Will sterling push higher? Grain market daily

Tuesday, 10 November 2020

At 3.20pm today sterling was up considerably, almost entirely across the board (down against Indonesian rupiah and Hungarian forint), the gains extended to +0.85% against the US dollar, +0.74% against the Japanese yen and the euro.

As sterling strengthens the value of sterling priced products fall as they become more expensive on the global market. For example, at 15.46pm today, UK feed wheat futures (May-21) were down £2.10/t at £189.00/t, despite Paris and Chicago markets moving higher.

Should sterling continue to appreciate the value of UK cereals and oilseeds products are highly likely to see further declines.

What is driving this strength?

The gains in sterling, have been in part driven by market positivity following the announcement by pharmaceuticals company Pfizer that their coronavirus vaccine is 90% effective. Elsewhere, sterling was supported by the House of Lords rejection of the UK governments Brexit bill, which if passed would have given government the power to break sections of the UK-EU divorce agreement.

Further, sterling made ground in spite of a month-on-month increase in UK unemployment figures, which were in-line with expectations in a pre-report Refinitiv poll.

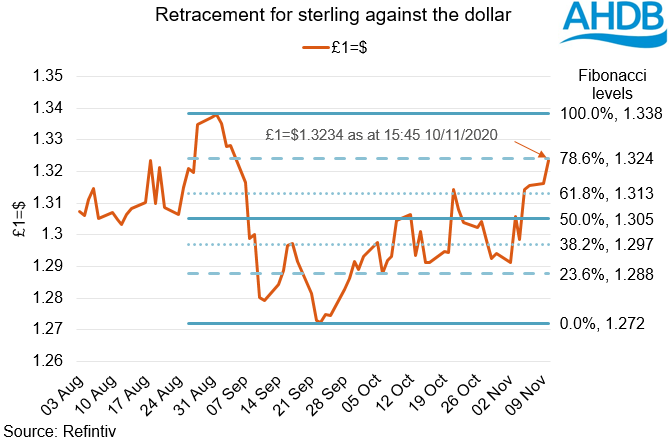

Sterling closed yesterday at £1=$1.3163, above the previous peak in the market (£1=$1.3144 on 21 October). The next significant support level is at £1=$1.3381, hit on 1 September. The ability to reach these levels will be dependent on a number of factors, not least the publication UK GDP figures for September.

From a technical standpoint, yesterday’s close was significantly above the 10 and 20-day short-term moving averages, which broke above the 50-day average on the 28 October and 3 November respectively. It should be noted that the 78.6% retracement level between the high on 1 September and the low on 23 September (£1=$1.272), is at £1=$1.3242, it is possible we hit this level and then bounce back in the coming days.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.