Mid-week market movers: Grain market daily

Wednesday, 13 November 2024

Market commentary

- Nov-24 UK feed wheat futures closed at £177.40/t yesterday, down £0.20/t from Monday’s close. The May-25 contract lost £1.25/t over the same period, to close at £189.85/t.

- Domestic prices tracked global grain markets down yesterday. Chicago wheat futures (Dec-24) ended yesterday’s session at $202.90/t, down $4.86/t from Monday’s close. Similarly, Chicago maize futures (Dec-24) declined $0.59/t yesterday to close at $168.70/t. Prices were generally weighed on by stronger US wheat ratings and strengthening of the US dollar – read more below.

- Paris rapeseed futures (Feb-25) fell €3.50/t yesterday, ending the session at €535.50/t, tracking downward movements in the wider oilseed complex. More on this below.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Mid-week market movers

Grains

Grain prices have generally trended lower so far this week (since Monday) due to a few factors, including improved crop conditions in the US and strengthening of the US dollar.

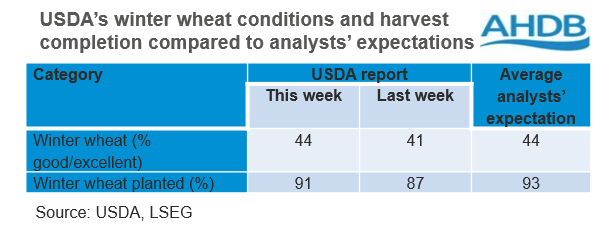

Recent rains have improved the condition of the US winter wheat crop. According to yesterday’s USDA crop progress report, 44% of US winter wheat was rated good-to-excellent as at 10 November. This is up 3 percentage points from last week and in-line with average Reuters pre-report analyst expectations. Additionally, winter wheat planting is 91% complete, up from 87% last week. While the rate of plantings falls short of the average analyst expectations of 93% in the Reuters pre-report poll, it sits within the analyst range of 90-95% complete.

The US dollar hit a six-month high yesterday against a number of currencies, driven by strong economic data and market reactions to potential policy changes. This surge has made US crops less competitive globally, weighing down on wheat and soyabean prices.

Also yesterday, France’s agricultural ministry revised its 2024 soft wheat harvest estimate up slightly from 25.4 Mt last month, to 25.6 Mt. However, the latest estimate is still 27% lower than 2023 and is among the smallest crops since the 1980s. The maize output projection was also raised by 0.1 Mt, now 13% higher than 2023 and 10% above the 2019 - 2023 average, due to a larger sown area.

Oilseeds

Soybean prices also fell yesterday, following the drop in soyabean oil markets. The Dec-24 Chicago soyabean oil futures contract lost $42.10/t over yesterday’s session, to close at $1019.19/t. Soya oil markets are being pressured by concerns over President-elect Donald Trump’s candidate for the head of the US Environmental Protection Agency, as they are perceived to be unsupportive of the biofuel industry. In turn this could potentially reduce demand for soybean oil, a key biofuel feedstock.

The soyabean market is also experiencing harvest pressure from the US. According to the USDA crop report, the US soyabean harvest reached 96% complete as of 10 November, up from 94% the previous week and above the five-year average of 91%. This increased supply can contribute to lower prices as more soybeans enter the market.

Looking ahead

Changes in US weather and how it impacts winter wheat conditions will remain a key watch point for grains. For oilseeds, the US soyabean harvest will continue to add weight to markets in the short term. However, market reactions to potential biofuel policy changes in the US will be a longer-term watch point for the direction of oilseed markets. The strength of the US dollar will also remain an area of interest, potentially keeping US export prices high and pressuring US commodity prices

In the UK, feed wheat prices have and will likely continue to follow the global trend. However, the decline in prices has somewhat been capped by currency fluctuations

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.