What has been driving my ex-farm wheat price? Grain market daily

Friday, 25 November 2022

Market commentary

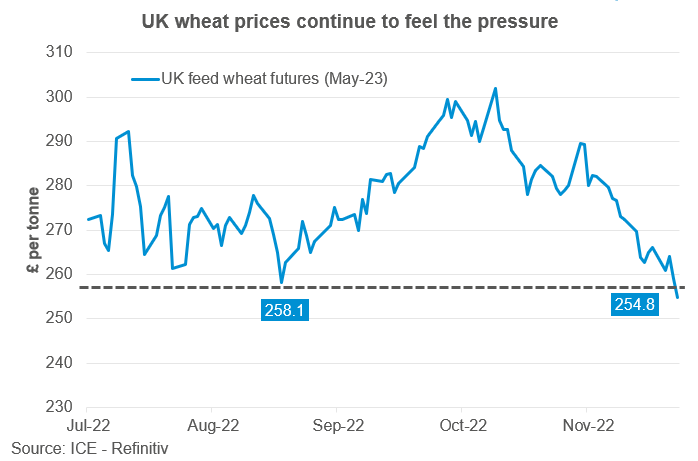

- UK feed wheat futures (May-23) closed yesterday at £254.80/t, down £4.30/t on Wednesday’s close. The Nov-23 contract lost £2.50/t over the same period, closing at £238.50.

- Paris rapeseed futures (May-23) gained €1.50/t, closing at €588.75/t.

- According to the Buenos Aires Grain Exchange, soyabean plantings are at just 19.4%, 19.9pp behind this time last year and maize plantings are at 23.8% (6.2pp behind last year). This is because of poor soil moisture and limited rainfall – read more below.

- The AHDB Cereals & Oilseeds Grain Market Outlook podcast is now live. In this episode of the Food & Farming podcast the AHDB discuss the Grain Market Outlook Conference, what’s driving global markets, farm margins and input costs by analysing Farm Bench data.

What has been driving my ex-farm wheat price?

Over the course of the week so far grain markets have felt pressure. This is despite some stronger demand for European wheat with French wheat sales to China and talk of Polish or German wheat being booked in the US.

UK wheat futures (May-23) closed at £254.80/t yesterday, down £11.30/t since last Friday’s close. Interestingly yesterday this contract broke its previous support level in August where the contract closed at a low of £258.10/t.

UK wheat prices have followed the global wheat markets down so far this week. Sterling strengthening against both the US dollar and euro has meant domestic prices have been pressured further.

It appears that over this week the agreed extension to the Black Sea grain corridor last week for another 120 days has weighed on the market.

Other factors pressuring grain markets has been the rise in COVID-19 cases in China. In some areas lockdown restrictions have been tightened, which is expected to reduce demand for ag commodities, especially soyabeans.

Despite this soyabeans are currently maintaining elevated support due to demand for soya oil and further potential weather problems in Argentina. As mentioned in the market commentary, Argentina’s current soyabean planting campaign is facing delays with plantings currently below the 5-year-average of 40.2% (Buenos Aires Grain Exchange). Weather in Argentina is a key watchpoint in the coming weeks to ensure there isn’t a reduction to this soyabean area. Fortunately, scattered rains are again forecast from the start of next week, but this is a key focus currently.

For rapeseed, there has been continued pressure so far this week with Paris rapeseed futures closing at €588.75/t yesterday, down €21.25/t from last Friday. This is largely following pressure in Canadian canola markets, which have come down following speculators selling positions. Also, pressure in crude oil markets which are down due to limited Chinese demand, larger than expected U.S. gasoline inventories and the price cap on Russian oil being considered by the G7 may be above the current market level, which may not impact global supply much.

Although the US markets have been closed for some of this week due to public holiday, it appears that the signing of the Black Sea corridor seems to have pressured wheat markets, although volatility will remain going forward. Key watch points over these next couple of weeks are the plantings of maize and soyabean crops in Argentina and Brazil.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.