Wheat exports at 7 year high: Grain market daily

Friday, 14 July 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £193.50/t yesterday, up £2.00/t from Wednesday’s close. The Nov-24 contract was up £2.10/t over the same period, closing the session at £196.85/t.

- Global wheat markets climbed yesterday amid concerns over the extension of the Black Sea Initiative export deal. The European Commission is also helping the UN and Turkey as they attempt to extend the deal ahead of its expiry on Monday (Refinitiv).

- Paris rapeseed futures (Nov-23) gained €10.25/t yesterday, closing at €481.25/t. The Nov-24 contract closed at €474.00/t, up €4.00/t over the same period.

- Rapeseed prices followed soyabean markets up yesterday. Following pressure after the USDA forecast record soyabean yields in their latest WASDE report on Wednesday, focus shifted back to adverse US weather and supplies. Prices were also supported by bargain buying.

Wheat exports at 7 year high

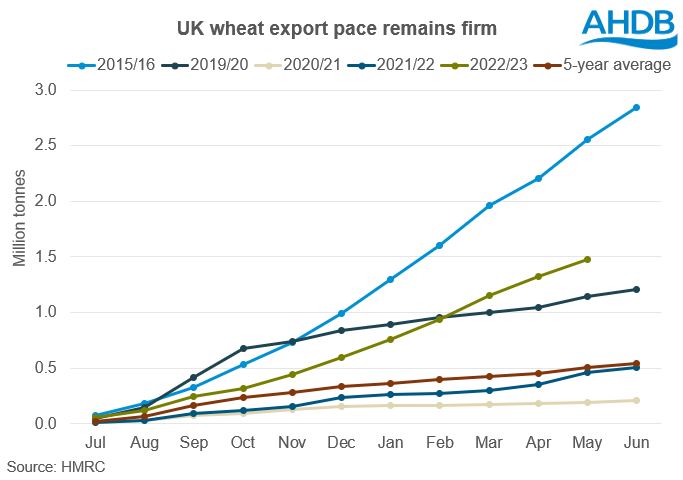

Yesterday, HMRC released the latest trade data, including volumes exported and imported up to the end of May. As is well known, the UK held a substantial exportable surplus of feed wheat last season (2022/23), so how much of it was shifted by the end of May, and what might that mean for this season’s wheat outlook?

Between the months of July and May, the UK exported 1.477 Mt of total wheat (including durum), more than 3 times the volume shipped by this point in 2021/22, and the largest volume exported up to that point in the season since 2015/16. In total, 156.12 Kt of wheat was exported from the UK in May. While this pace was down slightly from the previous few months, it’s still the greatest volume for that month since 2015/16.

In AHDB’s May UK cereal supply and demand estimates, 2022/23 full season wheat exports were estimated at 1.650 Mt. Given the volume exported up to the end of May, this would mean that just over 173 Kt of wheat would need to have been exported in June to meet the forecast. Given that only February and March saw volumes above this figure, it might be that exports don’t quite reach that level, though will likely be close to it.

If exports have reached the estimated volume, ending stocks for last season (2022/23) are estimated at 2.440 Mt, well above the 5-year average of 1.866 Mt. As such, we are expecting larger than average opening stocks for this season (2023/24). If exports are slightly lower than expected this of course could add to the opening stocks figure, if all other factors remain equal (though ultimately will depend on domestic consumption too).

On top of this, much like last season (2022/23), given the high cost of fertiliser, and the dry weather in the spring, there is again concern over the quality of this year’s wheat crop - with the added watchpoint of the rain now. Given total wheat area is expected to be up slightly on the year (1% according to AHDB’s Early Bird Survey), if quality is down we could see a greater surplus of feed wheat than we have now.

Therefore, to conclude, despite the relatively strong export pace we have seen for much of this season, we are still heading into this new season with heavy feed wheat stocks, with the expectation of another hefty feed wheat harvest.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.