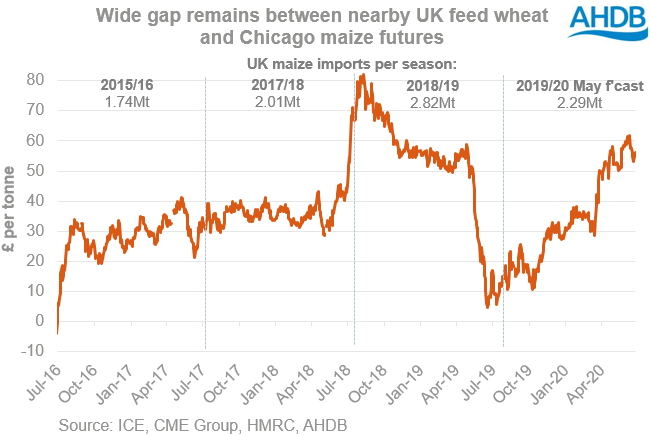

There’s a wide gap between UK feed wheat and global maize prices, reflecting expectations for a small UK wheat crop but large US maize crop. The gap is down a bit from a couple of weeks ago but still near its widest since the 2018/19 season, when drought limited the UK wheat crop and we needed to import over 2.8Mt of maize.

We don’t import much maize from the US but the Chicago prices are still the global benchmark for the commodity. The US maize area will be confirmed on 30 June by the USDA and weather reports are likely to affect maize prices in the weeks ahead.

New season maize is already looking attractive into the UK, so any drop in global maize prices would put pressure on UK wheat prices to follow. Conversely, any rise in maize prices could mean support for UK wheat prices if the weather turns hot and dry in July across the US Corn Belt.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.