What’s in the WASDE? Maize yields up, soy down: Grain market daily

Friday, 11 October 2019

Market Commentary

- US maize futures (Dec-19) tumbled 4% on the back on yesterday’s WASDE release, closing at $149.70/t. This dragged US wheat futures lower (Dec-19), down $2.66/t, to close at $181.48/t.

- UK (Nov-19) and Paris (Dec-19) wheat futures declined slightly before markets closed, ending at £137.50/t (-1%) and €177.00/t (-1%) respectively.

- UK barley exports in July and August reached 330Kt, the fastest export pace for the last 20 years. This is expected to continue in future data releases, as the trade tries to shift as much as possible of this season’s surplus before the current Brexit deadline.

What’s in the WASDE? Maize yields up, soy down.

- The US maize production estimate is below the previous WASDE release, but only 0.51Mt. This was less than trade expectations, with the USDA surprisingly slightly raising yield estimates where cuts were expected.

- Support to US soyabean, with higher than expected cuts to production (96.62Mt, down 2.26Mt) and positive sentiment ahead of US China trade talks.

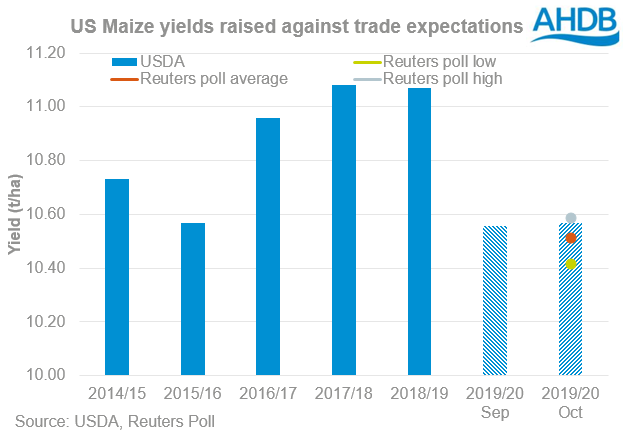

The cuts to US maize production in yesterday’s WASDE release were not as great as average trade expectations. Currently the USDA predicts a crop of 350.00Mt, down 0.51Mt from September’s release, this is 2.4Mt above average trade expectations (347.57Mt) in a pre-report Reuters’ poll. The decline was driven by a cut in harvest area to 33.11Mha (-0.08Mha), following adverse weather earlier in the season.

Unexpectedly the USDA raised US maize yields slightly to 10.57t/ha (+0.01t/ha), citing good weather throughout September. This is contrary to industry expectations which expected a cut in yield. Trade estimated corn yields at 10.51t/ha, down 0.05t/ha from the USDA’s September forecast.

US maize futures dipped in response to the report, down 4% by days close. The fall led wheat futures to close lower across the board yesterday. Moving forward there remains some questions around the yield figure, with an expectation that if the weather deteriorates we could see it move lower.

While we saw maize dip lower, yesterday’s WASDE was bullish for the US soy crop. Yields took a larger than expected hit, with production forecasts cut by 2.25Mt, to 96.62Mt. This was 0.9Mt below the average trade expectation of 97.52Mt.

There were also significant cuts to US soyabean ending stocks which fell to 12.52Mt (-4.90Mt). This was a larger than expected cut and the global soyabean balance seems to be gradually tightening (ending stocks at 95.21Mt, -3.98Mt). Furthermore, dry weather is currently an issue for soyabean planting in South America. This could result in further cuts to forecasts later in the year.

Any indications of progress in resolving the dispute over the coming weeks would provide support to soyabean prices and potentially allow EU rapeseed prices to rise.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.