Where are rapeseed prices going? Grain Market Daily

Tuesday, 24 September 2019

Market Commentary

- Grain markets generally drifted sideways yesterday.

- UK feed wheat futures (Nov-19) closed at £136.25/t, £0.25/t gain.

- Paris milling wheat futures (Dec-19) followed suit, gaining just €0.50/t to close at €171.75/t.

- Currently there is little fresh news entering the market, allowing prices to drift slightly. US HRS wheat harvests are one to watch due to adverse weather hampering progress and potentially damaging quality.

Where are rapeseed prices going?

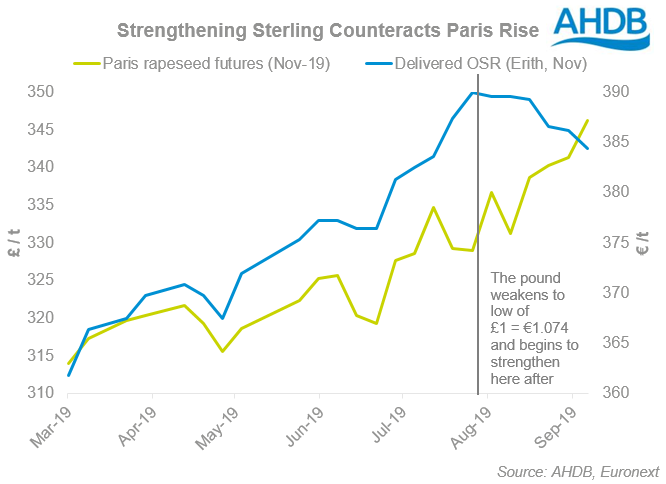

Physical delivered oilseed rape prices for November delivery into Erith have been on an upward trend from March to August. This isn’t surprising as Paris rapeseed futures (Nov-19) have also been following a similar trend. However, there have been times where Paris futures have dropped off and UK physical prices have firmed, and more recently we have seen the opposite.

Over the last 4 weeks, UK physical oilseed rape prices have seen continued losses. From Friday 23 August to Friday 20 September, oilseed rape delivered to Erith in November has lost £7.00/t. Over the same period, Paris oilseed rape futures (Nov-19) have gained €11.25/t.

Why has this happened? Sterling.

The pound has been heading downhill for some time, reaching its lowest value against the euro since 2009 in early August. This supported physical UK prices somewhat, counteracting the drops in Paris futures at times. However since 9 August, the pound has strengthened by over 5%, closing yesterday at £1=€1.1303. This has dampened any price increases, counteracting recent Paris futures gains.

Is there any support out there?

US soyabean prices have been under pressure for some time. Large US stocks and a continued trade dispute between the US and China, the largest soyabean purchaser, have driven this. There has been some recent optimism around a trade agreement between the two, with deputy-level talks described as “productive”.

In addition, there have been some recent purchases of US soyabeans from Chinese traders. Yesterday, reports state that China purchased 600Kt of US soyabeans for shipment in October to December. This is following 600Kt of purchases the previous week.

This trade optimism is coupled with bad weather prospects in the US causing concern for the developing crop. Last night’s USDA crop progress report showed soyabean crops had maintained condition from last week, but development is well behind last year and the 5-year average.

These two factors together could lift US soyabean prices, which may offer further support to oilseed rape.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.