What's weighing on European oilseed prices? Grain Market Daily

Tuesday, 6 August 2019

Market Commentary

European wheat markets moved down yesterday. UK feed wheat futures (Nov-19) closed at £144.80/t, down £1.15/t since Friday. As the UK wheat harvest begins, prospects are good for high yielding, quality crops. UK pricing will need to be export competitive if harvest expectations are met. Weak sterling could help make the UK more favourable.

Paris rapeseed futures (Nov-19) continued to fall yesterday, albeit marginally. Yesterday’s close, at €372.50/t is down €3.75/t from the start of the month. Sterling also continued on the long term downward trend against both the euro and dollar yesterday.

What's weighing on European oilseed prices?

- The trade dispute between the US and China esculated to new levels last week.

- The build-up of soyabean stocks in the US will continue if no agreement is reached as China is a key buyer of US soyabeans.

- Although European harvest outlook remains poor, production will soon be known and soyabeans could be the key influencer on rapeseed prices.

Chicago soyabean futures (Nov-19) closed Thursday at $317.89/t, the lowest point since 24 May on the back of the US-China trade war escalation. Although there has been a slight gain of $1.29/t since then, this bearish sentiment will likely remain.

As the spread widens between US soyabeans and European rapeseed it could drag rapeseed prices down. European harvests are underway and once the final production figures are known, US soyabeans will again be a key influencer on European pricing. The recent downwards move for European rapeseed has been counteracted by weakening sterling, somewhat insulating UK physical rapeseed prices.

The China-US trade dispute escalated further last week. Trump has implemented a 10% tariff on $300bn worth of Chinese imports. China have responded by halting purchases of US agricultural products.

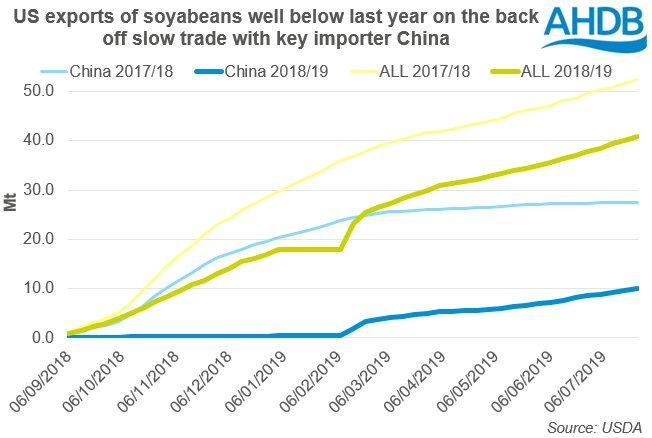

Considering China were a top buyer of US soyabeans this ongoing trade dispute is having major effects on US soyabean trade and subsequently the build-up of stocks. Up to week ending 25 July, accumulated soyabean export sales to China totalled just 10.11Mt, down 17.38Mt from the same point last year. Total US soyabean exports are down 11.43Mt year-on-year. The slow rate of sales has caused a build-up of old-crop soyabean stocks. Without a significant change in sales this will result in high volumes of carry out stocks into the new marketing year.

The 2019 soyabean crop is also looking good despite the historically late planting. Yesterday’s USDA crop progress report pegged 54% of US soyabeans in good or excellent condition with a further 33% rated fair. If the crop continues to progress well, 2019/20 crop could reach harvest with decent yields adding additional weight to the global oilseed complex. However, there is still some uncertainty around the planted area of US soyabeans which Mondays USDA report should give some clarification.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.