Where next for UK rapeseed prices? Grain Market Daily

Friday, 5 February 2021

Market Commentary

- UK feed wheat futures continued their retreat yesterday, with the May-21 contract closing £0.70/t lower, at £201.80/t. Nov-21 futures also lost ground closing at £165.00/t, down £1.00/t.

- The UK market followed moves down in global wheat markets, with Euronext, Paris milling wheat futures (May-21) also ending the day lower, down €1.00/t at €218.75/t.

- With little time to go until the introduction of a tax on Russian wheat, we are seeing a strong drive for Russia and the EU to compete in export markets. Demand has been somewhat reduced; apart from the recent Egypt tender, and this is driving prices lower.

Where next for UK rapeseed prices?

UK rapeseed prices have been firm over the course of the season so far. This is hardly surprising given that production was just 1.03Mt. As a result UK prices have had to hold at a level to attract imports. But, how much more do we need to import this season? And what does this mean for domestic rapeseed prices?

How much have we imported so far?

From a pure rapeseed perspective, the UK has imported at least 364Kt of rapeseed in 2020/21, through to January.

Considering UK rapeseed demand is often quoted at 2Mt, this would suggest there is still some way to go for imports. However, looking at seed belies the true nature of the UK rapeseed market this season.

We also need to consider the picture for vegetable oil imports. Whilst other imports of vegetable oils have been relatively stable so far this season, imports of rapeseed oil have increased significantly. This is hardly surprising with domestic demand for rapeseed oil unlikely to have changed during the time Erith was closed in 2020, the drop in oil supply needed to be fulfilled.

If we look at rapeseed oil imports as a seed equivalent (40% oil basis), and add this to seed imports the UK has imported some 667Kt of rapeseed this season. Imports of rapeseed oil (seed equivalent) are up 250Kt on last year.

How much more do we need?

Taking this 667Kt of combined seed and oil (seed equivalent) imports and adding 1.03Mt of production gives us a total supply of 1.7Mt through to January. This gives us 5 months plus any EU trade in December non-EU trade in January, to reach 2.0-2.2Mt (allowing for ending stocks), at 60-100Kt a month.

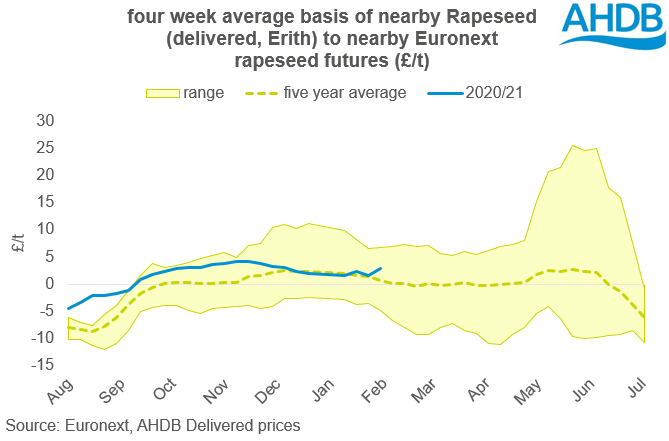

However, UK delivered rapeseed prices, are not pricing in a manner that suggests we need such a high volume of imports with the basis of delivered rapeseed (nearby, Erith) to Euronext rapeseed futures (nearby), broadly in line with the 5-year average.

With UK values not pricing as though we need to attract huge volumes of imports, we need to think about the impact of Erith’s closure. With the plant closing in June 2020, we need to factor in around four and half months of reduced crush in the UK. This could be somewhere between 300Kt and 400Kt. Factoring this into the import picture suggests that imports are either almost done (highly unlikely) or we need around 56Kt a month. The latter would echo better with domestic prices.

What does this mean for domestic prices?

With the UK import demand not huge there is no great need for the basis to futures to extend. As a result UK prices are likely to track the Euronext futures market closely over the remainder of the season. This suggests that we need to watch the EU import picture closely over the next 5 months as this will go a long way to setting UK prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.