Will US harvest cap recent wheat gains? Grain market daily

Tuesday, 5 October 2021

Market commentary

- Nov-21 UK feed wheat closed yesterday at £202.50/t, flat from Friday’s close. All key global grains contracts drifted yesterday.

- Yesterday, OPEC+ announced that they would continue to gradually increase oil output. As, a result, brent crude oil (nearby) closed at $81.26/barrel, the highest price since October 2018.

- Rises in crude oil prices have also driven another boost to palm oil. Malaysian palm oil (nearby) has surpassed a lifetime high level this morning, trading as high as RM5,000/t but closing at RM4,975/t.

Will US harvest cap recent wheat gains?

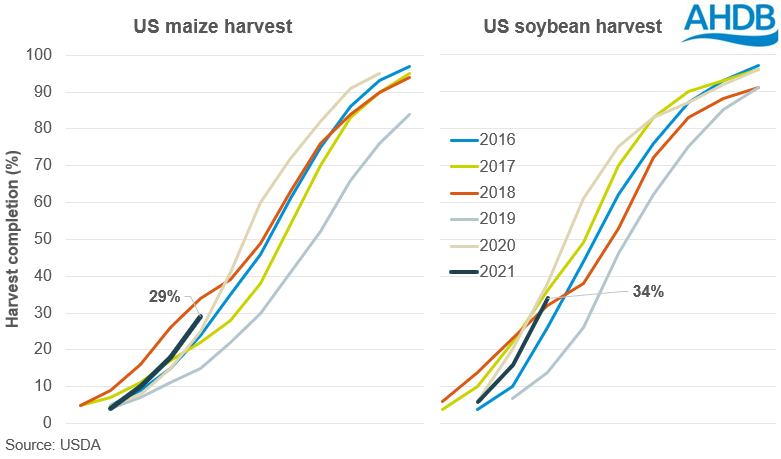

The US harvest continues at pace. Last night, the USDA crop progress report showed that the US maize harvest was 29% complete as of 3 October. This is 7 percentage points (pp) ahead of average, and 5pp ahead of last year. The soybean harvest has also been progressing at speed, now 34% complete. This compares to a five-year average of 26%, however, it does drop behind last years’ progress by 1pp.

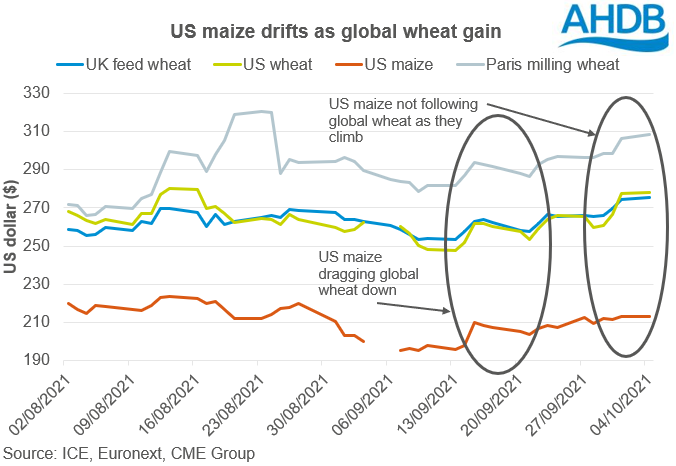

Harvest progress has pressured markets recently. Previously maize has dragged other major grains contracts down with it. However, maize has been somewhat left behind against wheat in the past week. Wheat continues to find support from a tight supply and demand picture.

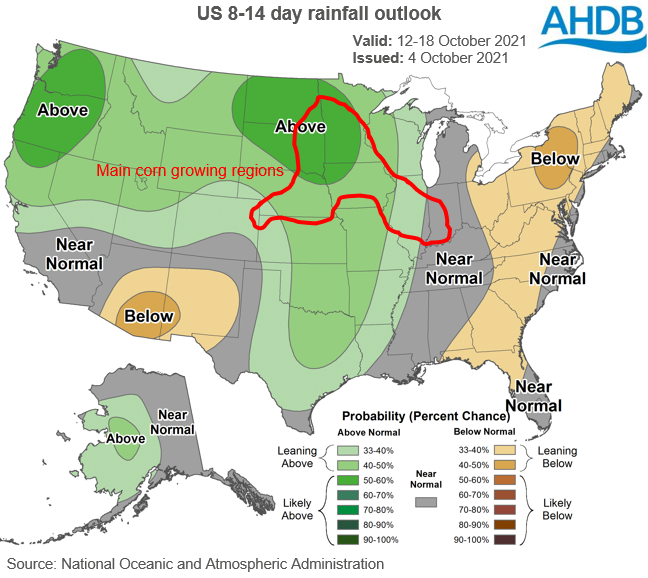

As the US maize harvest advances well, the sentiment around tight supply eases, at least temporarily. But, the weather outlook over the next fortnight is for increased rainfall for much of the US maize producing regions. This could slow the pace of harvest, dampening sentiment and supporting prices.

Other weather news, which is currently weighing on maize markets, is situated in South America. Global markets are relying on South American crops. Brazil is set for a record maize crop in 2021/22 at 188Mt (USDA). The first crop is currently being planted; 33% complete, versus 31% last year. Good rainfall received in September has alleviated dry conditions somewhat, aiding positive prospects. More rain is forecast in the next fortnight, which would continue to support crop development.

However, the biggest impact will come in spring 2022 when planting of Brazil’s Safrinha (second) crop will commence. This forms the majority of Brazil’s total maize production. So, despite rain boosting prospects for a good Brazilian first crop, the global grains supply picture remains a tight one.

As maize is often a driver of all global grain markets, if it continues to drift, the rise in wheat prices could be capped. As UK prices are influenced by global markets, movements will likely affect our prices and is something to keep an eye on.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.