What to expect from Thursday’s USDA reports: Grain market daily

Tuesday, 10 January 2023

Market commentary

- May-23 UK feed wheat futures closed at £237.00/t yesterday, down £2.90/t from Friday’s close. The Nov-23 contract also lost ground, settling at £228.70/t down £1.30/t over the same period. UK markets followed the direction of global markets which were weighed on by somewhat lacklustre US exports as well as traders positioning ahead of Thursdays triple USDA release – read more below.

- Paris rapeseed futures (May-23) closed at €571.75/t yesterday, down €11.25/t from Friday’s close. Rapeseed markets were pressured by downward movements in palm oil markets, driven by lower Malaysian exports in December. Soyabean markets also closed down yesterday, driven by smaller than expected US export commitments. However, continued weather worries in Argentina capped losses.

What to expect from Thursday’s USDA reports

On Thursday, the USDA is set to release a trio of reports, the latest World Agricultural Supply and Demand Estimates (WASDE), US quarterly stocks as at 1 December and the area planted to winter wheat for harvest 2023. Looking back over the years, the release of these reports has influenced price movements. While the impact on price movements has been limited in recent years, if the reports differ from expectations, or bring a more bearish/ bullish sentiment, we could see prices shift accordingly.

Below is a round-up of key watch points for Thursday’s reports.

WASDE

With Argentina experiencing extreme drought conditions, it is expected that the USDA will lower its estimates for Argentinian maize and soyabean production. Average trade estimates from a Refinitiv pre-report poll have Argentina’s maize production pegged at 51.97Mt, down from 55.00Mt in December's WASDE. The average trade estimate for soyabean production is 46.71Mt, down from 49.50Mt in December.

While Argentinian output is expected to be cut, could the impact of this on markets be dampened by higher US end-season stocks? Results from a pre-report poll, suggest that traders are expecting US wheat, maize and soyabean end-season stocks to be revised higher. Average trade estimates for US wheat closing stocks are up 249Kt from December at 15.79Mt, 1.455Mt higher for maize at 33.38Mt and 428Kt higher for soyabeans at 6.42Mt (Refinitiv).

US stocks

US stocks of wheat, maize and soyabeans are all expected to be lower as at 1 December compared with the same point a year earlier. Average trade estimates expect US wheat stocks to be at a 15- year low for that point in the year, with maize stocks expected to be at a nine-year low.

Stocks may come in lower, but it’s all about the supply and demand balance, if it is to have a major impact on price movements. Over recent weeks it has been well reported that the US has been struggling to compete on the export market, facing stiff competition from ample South American and Black Sea supplies. In the week ending 29 December, US export sales of wheat, maize and soyabeans all came in at the lower end of analyst expectations.

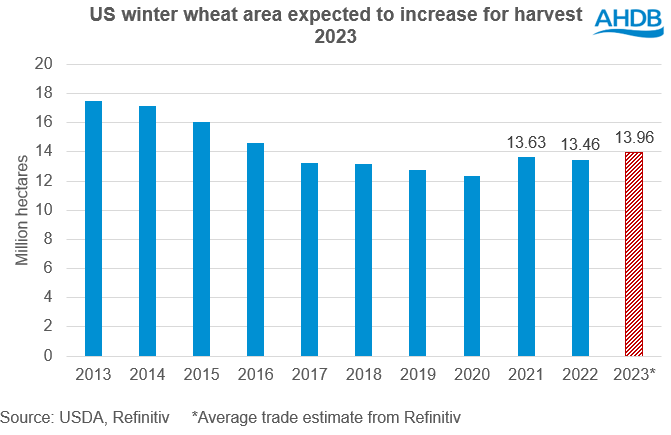

US winter wheat plantings

US winter wheat plantings are expected to increase on the year, to a seven-year high, according to results from a Refinitiv pre-report poll. The average trade estimate for the area planted to winter wheat in the US for harvest 2023 is 13.96Mha, up 4% on the year.

While a larger winter wheat area could lead to a bigger crop in 2023, considerations have to be made for the possible impact of drought on yields across key growing states. The impact, if any, of the adverse conditions is yet to be fully known. However, latest data from the USDA would suggest that conditions are slowly improving. As at 3 January, 64% of the US winter wheat area was impacted by drought, down from 69% in the previous week. For context, at the start of 2022 65% of the US winter wheat area was experiencing drought.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.