Wheat price support from low inflation: Grain Market Daily

Wednesday, 18 September 2019

Market Commentary

- UK feed wheat futures (Nov-19) remained relatively stable yesterday, falling £0.40/t to close at £134.50/t. UK futures have trade in a tight channel for the past eight sessions between £134.15/t and £135.00/t.

- The 10-day moving average has broken through the 20-day, suggesting a short term bullish move. However, there is still a significant gap between the 20 and 50-day averages.

- Futures have seen a considerable jump so far this morning, relative to moves other wheat futures markets (Paris and Chicago). This suggests the move higher may be partially led by the move lower in sterling (read more below).

Wheat price support from low inflation

We have seen domestic wheat prices trade within an £0.85/t channel over the last eight days. However, shifts in financial markets and politics have pushed the Nov-19 wheat price higher. We look at why.

Brace yourself, I’m going to talk Brexit

Brexit has been and will continue to be an important driver of foreign exchange and subsequently wheat prices for the foreseeable future. The latest twist, Jean-Claude Junker highlighting the “palpable” risk of no-deal, has pushed sterling down from its more than four month high against the euro.

While the move lower is not massive, -0.19% at 10am, it has been enough to move wheat price up to £135.50/t.

Inflation causing further weakness

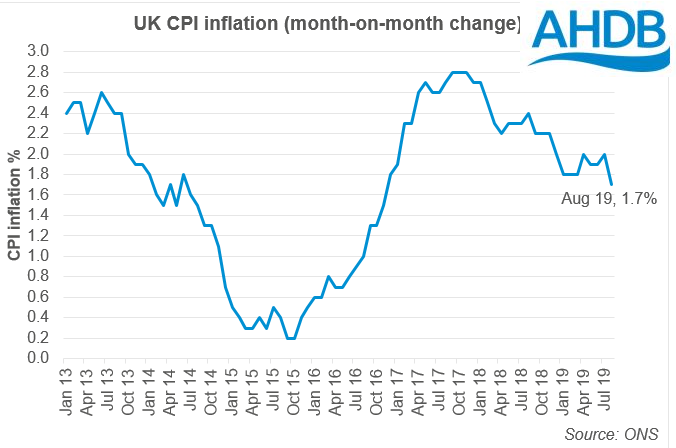

The Brexit-based move lower in sterling has been compounded by the latest UK inflation data. Consumer Price Inflation (CPI) for August was reported at 1.7%, a 0.4% drop month-on-month and the weakest price growth since December 2016.

Weak inflation data has the potential to drive a move lower in the value of sterling. While unlikely to result in a knee-jerk reaction, the latest fall in price growth sees inflation move further below the Bank of England target rate (2%).

There are a two tools available for the bank that can help to move inflation back up, a cut to interest rates, and an increase in quantitative easing (QE). We have already seen the EU employ these tactics in September to combat weak economic growth.

If interest rates fall or QE is employed, the value of holding sterling based assets will fall, reducing the attractiveness of sterling and moving exchange rates lower. It is unlikely that the Bank of England will use these tools following their next meeting (tomorrow) in light of Brexit uncertainty, but the sentiment remains nonetheless.

The move lower for exchange rates helps support UK grain and oilseed prices in turn.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.