Will UK milling wheat premiums remain strong? Grain market daily

Wednesday, 14 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £277.10/t yesterday, up £1.25/t from Monday’s close. The Nov-23 contract saw a £1.50/t drop over the same period, closing at £262.75/t.

- Global wheat markets edged higher yesterday over concerns around Black Sea exports, following Putin’s criticism of the grain corridor out of Ukraine (Refinitiv).

- AHDB were unable to publish a UK produced AN price for August in its latest GB fertiliser price series due to insufficient data available to produce a robust monthly average. View other prices in the data series.

- The temporary halt in production of ammonia at CF industries Billingham site continues to bring uncertainty to the domestic fertiliser market.

Will UK milling wheat premiums remain strong?

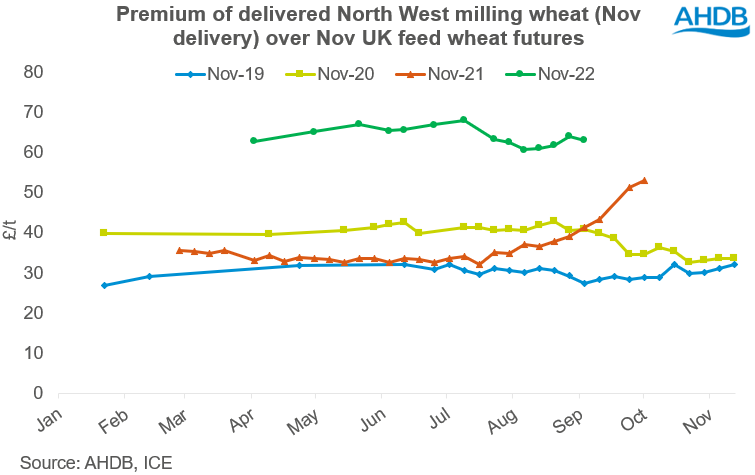

Global and domestic wheat futures have been on the rise over the last few weeks as concerns surrounding global maize supply, combined with speculation over how much grain will leave Ukraine, has added support to cereal markets. Over the same period, the premium of UK milling wheat over futures has edged lower slightly but remains historically high.

Looking at the latest price data (8 Sep), the premium of delivered North West milling wheat (Nov delivery) over Nov-22 UK feed wheat futures is currently at £63.00/t. At the same point last year, the premium sat at £41.30/t (NW milling wheat for Nov 21 delivery over Nov-21 UK feed wheat futures), which at the time was also high.

As is well known, milling wheat premiums have been strong over the past few months, driven by concerns over the quality and quantity of domestic milling wheat this season. As mentioned above, over recent weeks milling premiums have been squeezed slightly, as feed wheat futures have been supported by climbing maize markets. Global maize production was trimmed by 7Mt from previous projections in Monday’s USDA World Agricultural Supply and Demand Estimates (WASDE), with production now pegged at 1,173Mt for 2022/23.

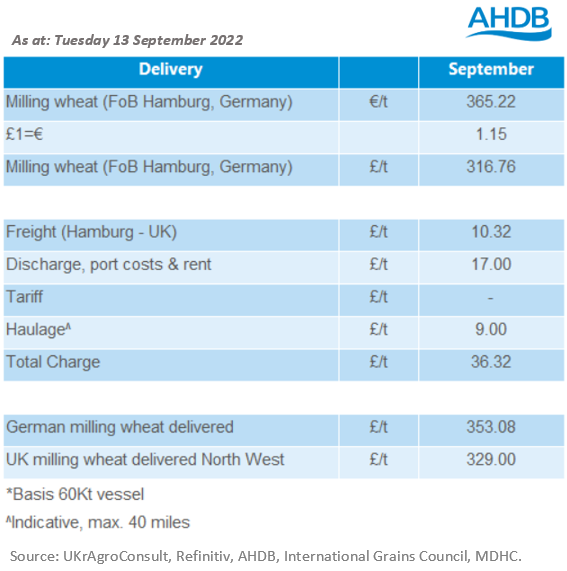

With the UK typically importing around 15% of the total amount used to produce flour each year (supply and quality dependent), it’s important to look at availability and prices in these import origins. Germany, a key import origin for UK milling wheat, is said to have had a better-than-expected winter wheat crop following the drought, with production estimated to be up 4.6% on 2021, according to the German Agricultural Ministry. However, the average protein content is expected to be lower at 11.8%, compared with 12.7% in 2021. In France, another key UK import origin, soft wheat production is expected to be lower this year, with protein content also lower. According to FranceAgriMer, the average protein content for the soft wheat harvest is 11.4%, compared with 11.9% in 2021.

While this is an indicative view, as shown in the table above, delivered UK milling wheat prices are still some way off being at parity with imported German milling wheat. With feed wheat futures supported by the wider feed grain market, milling premiums could continue to feel the pressure. However, with high continental prices, and concerns over protein levels both domestically and across the Northern Hemisphere, it is likely milling wheat premiums will remain strong for at least the short to mid-term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.