What’s driving the volatile grain market? Grain market daily

Wednesday, 29 June 2022

Market commentary

- UK feed wheat futures (Nov-22) recovered some losses yesterday, closing at £277.00/t. This is up £5.50/t on Monday’s close. The May-23 and Nov-23 contracts also rose by the same amount, closing at £283.50/t and £247.80/t yesterday, respectively.

- Domestic grain prices followed Chicago and Paris futures contracts yesterday. Contracts gained support on lower-than-expected ratings for US row crops, demand (more on this below) as well as wider gains in the financial markets.

- The US Department of Agriculture (USDA) on Monday rated 67% of US maize and 65% of soyabeans in “good-to-excellent” condition as at 26 June. This is down from 70% and 68% respectively the previous week and follows dry weather conditions across June.

- Paris rapeseed futures (Nov-22) saw more modest gains yesterday and closed at €685.50/t, up by €4.25/t on Monday’s close.

What’s driving the volatile grain market?

Volatile grain prices remain. Last week we saw large losses on harvest pressure, news around establishing a Ukrainian grain export corridor, and mounting concerns around demand impacts from economic downturn.

Domestic gains yesterday followed global markets upwards on fresh demand, China easing COVID-19 restrictions, and fresh worries on US maize and soyabeans crops.

Expect volatile prices to continue, with the market sensitive to any new news that might alter the supply and demand balance.

Are we finding global demand at lower global prices?

In short, the answer looks to be yes. This is an important factor to consider given recent harvest pressure seen across global grain prices. Recent ‘bargain’ buying is providing a floor of support for markets.

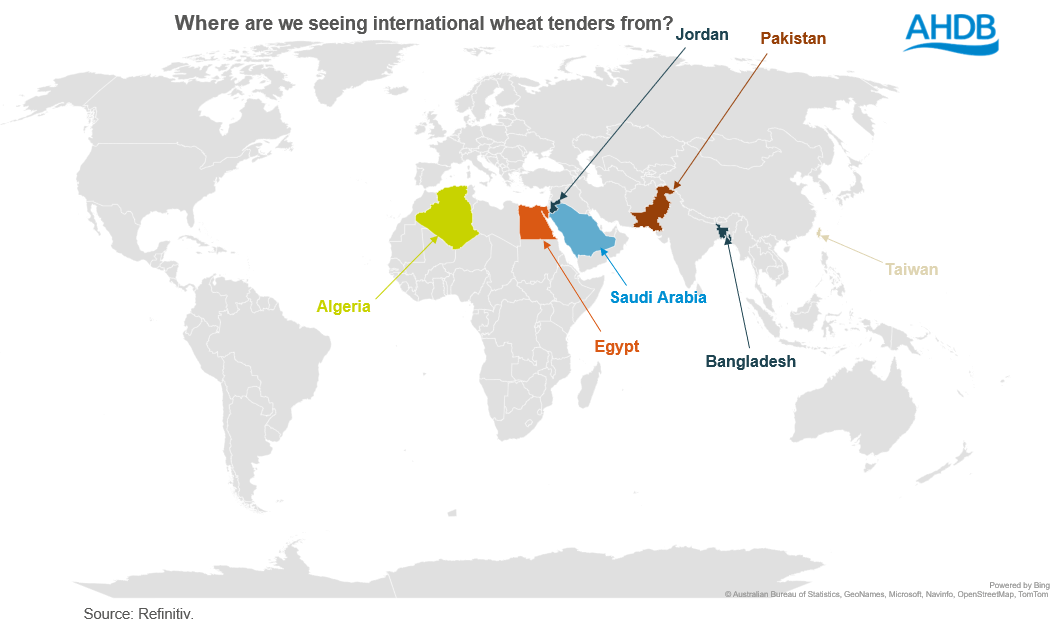

Recent tenders and purchases include:

- Jordan buying 60Kt of hard milling wheat and they have issued a new 120Kt wheat tender for optional origins.

- Algeria’s state agency (OAIC) purchasing 740Kt wheat optional origin.

- Egypt’s state grains buyer General Authority for Supply Commodities (GASC), on Monday tendered for an unspecified amount of wheat for shipment over August, September, and October.

- Taiwan Flour Millers Association have tendered for 40Kt milling wheat.

- Pakistan government agency have tendered for 500Kt of milling wheat.

- Bangladesh state grain buyer have tendered for 50Kt of milling wheat.

Though demand remains a watchpoint considering recessionary concerns. Consumers face disposable income squeezes, which is playing into guaranteed demand for products.

Livestock margins too are being squeezed. Something to watch considering a large demand outlet for cereal usage.

Finally, biofuel demand will remain a key watchpoint. At the G7, the UK accompanied Germany in proposing a temporary waiver on mandates. Though this was reportedly met by some resistance from the US and Canada.

Where next for prices?

Harvest pressure looks to continue as we see combines roll in the Northern Hemisphere. Though prices will likely stay volatile.

Demand factors will certainly remain closely watched, at what price are we finding global demand? The market still awaits news on how much supply can be expected from harvest 22 as well.

Supply factors to watch:

- Revised US acreage for harvest 22, and stocks report as at 01 June - due tomorrow.

- US weather – harvest progress for winter wheat will need clear skies. However, rain is needed in maize and soyabean areas. This is following small trims to condition ratings on Monday as mentioned in market commentary above. Rain is forecast at beginning of next week. With the US due for a long weekend, if this remains, we could see some risk taken out of prices on Friday.

- Russia announcing a change to their export tax formulation to reduce the impact of the rouble. Considering capital controls, the rouble has increased in value hampering exports. This change to formulation is set to support exports, though details remain to be known.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.