What to watch in today's WASDE: Grain Market Daily

Friday, 8 November 2019

Market Commentary

- Nov-20 UK feed wheat futures have continued their recent surge ending yesterday at £159.35/t. Nov-20 feed wheat currently sits £8.35/t ahead of the 20-day rolling average, as planting concerns continue.

- The rally in UK feed wheat futures could be checked in the next few days, as the likelihood of profit taking rises.

- US corn futures have been in decline ahead of today’s USDA supply and demand estimates release, while soyabeans have been relatively flat. With US corn and soya 52% and 75% harvested respectively as at 3 November, will we see any yield led production adjustments?

What to watch in today’s WASDE

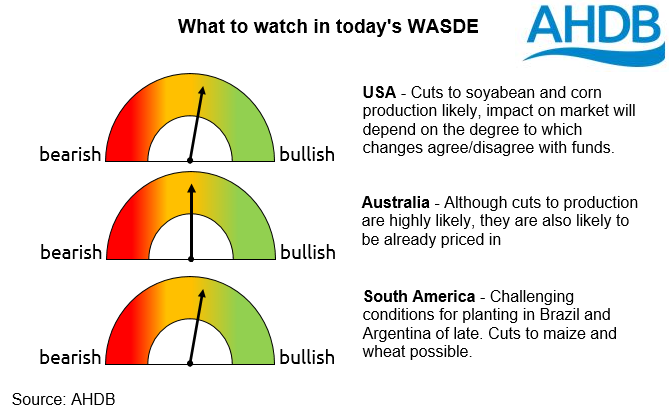

This afternoon (17.00) the USDA will release its latest supply and demand estimates. The report will be watched closely for its assessment of US and southern hemisphere crops. Significant weather challenges have led to delays for northern hemisphere harvesting (and new crop planting) and driven concerns over conditions of South American crops.

USA

The two key crops to watch for the US will be soyabeans and maize, there is a general acceptance amongst industry analysts that present US yield figures are north of reality. As harvests have progressed more yield figures will be known.

In a pre-Report Reuters’ poll analysts have estimated cuts to the forecast yield of both crops (soya – Reuters’: 3.13t/ha vs USDA: 3.15t/ha; corn – Reuters’: 10.51t/ha vs USDA: 10.57t/ha), as well as estimating smaller harvested areas. A significant enough cut would support both markets.

Australia

The current USDA forecasts for Australian wheat production is pegged at 18.0Mt, some way above the estimates of the International Grains Council (17.0Mt) and of Rabobank (15.8Mt). However, with industry expectations set it would take a significant cut for a change in Australian wheat production to impact markets.

Similarly, current USDA estimates of canola production are above industry expectations.

South America

South America has been plagued by dryness in recent months, and production estimates of wheat and maize have been walked lower. Cuts to maize production forecasts could have a supportive impact for markets.

In mid-October the USDA Foreign Agricultural Service post in Buenos Aires, reduced its estimate for corn production by 2.0Mt. Even with rainfall in the forecast further cuts are possible given the dryness that remains in key parts of Argentina.

For Brazil, delayed soyabean plantings could impact forecasts of both soya and maize production, although conditions have improved. If soyabean planting is further delayed, there is greater a chance of a negative impact on the Brazilian Safrinha (second) maize crop.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.