Analyst Insight: when will soyabeans drive rapeseed prices again?

Thursday, 16 December 2021

Market commentary

- UK wheat futures (May-22) closed yesterday at £222.00/t, down £5.50/t on Tuesday’s close. The Nov-22 contract closed at £196.00/t, down £4.00/t on Tuesday’s close.

- UK prices followed movements in both the Chicago and Paris wheat markets. One bearish driver cited is the ongoing harvest of Australia’s bumper wheat crop.

- Further to that, there is news that Russia might alter their planned wheat export quota. This quota is currently set at 9.0Mt and will run from February to June next year. Sources suggest that this quota, for wheat, could be revised to 8.0Mt (Refinitiv, Interfax).

When will soyabeans drive rapeseed prices again?

Current rapeseed (OSR) prices are well supported and their pricing relationship to soyabeans has increased quite significantly.

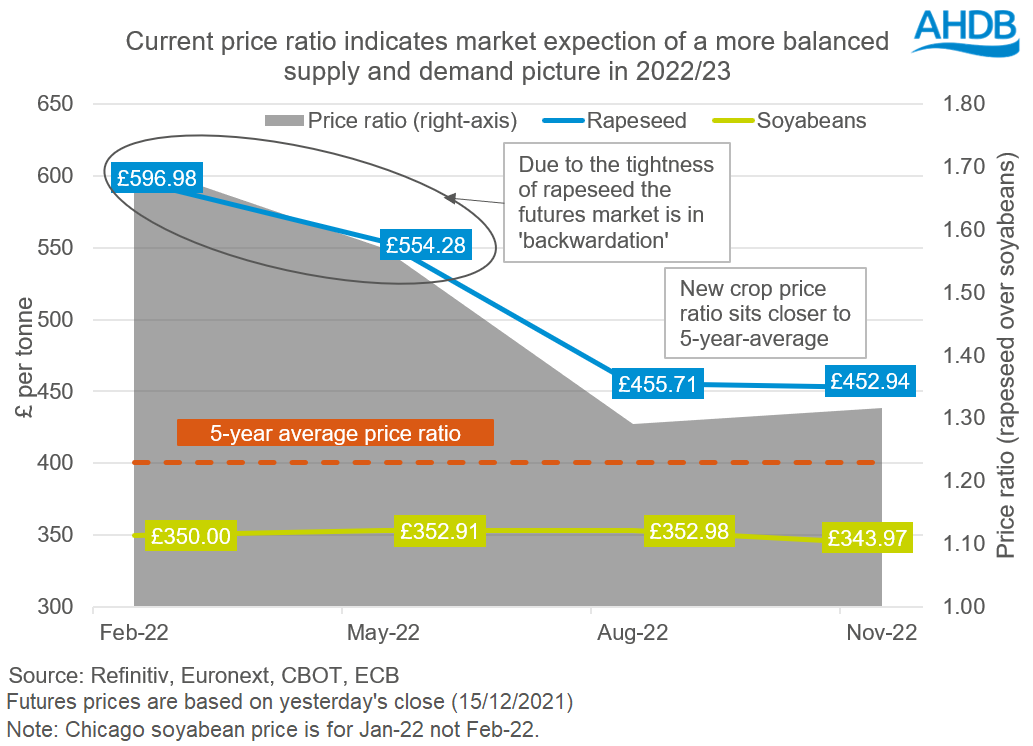

Nearby Paris rapeseed future closed yesterday at c.£596.98/t, while Chicago soyabeans closed at c.£350.00/t. This shows that rapeseed is approximately 1.71 times more expensive (price ratio: 1.71).

