When will EU rapeseed imports halt? Grain Market Daily

Wednesday, 18 December 2019

Market commentary

- UK feed wheat futures (May-20) closed at £151.50/t yesterday, up £1.50/t from the previous day’s close. The lift was due in part to the weakening of the pound, which slid to £1=€1.18 yesterday, following the spike in value post-election (read more below).

- Argentina has announced a rise in taxes on both wheat and maize to 15%, up 3 percentage points. While seed is already bought at this stage, we may see farmers reduce investment in crops by decreasing input purchases, which could affect production.

When will EU rapeseed imports halt?

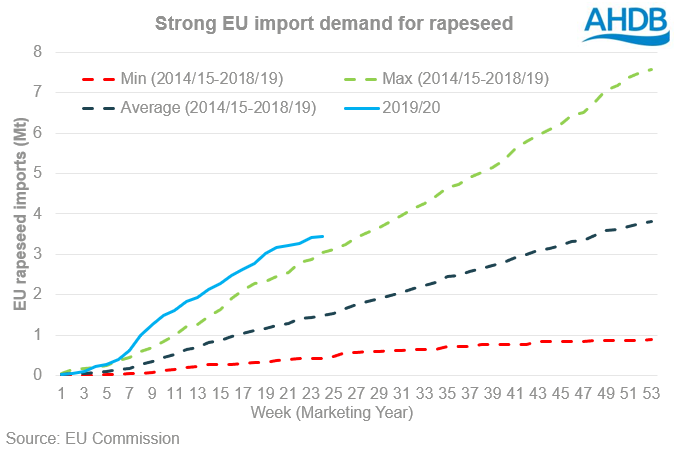

As at 16 December, the EU had imported 3.4Mt of rapeseed, 57% of estimated imports this season. However, with Ukrainian rapeseed exports likely to tail off in the near future, where remaining supplies will come from is uncertain. Ukraine is forecast to export 2.9Mt of rapeseed this season and the EU has already imported 93% of this figure (2.6Mt).

The EU has imported 0.7Mt of rapeseed from Canada so far this season. However, canola can be more difficult to find markets for the meal and glycerine after crushing. Imports from Australia could be scarce, with production currently estimated at just 2.1Mt by ABARES, down 35% from the five-year average.

With limited options, imports are likely to tail off as we move into warmer weather and biodiesel producers are able to switch away from rapeseed oil to alternative feedstocks.

In the short-term, the tightness in the market will continue to support prices. Nearby Paris rapeseed have risen €20.50/t since the start of October and closed yesterday at €406.50/t. In recent weeks a strengthening pound has capped domestic prices and prevented them from following the same pattern.

However, with the post-election pound strength now ebbing, domestic prices may see some benefit if this weakening continues.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.