What’s driving grain prices this week? Grain market daily

Wednesday, 11 October 2023

Market commentary

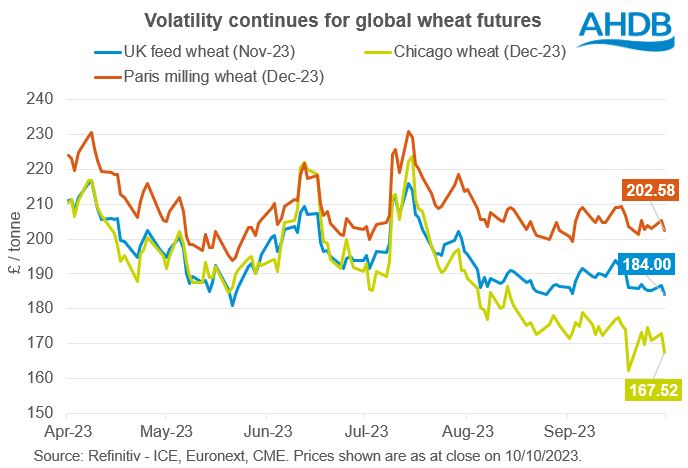

- Nov-23 UK feed wheat futures closed at £184.00/t yesterday, down £2.55/t from Monday’s close. UK feed wheat futures (Nov-24) closed at £198.55/t yesterday, down £2.50/t over the same period.

- Russian wheat exports are weighing on markets, following low prices and a second consecutive bumper harvest. Russia is said to be undercutting the unofficial floor price, following their recent trade with Egypt as they increase their global export market share to 28% for the first 3 months of marketing, from 21% last year. Read more on this below.

- Nov-23 Paris rapeseed futures closed at €419.75/t yesterday, down €6.50/t from Monday’s close. The Nov-24 contract closed at €445.00/t, down €5.00/t over the same period.

- Despite gains in Chicago soybean futures (Nov-23) (up $7.25/t from Mondays close), Nov-23 Chicago soybean oil futures fell $2.14/t yesterday. Weaker Ukrainian and Russian currency are boosting sunflower seed and oil exports from these countries, applying significant pressure on the wider oilseed complex. This pressure is worsened by increased Ukrainian export capability, and an estimated record export of sunflower oil from Russia, up 0.8 Mt from last year. In addition, following a brief recovery earlier in the week, nearby Brent crude oil futures closed at $87.65/barrel – down $0.50/barrel from Mondays close.

What’s driving grain prices this week?

Global grain prices have remained volatile as of late. After some support on Monday, it fell back again during yesterday’s session. While grain futures were supported following investor concerns about the attack on Israel by Palestinian militant group Hamas over the weekend, Black Sea supplies are once again weighing on the market. The swift maize harvest in the USA is also pressuring grain prices, though the market awaits updates from Thursday’s USDA World Agricultural Supply and Demand Estimates (WASDE).

Heavy Black Sea supplies

Competitively priced Russian grain is continuing to weigh down on global markets. Analysts expect Russian exports to fall during October due to weak demand and an informal government price floor. However, according to Refinitiv, Egypt’s state buyer GASC purchased 480 Kt of Russian wheat in a private deal yesterday. Traders are estimating that the wheat was bought for c.$265/t FOB (free on board) for November and December shipping. Falling prices and a growing harvest surplus will likely see substantial exports throughout the rest of the season too. On Monday, Russian agriculture consultancy IKAR, raised its forecasts for Russia’s grain crop this season to 141.2 Mt from 140.0 Mt previously, with grain exports up to 64.5 Mt from 64.0 Mt.

In terms of Ukrainian exports, President Zelensky is in Romania today to discuss Black Sea security. With Romania becoming key to ensuring transit of Ukrainian grain, Zelensky has said a corridor would soon be established to move grain to Romania via Moldova. Kyiv continues to rely on a route that takes grain along the Danube via the port of Constanta in Romania, though several attacks have been reported on the river ports. For September, wheat exports from Ukraine totalled 1.23 Mt, down 31.4% from the same period last season (UkrAgroConsult).

US maize harvest progresses

In the USDA’s weekly crop progress report released on Monday, the US maize harvest was 34% complete. This is up from 23% the week before and ahead of the five-year average of 31%. The condition of the US maize crop was unchanged on the week, with 53% of the crop in good/excellent condition. This is in line with last year, when 54% of the crop was rated good/excellent.

With the crop thought to be in reasonable condition, and harvest progressing quickly, markets are awaiting any adjustments to the crop in the upcoming WASDE report due out tomorrow. According to a Refinitiv pre-report poll, analysts on average expect the US maize yield to be revised down to 10.89 t/ha, from September’s estimate of 10.91 t/ha. Of course, if revisions are not as expected, we will likely see some price movement at the end of the week following the report – something to watch out for.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.