What is the weather doing in South America? Grain Market Daily

Friday, 18 September 2020

Market Commentary

- London wheat futures (Nov-20) have continued to rally this week, trading briefly this morning at £179.80/t, the highest the contract has traded since October 2018.

- At the time of writing, new crop wheat futures (Nov-21) are at £154.50/t, a £23.25/t discount to Nov-20’s last trade of £177.75/t.

- Dec-20 Matif rapeseed has rallied €11.50/t since last Friday’s close to close last night at €392.50/t.

What is the weather doing in South America?

Drier than usual weather across South America has become an increasing focus point for global grain markets of late.

Current weather concerns

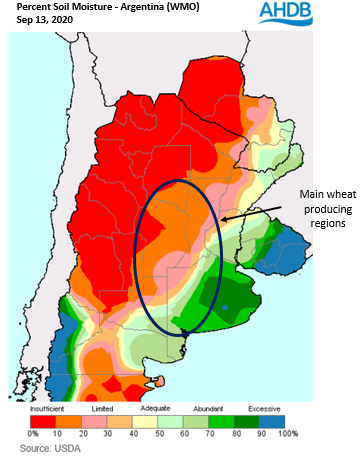

Argentina has had very little rainfall for the last five months. There have been a few showers in Central and Southern regions, but the North is still in a drought. In their most recent report from 17 September, Bolsa de Cereales rated 40% of the wheat crop in very/poor condition, compared with just 18% last year. Additionally, last week the USDA revised Argentinian wheat production down 1Mt on the back of weather concerns. However, despite this revision, at an estimated 19.5Mt production still pegs it higher than pre 2018/19 levels.

Conditions across the world’s third largest maize producer, Brazil, have been hot and dry in Central and Northern regions, with some recent rains in Southern regions. Maize plantings have got off to a slow start due to dryness concerns, with heavier rains in Mato Grosso, the country’s largest corn producing state, not forecast until mid-Oct. However, supported prices have helped motivate an increase in the planted area intended this season, with production predicted to be 8% higher than last year’s record crop at 110Mt.

Future weather concerns

There is an ever-increasing risk of La Nina developing by October and continuing into early 2021. This will lead to drier than usual weather across Argentina and Southern Brazil and increased rainfall across the Northern regions.

Despite the Argentinian wheat harvest still being a couple of months away, prices may see some support if this dry weather continues, potentially impacting yield potential. Conversely, this could be mitigated if rainfall occurs in a timely fashion across key wheat regions.

However, a shortfall in Argentine production this season could be more than offset by favourable wheat harvests in Australia and Canada, which would help to keep global supplies supported and potentially cap any price gains.

With Brazilian maize planting beginning this month, progress could be slowed due to weather, potentially tightening the planting window for some. This tightness could be exacerbated with a developing La Nina. However, given the increase in 20/21 production estimated for Brazil by the USDA, coupled with predicted weighty global stocks, weather concerns may play little support in prices and remain more a watch point at present.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.