Why aren't UK wheat futures following US trends? Grain Market Daily

Wednesday, 23 October 2019

Market Commentary

- UK feed wheat futures (Nov-19) increased £0.30/t from Monday to close yesterday at £135.40/t. At 11.30am Nov-19 futures were up £1.60/t at £137.00/t.

- We were again unable to publish a FOB price yesterday. The potential implementation of tariffs in the event of a no-deal Brexit has meant ports are currently ‘near to full’ , with limited “new” trade.

- China has offered a 10Mt tariff free import quota to major Chinese soyabean processors enabling an exemption from US tariffs until March. The reaction from Chicago soyabean futures was muted, with China currently opting for cheaper Brazilian origin beans.

Why aren't UK wheat futures following US trends?

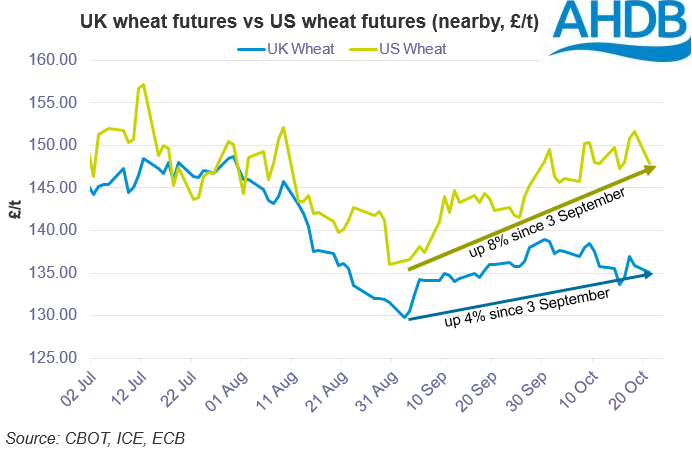

US nearby (CBOT) wheat futures have been trading at prices similarly seen in 2018’s drought season and are currently at three-month highs, owing to the maize crop issues. US maize conditions are likely to point towards a smaller crop than USDA figures forecast. In Monday’ US crop report 30% of the maize crop was reported as harvested, 17 percentage points behind the 2014-2018 average.

Uncertainty around the size and quality of the maize crop has left US grain futures well supported this season. Whilst the global market is largely bullish for both wheat and maize, the UK market has not followed this trend to the same degree.

Last year, drought conditions created a tighter picture for global and domestic wheat supply. The UK’s stance as a net importer enabled UK wheat futures to better follow trends in global cereal markets.

Whilst concerns over US maize and Southern Hemisphere crops will continue to support US futures, such price rises may not initially filter through to UK cereal markets.

UK wheat production, at 16.28Mt, will overhang domestic markets, especially with trade uncertainty surrounding Brexit. The surplus of wheat available for free stock or export is estimated at 2.88Mt this season. Thus, the UK will need to remain price-competitive in a well-supplied global market, with uncertainty continuing on tariff access to EU markets post-Brexit.

Currency does come into play too. Earlier this season, a weakened sterling meant UK wheat was able to track closer to European markets. However, increases to sterling similar to the last ten days (13 - 23 Oct), GBP/EUR has risen 4%, will pressure domestic cereal markets in order to remain competitive.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.