Wheat price spikes on sterling weakness: Grain Market Daily

Tuesday, 30 July 2019

Market Commentary

- The value of UK feed wheat futures jumped yesterday, with a significant devaluation in sterling as the prospect of a no deal increases (read more below).

- UK feed wheat futures have now broken back above the 20-day moving average, for the first time in more than a month.

- The USDA crop progress report released yesterday, showed little change in crop conditions on the week. The harvest of winter wheat continues to progress albeit slower than last year, the harvest is now 75% complete.

- Both corn silking and soyabean blooming remain significantly behind last season.

Wheat price spikes on sterling weakness

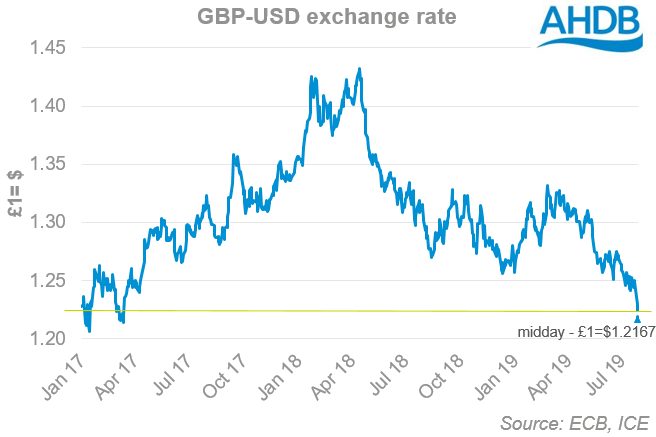

- Sterling has reached its weakest point against the dollar for more than two years.

- Further volatility in currency expected this week with key economic data due to be released by the Bank of England on Thursday.

- Weaker sterling will support the wheat price, while stronger sterling will weaken prices of UK agricultural products.

The value of sterling has fallen to its weakest point against the dollar for more than two years ahead of a week of key economic data. Weakness in the value of sterling will act to support the value of UK agricultural products by making them cheaper in other currencies.

In response to the weakness in sterling, UK feed wheat futures jumped significantly higher relative to EU and US futures markets. The value of Nov-19 UK feed wheat futures reached £148.50/t yesterday, a rise of £1.80/t.

Sterling weakness could well continue throughout the course of the week depending on the outcome of key economic data, due to be released on Thursday. The Bank of England inflation report and Monetary Policy Committee (MPC) meeting minutes could signal changes in interest rates or quantitative easing.

There is likely to be conflicting messages coming from the release. The role of the MPC is to manage inflation and support economic growth. While inflation is presently at the target level (2%), if the rate pushes higher the MPC could raise interest rates to cap spending, this would serve to boost sterling.

Conversely, economic growth in the UK is limited, which combined with an uncertain Brexit outlook could see the MPC choose to keep rates stable or lower, to support investment.

Either way, movements in the exchange rate will be crucial to the direction of UK agriculture markets.

The value of sterling against the dollar will also be influenced by potential cuts to interest rates in the US. The US Federal Reserve is expected to cut interest rates later this week to support the US economy. This could see the dollar move lower, supporting US grain prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.