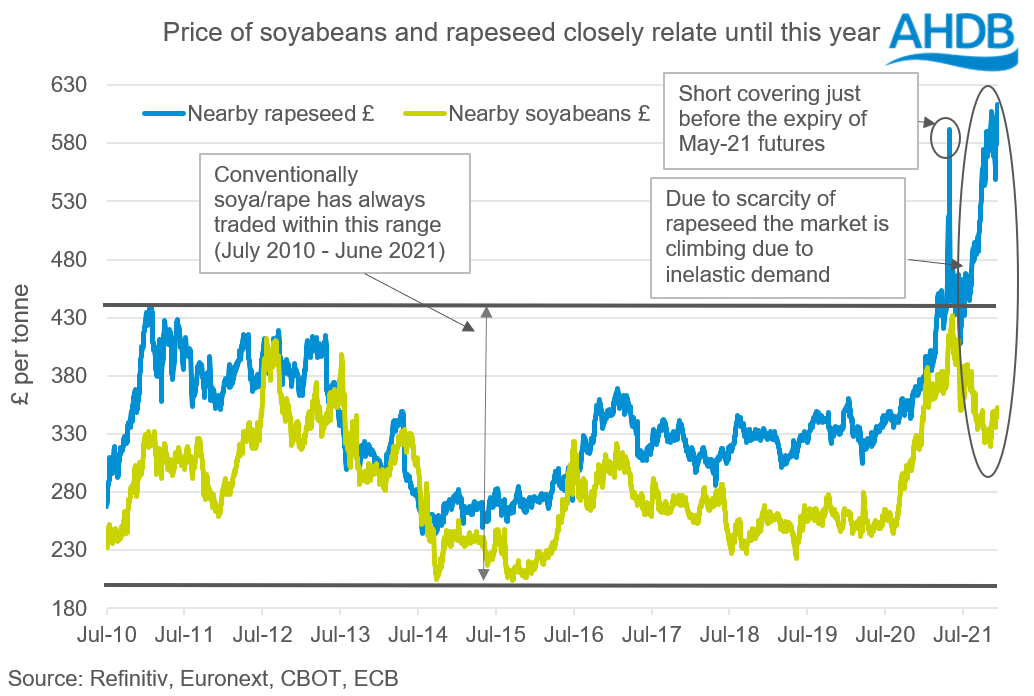

Conventionally, soyabeans and rapeseed prices sit within a range. The supply and demand fundamentals drive each other, along with other oilseeds, oils and the global economy.

Rapeseed prices have soared this season driven by the very low stocks-to-use ratio for the 2021/22 marketing year. This is pegged at 6.2%, versus 8.1% in 2020/21, and the 5-year-average, 10.4% (2016-2020). A key driver behind the tight picture comes from a 35% reduction in Canada’s production year-on-year.

Going forward though, how much further can OSR prices climb in comparison to soyabeans?

Rapeseed and soyabeans sitting in a range

Analysing prices between July 2010 and June 2021, both nearby Paris rapeseed and Chicago soyabeans have sat within a pricing range. Throughout this time, rapeseed is generally at a premium to soyabeans. However, due to large global production of soyabeans, soyabean fundamentals usually drive other oilseeds. That is until now.

Excluding the current marketing year (2021/22), and the end of April 2021’s short covering on Paris rapeseed (May-21), the range that both commodities have traded within has been £203 - £476/t. The 5-year-average price ratio between both commodities is 1.23 (2016/17 – 2020/21). This is well below the average so far this year (2021/22), 1.51.

Interestingly, as shown in the graph above, soyabeans have continued to trade within that range in the 2021/22 marketing year. Meanwhile the rapeseed market has kept climbing. The main sentiment being, very tight rapeseed supply.

Therefore, one could argue that the limit to old crop rapeseed is whatever someone is willing to pay. Rapeseed is both elastic and inelastic when it comes to demand depending on the end use.

What could happen to rapeseed next year?

High prices were providing incentive to plant OSR. We have seen this domestically in our Early Bird Survey, and on a continental level in the latest Stratégie Grains EU oilseed report.

New crop (Nov-22) Paris rapeseed futures are pricing within “normal” ranges comparative to soyabeans. This implies the market could be expecting a rebound in 2022/23 rapeseed production.

As displayed in the graph above, the price ratio of old crop futures contracts (Feb-22, May-22) is well above the 5-year-average mentioned previously. However, based on yesterday’s close, the new crop (Aug-22, Nov-22) price ratio sits nearer to the average.

If the anticipated large South American soyabean crop is realised, this will weigh on soyabean prices. From harvest-22, it is expected there will be increased oilseed supply globally and therefore will likely see rapeseed price off soyabeans again.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.